- SAP Community

- Products and Technology

- Technology

- Technology Blogs by Members

- Brief Stock Market Time Series Data Analysis

- Subscribe to RSS Feed

- Mark as New

- Mark as Read

- Bookmark

- Subscribe

- Printer Friendly Page

- Report Inappropriate Content

The purpose of this blog is to show the application possibilities of SAP Lumira regarding a brief time series data analysis of stock market data.

Basically, I picked several companies that are traded on the NYSE and gathered their historical data, such as opening price, closing price, adj. price, traded volume, market capitalization and so on. Once the data was gathered, I decided to take a closer look on the performance of the closing prices of these corporations over ten years for my first data analysis with Lumira.

As soon as I had my .csv files merged into Lumira and prepared for the analysis, I started to assign the necessary key figures. Once I had the closing prices and the corresponding dates, I was ready to start. The graphics could be easily created by applying the closing prices to the y-axis and the date to the x-axis.

3M - MMM (2003 - 2013) Closing Price Time Series

AXP - American Express (2003 - 2013) Closing Price Time Series

BA - Boeing Company (2003 - 2013) Closing Price Time Series

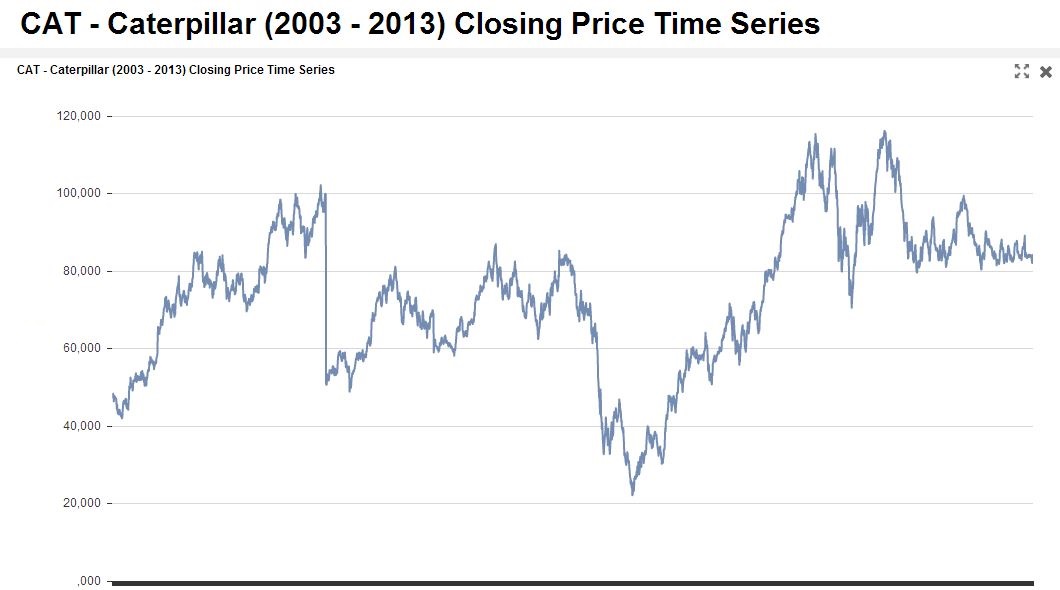

CAT- Caterpillar (2003 - 2013) Closing Price Time Series

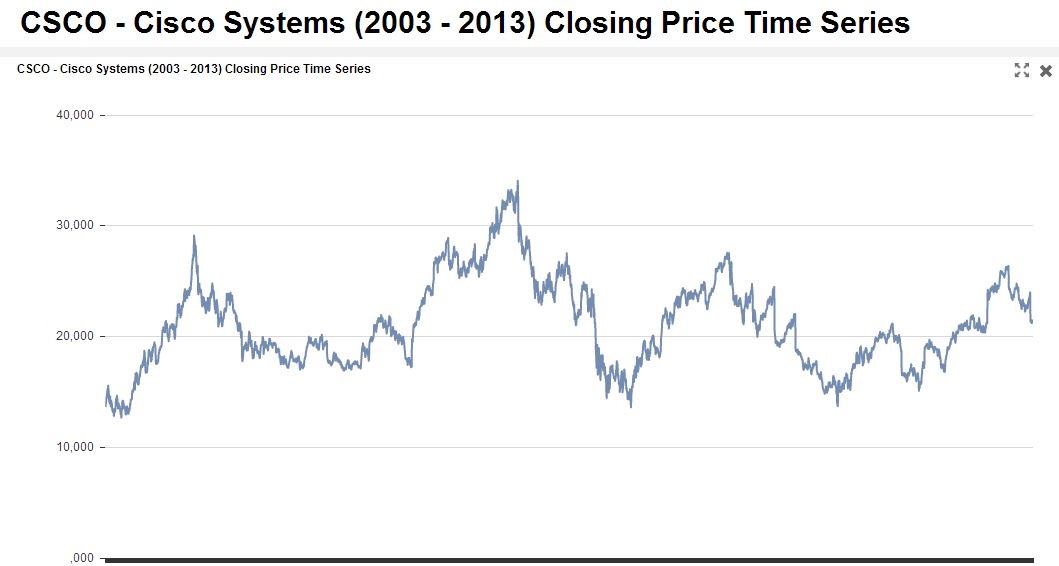

CSCO - Cisco Systems (2003 - 2013) Closing Price Time Series

CVX - Chevron (2003 - 2013) Closing Price Time Series

DD - du Pont de Nemours (2003 - 2013) Closing Price Time Series

GE - General Electric (2003 - 2013) Closing Price Time Series

GS - Goldman Sachs Group (2003 - 2013) Closing Price Time Series

KO - Coca Cola (2003 - 2013) Closing Price Time Series

PG - Procter & Gamble (2003 - 2013) Closing Price Time Series

SAP - SAP (2003 - 2013) Closing Price Time Series

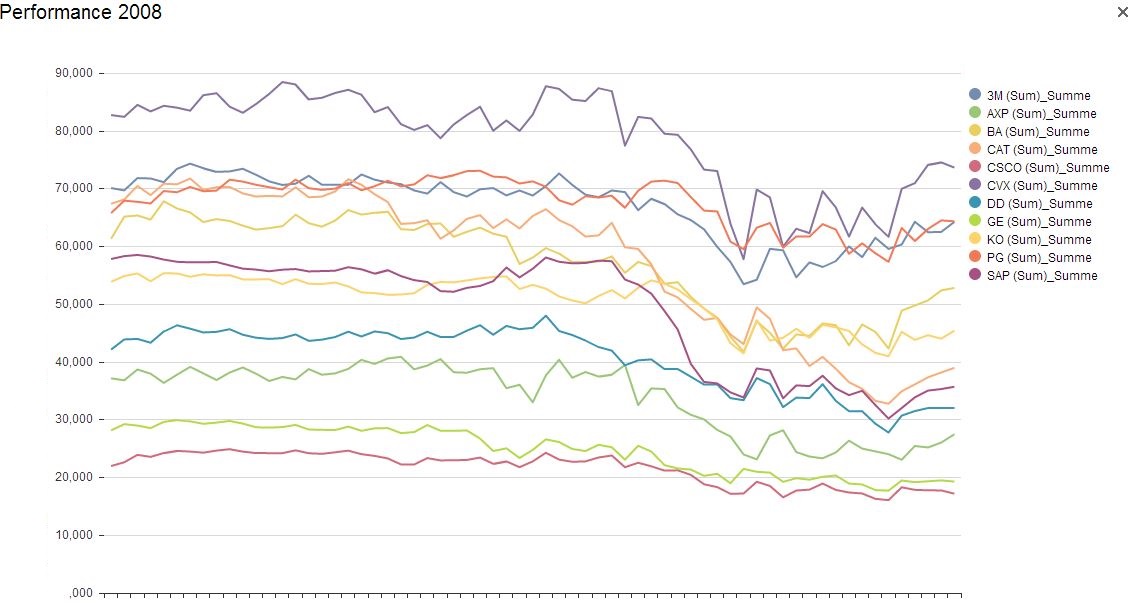

Moreover, I was curious how each share performed in comparison to the others. Therefore, I created a time series analysis that took all available closing prices into account.

Total Performance 2007 - 2013

Furthermore I wanted to compare the performance of each share in between the year 2007 and 2009 (before / after the subprime crisis & Lehman) and also particularly in the year 2008.

