- SAP Community

- Groups

- Interest Groups

- Application Development

- Blog Posts

- Dealer Process Capture.

- Subscribe to RSS Feed

- Mark as New

- Mark as Read

- Bookmark

- Subscribe

- Printer Friendly Page

- Report Inappropriate Content

Hello All,

I would Like to Show the Process how the Dealer Process(1st Dealer) can mapped in SAP,While procuring from dealers, the dealer's invoicing amount is known but the excise duties amount are not known at the time of PO creation. The invoice price is taken as the PO price and the excise duties aren't calculated in the PO.

To capture the excise invoice corresponding to the incoming goods and to take credit for the excise duty component in the dealer's price, it is required to split the PO price into its two components - the excise base value and the excise duties amount.

Objective is to Understand

- Purchase Order, MIGO, and MIRO for dealer Vendor.

- Excise Activities.

Prerequisites

For dealer or Normal GR process 1st maintain all respective details in Excise Rate Maintenance Screen (J1ID) for material and vendor Excise in CIN Tab in Vendor Master or In J1ID Vendor Excise Details

To Capture Dealer data a Invoice Copy is Mandatory.

Before Starting Process i would like share some Tips for how to know Vendor is a Dealer or Manufacturer.Every Vendor in India Expect Small Scale Industries they have Excise Registration Number.

How to Find ECC Number In Vendor Invoice?

The ECC number is a registration number, issued to all the Central Excise Assesses. This Number is based on the principles of 'Common Business Identifier' which shall be used for revenue accounting, validation of documents (e.g. CENVAT invoices), and inter-agency coordination and for creation of data warehouse.

ECC number is a PAN based 15 digit alpha numeric numbers. The first part denotes 10 character (alpha numeric) Permanent Account number issued by Income tax authorities to the concerned person to whom the ECC Number is to be allotted and the second part comprises of a fixed 2 character alpha code which is as follows:

Category | Code |

Central Excise Manufacturer (Including registered warehouses) | XM |

Registered Dealer | XD |

This is followed by 3-Character numeric code - 001, 002, 003 etc. In case, a manufacturer, registered with the Central Excise Department, has only one factory /dealer's premise/warehouse, the last three characters will be 001. If there are more than one factories/warehouses/dealer's premises of such a person having common PAN for all such factories/warehouses/dealer's premises, the last 3 character of the new ECC would be 001, 002, 003 etc.

The ECC Number has to be quoted on the GAR–7Challans covering deposit of Central Excise duties, Additional duties, Cess and other dues to the Government.

Examples:

Where the concerned person has only one factory:

ECC Number will be - PAN + XM + 001

Suppose PAN is ABCDE1234H, the ECC Number will be - ABCDE1234H XM 001

Where the concerned person has more than one factory, say 3 factories, having PAN as aforesaid, then the ECC Number will be:

ABCDE1234H XM 001

ABCDE1234H XM 002

ABCDE1234H XM 003

Where the concerned person has one factory and is also registered as a dealer, having PAN as aforesaid, then the New ECC Number will be:

ABCDE1234H XM 001 (for Factory)

ABCDE1234H XD 001 (for Dealer)