Total Performance 2007 - 2009

Total Performance 2008

It was obvious that in fall 2008 (25th of September – exactly one week after Lehman filed chapter 11 / bankruptcy) the closing prices of almost each share in the comparison began to drop heavily.

Performance Drop 2008

Although a similar analysis can be created with common computing tools, I found it quite interesting to make my first steps with Lumira and to explore the software’s functionalities.

Have a nice day and thank you for reading 🙂

- SAP Managed Tags:

- SAP Lumira

You must be a registered user to add a comment. If you've already registered, sign in. Otherwise, register and sign in.

-

"automatische backups"

1 -

"regelmäßige sicherung"

1 -

"TypeScript" "Development" "FeedBack"

1 -

505 Technology Updates 53

1 -

ABAP

14 -

ABAP API

1 -

ABAP CDS Views

2 -

ABAP CDS Views - BW Extraction

1 -

ABAP CDS Views - CDC (Change Data Capture)

1 -

ABAP class

2 -

ABAP Cloud

2 -

ABAP Development

5 -

ABAP in Eclipse

1 -

ABAP Platform Trial

1 -

ABAP Programming

2 -

abap technical

1 -

absl

1 -

access data from SAP Datasphere directly from Snowflake

1 -

Access data from SAP datasphere to Qliksense

1 -

Accrual

1 -

action

1 -

adapter modules

1 -

Addon

1 -

Adobe Document Services

1 -

ADS

1 -

ADS Config

1 -

ADS with ABAP

1 -

ADS with Java

1 -

ADT

2 -

Advance Shipping and Receiving

1 -

Advanced Event Mesh

3 -

AEM

1 -

AI

7 -

AI Launchpad

1 -

AI Projects

1 -

AIML

9 -

Alert in Sap analytical cloud

1 -

Amazon S3

1 -

Analytical Dataset

1 -

Analytical Model

1 -

Analytics

1 -

Analyze Workload Data

1 -

annotations

1 -

API

1 -

API and Integration

3 -

API Call

2 -

Application Architecture

1 -

Application Development

5 -

Application Development for SAP HANA Cloud

3 -

Applications and Business Processes (AP)

1 -

Artificial Intelligence

1 -

Artificial Intelligence (AI)

4 -

Artificial Intelligence (AI) 1 Business Trends 363 Business Trends 8 Digital Transformation with Cloud ERP (DT) 1 Event Information 462 Event Information 15 Expert Insights 114 Expert Insights 76 Life at SAP 418 Life at SAP 1 Product Updates 4

1 -

Artificial Intelligence (AI) blockchain Data & Analytics

1 -

Artificial Intelligence (AI) blockchain Data & Analytics Intelligent Enterprise

1 -

Artificial Intelligence (AI) blockchain Data & Analytics Intelligent Enterprise Oil Gas IoT Exploration Production

1 -

Artificial Intelligence (AI) blockchain Data & Analytics Intelligent Enterprise sustainability responsibility esg social compliance cybersecurity risk

1 -

ASE

1 -

ASR

2 -

ASUG

1 -

Attachments

1 -

Authorisations

1 -

Automating Processes

1 -

Automation

1 -

aws

2 -

Azure

1 -

Azure AI Studio

1 -

B2B Integration

1 -

Backorder Processing

1 -

Backup

1 -

Backup and Recovery

1 -

Backup schedule

1 -

BADI_MATERIAL_CHECK error message

1 -

Bank

1 -

BAS

1 -

basis

2 -

Basis Monitoring & Tcodes with Key notes

2 -

Batch Management

1 -

BDC

1 -

Best Practice

1 -

bitcoin

1 -

Blockchain

3 -

BOP in aATP

1 -

BOP Segments

1 -

BOP Strategies

1 -

BOP Variant

1 -

BPC

1 -

BPC LIVE

1 -

BTP

11 -

BTP Destination

2 -

Business AI

1 -

Business and IT Integration

1 -

Business application stu

1 -

Business Application Studio

1 -

Business Architecture

1 -

Business Communication Services

1 -

Business Continuity

1 -

Business Data Fabric

3 -

Business Partner

12 -

Business Partner Master Data

10 -

Business Technology Platform

2 -

Business Trends

1 -

CA

1 -

calculation view

1 -

CAP

3 -

Capgemini

1 -

CAPM

1 -

Catalyst for Efficiency: Revolutionizing SAP Integration Suite with Artificial Intelligence (AI) and

1 -

CCMS

2 -

CDQ

12 -

CDS

2 -

Cental Finance

1 -

Certificates

1 -

CFL

1 -

Change Management

1 -

chatbot

1 -

chatgpt

3 -

CL_SALV_TABLE

2 -

Class Runner

1 -

Classrunner

1 -

Cloud ALM Monitoring

1 -

Cloud ALM Operations

1 -

cloud connector

1 -

Cloud Extensibility

1 -

Cloud Foundry

4 -

Cloud Integration

6 -

Cloud Platform Integration

2 -

cloudalm

1 -

communication

1 -

Compensation Information Management

1 -

Compensation Management

1 -

Compliance

1 -

Compound Employee API

1 -

Configuration

1 -

Connectors

1 -

Consolidation Extension for SAP Analytics Cloud

1 -

Controller-Service-Repository pattern

1 -

Conversion

1 -

Cosine similarity

1 -

cryptocurrency

1 -

CSI

1 -

ctms

1 -

Custom chatbot

3 -

Custom Destination Service

1 -

custom fields

1 -

Customer Experience

1 -

Customer Journey

1 -

Customizing

1 -

cyber security

2 -

Data

1 -

Data & Analytics

1 -

Data Aging

1 -

Data Analytics

2 -

Data and Analytics (DA)

1 -

Data Archiving

1 -

Data Back-up

1 -

Data Governance

5 -

Data Integration

2 -

Data Quality

12 -

Data Quality Management

12 -

Data Synchronization

1 -

data transfer

1 -

Data Unleashed

1 -

Data Value

8 -

database tables

1 -

Datasphere

2 -

datenbanksicherung

1 -

dba cockpit

1 -

dbacockpit

1 -

Debugging

2 -

Delimiting Pay Components

1 -

Delta Integrations

1 -

Destination

3 -

Destination Service

1 -

Developer extensibility

1 -

Developing with SAP Integration Suite

1 -

Devops

1 -

digital transformation

1 -

Documentation

1 -

Dot Product

1 -

DQM

1 -

dump database

1 -

dump transaction

1 -

e-Invoice

1 -

E4H Conversion

1 -

Eclipse ADT ABAP Development Tools

2 -

edoc

1 -

edocument

1 -

ELA

1 -

Embedded Consolidation

1 -

Embedding

1 -

Embeddings

1 -

Employee Central

1 -

Employee Central Payroll

1 -

Employee Central Time Off

1 -

Employee Information

1 -

Employee Rehires

1 -

Enable Now

1 -

Enable now manager

1 -

endpoint

1 -

Enhancement Request

1 -

Enterprise Architecture

1 -

ETL Business Analytics with SAP Signavio

1 -

Euclidean distance

1 -

Event Dates

1 -

Event Driven Architecture

1 -

Event Mesh

2 -

Event Reason

1 -

EventBasedIntegration

1 -

EWM

1 -

EWM Outbound configuration

1 -

EWM-TM-Integration

1 -

Existing Event Changes

1 -

Expand

1 -

Expert

2 -

Expert Insights

1 -

Fiori

14 -

Fiori Elements

2 -

Fiori SAPUI5

12 -

Flask

1 -

Full Stack

8 -

Funds Management

1 -

General

1 -

Generative AI

1 -

Getting Started

1 -

GitHub

8 -

Grants Management

1 -

groovy

1 -

GTP

1 -

HANA

5 -

HANA Cloud

2 -

Hana Cloud Database Integration

2 -

HANA DB

1 -

HANA XS Advanced

1 -

Historical Events

1 -

home labs

1 -

HowTo

1 -

HR Data Management

1 -

html5

8 -

HTML5 Application

1 -

Identity cards validation

1 -

idm

1 -

Implementation

1 -

input parameter

1 -

instant payments

1 -

Integration

3 -

Integration Advisor

1 -

Integration Architecture

1 -

Integration Center

1 -

Integration Suite

1 -

intelligent enterprise

1 -

Java

1 -

job

1 -

Job Information Changes

1 -

Job-Related Events

1 -

Job_Event_Information

1 -

joule

4 -

Journal Entries

1 -

Just Ask

1 -

Kerberos for ABAP

8 -

Kerberos for JAVA

8 -

Launch Wizard

1 -

Learning Content

2 -

Life at SAP

1 -

lightning

1 -

Linear Regression SAP HANA Cloud

1 -

local tax regulations

1 -

LP

1 -

Machine Learning

2 -

Marketing

1 -

Master Data

3 -

Master Data Management

14 -

Maxdb

2 -

MDG

1 -

MDGM

1 -

MDM

1 -

Message box.