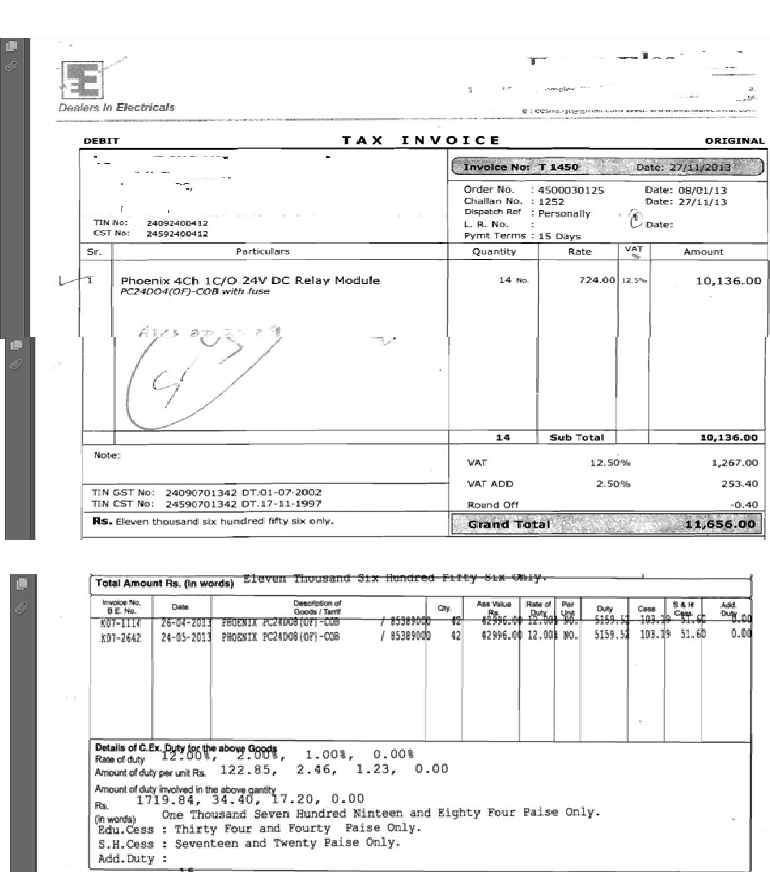

Below Screenshot is Original Vendor Invoice

Let me show how to map the Process in sap

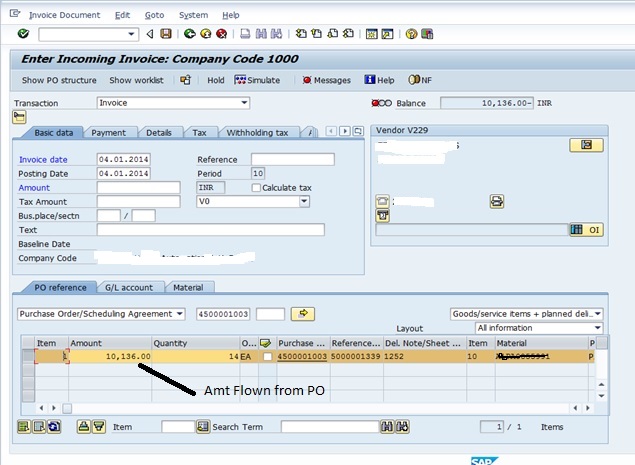

Create PO with Vendor given net price Below show standard PO

Then do Migo for PO

Here in above Image the base Price taken form PO i,e net price * quantity is shown below

| Invoice Value Amt | |||

| PO Qty | PO Net Price | PO Total | |

| 14 | 724.00 | 10136.00 | |

| Vat 15% | 1520.40 | ||

| Total Invoice Amt | 11656.40 | ||

In dealer case Excise rate pass is shown in below invoice copy shows the rate Excise pass on

Below Excise Rate given by vendor

| BED | 1719.84 |

| ECS | 34.4 |

| SECess | 17.2 |

| Total Rate | 1771.44 |

Here will deduct Total Excise amount on Base Amount ( Final Base Value = (Net Price* Quantity) - Total excise Value)

Hence the Final Base Value Becomes 10136 -1771.44 = 8364.56 this amount should be entered in Base value of Excise item tab in Migo.

Please note - the sum of the excise base and the excise duty values must always equal to the PO price. b'coz we are splitting the components.

Here If change base value without Putting MRP tick then GR will not Create with Proper Accounting Entry,You can find MRP Tick in Header level in excise invoice tab below Excise capture post Drill down More data ![]() click on it. A popup will come Below Screen Shot shows it

click on it. A popup will come Below Screen Shot shows it

Below images show the changes made to Base value

Here In Base Value we entered excise Deducted amount.

The Post the GR.Following Accounting Entries are Happened with Base value Captured amt in System are shown below

J1IEX Excise Part Since i have captured in Migo no need of doing again J1IEX.

Then will Complete the Process by doing MIRO(Invoice Capture), Shown below

Here in the above Screen Amt is flown from PO which is having Excise Amt, here in case of dealer we need to change item amount in IR so correct amt is Paid to Vendor

In MIRO screen we see the total amt is matched to vendor invoice amount below are the accounting entries

Dealer Process can be Done without any Constraint if followed above steps.

Snote Regarding CIN Dealer

1726234 - Wrong calculation of excise duty in dealer scenario- MIRO

1491695 - Wrong Ed open GR quantity for OPUoM conversion in PO- MIGO

796339 - Incorrect inventory valuation for First stage dealers -MRP

1035703 - GR valuation incorrect for dealer invoice with SECess

If you have query/question/objection about this Doc then please write back to me.

Regards;

Shiva

- SAP Managed Tags:

- Internationalization and Unicode

You must be a registered user to add a comment. If you've already registered, sign in. Otherwise, register and sign in.

-

A Dynamic Memory Allocation Tool

1 -

ABAP

8 -

abap cds

1 -

ABAP CDS Views

14 -

ABAP class

1 -

ABAP Cloud

1 -

ABAP Development

4 -

ABAP in Eclipse

1 -

ABAP Keyword Documentation

2 -

ABAP OOABAP

2 -

ABAP Programming

1 -

abap technical

1 -

ABAP test cockpit

7 -

ABAP test cokpit

1 -

ADT

1 -

Advanced Event Mesh

1 -

AEM

1 -

AI

1 -

API and Integration

1 -

APIs

8 -

APIs ABAP

1 -

App Dev and Integration

1 -

Application Development

2 -

application job

1 -

archivelinks

1 -

Automation

4 -

BTP

1 -

CAP

1 -

CAPM

1 -

Career Development

3 -

CL_GUI_FRONTEND_SERVICES

1 -

CL_SALV_TABLE

1 -

Cloud Extensibility

8 -

Cloud Native

7 -

Cloud Platform Integration

1 -

CloudEvents

2 -

CMIS

1 -

Connection

1 -

container

1 -

Debugging

2 -

Developer extensibility

1 -

Developing at Scale

4 -

DMS

1 -

dynamic logpoints

1 -

Eclipse ADT ABAP Development Tools

1 -

EDA

1 -

Event Mesh

1 -

Expert

1 -

Field Symbols in ABAP

1 -

Fiori

1 -

Fiori App Extension

1 -

Forms & Templates

1 -

IBM watsonx

1 -

Integration & Connectivity

10 -

JavaScripts used by Adobe Forms

1 -

joule

1 -

NodeJS

1 -

ODATA

3 -

OOABAP

3 -

Outbound queue

1 -

Product Updates

1 -

Programming Models

13 -

Restful webservices Using POST MAN

1 -

RFC

1 -

RFFOEDI1

1 -

SAP BAS

1 -

SAP BTP

1 -

SAP Build

1 -

SAP Build apps

1 -

SAP Build CodeJam

1 -

SAP CodeTalk

1 -

SAP Odata

1 -

SAP UI5

1 -

SAP UI5 Custom Library

1 -

SAPEnhancements

1 -

SapMachine

1 -

security

3 -

text editor

1 -

Tools

16 -

User Experience

5

| User | Count |

|---|---|

| 6 | |

| 5 | |

| 3 | |

| 3 | |

| 2 | |

| 2 | |

| 2 | |

| 2 | |

| 1 | |

| 1 |