1 -

Messages on RF Device

1 -

Microservices Architecture

1 -

Microsoft Universal Print

1 -

Middleware Solutions

1 -

Migration

5 -

ML Model Development

1 -

Modeling in SAP HANA Cloud

8 -

Monitoring

3 -

MTA

1 -

Multi-Record Scenarios

1 -

Multiple Event Triggers

1 -

Neo

1 -

New Event Creation

1 -

New Feature

1 -

Newcomer

1 -

NodeJS

2 -

ODATA

2 -

OData APIs

1 -

odatav2

1 -

ODATAV4

1 -

ODBC

1 -

ODBC Connection

1 -

Onpremise

1 -

open source

2 -

OpenAI API

1 -

Oracle

1 -

PaPM

1 -

PaPM Dynamic Data Copy through Writer function

1 -

PaPM Remote Call

1 -

PAS-C01

1 -

Pay Component Management

1 -

PGP

1 -

Pickle

1 -

PLANNING ARCHITECTURE

1 -

Popup in Sap analytical cloud

1 -

PostgrSQL

1 -

POSTMAN

1 -

Process Automation

2 -

Product Updates

4 -

PSM

1 -

Public Cloud

1 -

Python

4 -

Qlik

1 -

Qualtrics

1 -

RAP

3 -

RAP BO

2 -

Record Deletion

1 -

Recovery

1 -

recurring payments

1 -

redeply

1 -

Release

1 -

Remote Consumption Model

1 -

Replication Flows

1 -

Research

1 -

Resilience

1 -

REST

1 -

REST API

1 -

Retagging Required

1 -

Risk

1 -

Rolling Kernel Switch

1 -

route

1 -

rules

1 -

S4 HANA

1 -

S4 HANA Cloud

1 -

S4 HANA On-Premise

1 -

S4HANA

3 -

S4HANA_OP_2023

2 -

SAC

10 -

SAC PLANNING

9 -

SAP

4 -

SAP ABAP

1 -

SAP Advanced Event Mesh

1 -

SAP AI Core

8 -

SAP AI Launchpad

8 -

SAP Analytic Cloud Compass

1 -

Sap Analytical Cloud

1 -

SAP Analytics Cloud

4 -

SAP Analytics Cloud for Consolidation

2 -

SAP Analytics Cloud Story

1 -

SAP analytics clouds

1 -

SAP BAS

1 -

SAP Basis

6 -

SAP BODS

1 -

SAP BODS certification.

1 -

SAP BTP

20 -

SAP BTP Build Work Zone

2 -

SAP BTP Cloud Foundry

5 -

SAP BTP Costing

1 -

SAP BTP CTMS

1 -

SAP BTP Innovation

1 -

SAP BTP Migration Tool

1 -

SAP BTP SDK IOS

1 -

SAP Build

11 -

SAP Build App

1 -

SAP Build apps

1 -

SAP Build CodeJam

1 -

SAP Build Process Automation

3 -

SAP Build work zone

10 -

SAP Business Objects Platform

1 -

SAP Business Technology

2 -

SAP Business Technology Platform (XP)

1 -

sap bw

1 -

SAP CAP

2 -

SAP CDC

1 -

SAP CDP

1 -

SAP CDS VIEW

1 -

SAP Certification

1 -

SAP Cloud ALM

4 -

SAP Cloud Application Programming Model

1 -

SAP Cloud Integration for Data Services

1 -

SAP cloud platform

8 -

SAP Companion

1 -

SAP CPI

3 -

SAP CPI (Cloud Platform Integration)

2 -

SAP CPI Discover tab

1 -

sap credential store

1 -

SAP Customer Data Cloud

1 -

SAP Customer Data Platform

1 -

SAP Data Intelligence

1 -

SAP Data Migration in Retail Industry

1 -

SAP Data Services

1 -

SAP DATABASE

1 -

SAP Dataspher to Non SAP BI tools

1 -

SAP Datasphere

9 -

SAP DRC

1 -

SAP EWM

1 -

SAP Fiori

2 -

SAP Fiori App Embedding

1 -

Sap Fiori Extension Project Using BAS

1 -

SAP GRC

1 -

SAP HANA

1 -

SAP HCM (Human Capital Management)

1 -

SAP HR Solutions

1 -

SAP IDM

1 -

SAP Integration Suite

9 -

SAP Integrations

4 -

SAP iRPA

2 -

SAP Learning Class

1 -

SAP Learning Hub

1 -

SAP Odata

2 -

SAP on Azure

1 -

SAP PartnerEdge

1 -

sap partners

1 -

SAP Password Reset

1 -

SAP PO Migration

1 -

SAP Prepackaged Content

1 -

SAP Process Automation

2 -

SAP Process Integration

2 -

SAP Process Orchestration

1 -

SAP S4HANA

2 -

SAP S4HANA Cloud

1 -

SAP S4HANA Cloud for Finance

1 -

SAP S4HANA Cloud private edition

1 -

SAP Sandbox

1 -

SAP STMS

1 -

SAP SuccessFactors

2 -

SAP SuccessFactors HXM Core

1 -

SAP Time

1 -

SAP TM

2 -

SAP Trading Partner Management

1 -

SAP UI5

1 -

SAP Upgrade

1 -

SAP Utilities

1 -

SAP-GUI

8 -

SAP_COM_0276

1 -

SAPBTP

1 -

SAPCPI

1 -

SAPEWM

1 -

sapmentors

1 -

saponaws

2 -

SAPS4HANA

1 -

SAPUI5

4 -

schedule

1 -

Secure Login Client Setup

8 -

security

9 -

Selenium Testing

1 -

SEN

1 -

SEN Manager

1 -

service

1 -

SET_CELL_TYPE

1 -

SET_CELL_TYPE_COLUMN

1 -

SFTP scenario

2 -

Simplex

1 -

Single Sign On

8 -

Singlesource

1 -

SKLearn

1 -

soap

1 -

Software Development

1 -

SOLMAN

1 -

solman 7.2

2 -

Solution Manager

3 -

sp_dumpdb

1 -

sp_dumptrans

1 -

SQL

1 -

sql script

1 -

SSL

8 -

SSO

8 -

Substring function

1 -

SuccessFactors

1 -

SuccessFactors Time Tracking

1 -

Sybase

1 -

system copy method

1 -

System owner

1 -

Table splitting

1 -

Tax Integration

1 -

Technical article

1 -

Technical articles

1 -

Technology Updates

1 -

Technology Updates

1 -

Technology_Updates

1 -

Threats

1 -

Time Collectors

1 -

Time Off

2 -

Tips and tricks

2 -

Tools

1 -

Trainings & Certifications

1 -

Transport in SAP BODS

1 -

Transport Management

1 -

TypeScript

2 -

unbind

1 -

Unified Customer Profile

1 -

UPB

1 -

Use of Parameters for Data Copy in PaPM

1 -

User Unlock

1 -

VA02

1 -

Validations

1 -

Vector Database

1 -

Vector Engine

1 -

Visual Studio Code

1 -

VSCode

1 -

Web SDK

1 -

work zone

1 -

workload

1 -

xsa

1 -

XSA Refresh

1

- « Previous

- Next »

- SAP Partners unleash Business AI potential at global Hack2Build in Technology Blogs by SAP

- Introducing Blog Series of SAP Signavio Process Insights, discovery edition – An in-depth exploratio in Technology Blogs by SAP

- New Machine Learning features in SAP HANA Cloud in Technology Blogs by SAP

- 10+ ways to reshape your SAP landscape with SAP Business Technology Platform - Blog 7 in Technology Blogs by SAP

- 10+ ways to reshape your SAP landscape with SAP Business Technology Platform – Blog 4 in Technology Blogs by SAP

| User | Count |

|---|---|

| 11 | |

| 10 | |

| 7 | |

| 6 | |

| 4 | |

| 4 | |

| 3 | |

| 3 | |

| 3 | |

| 3 |