- SAP Community

- Products and Technology

- Enterprise Resource Planning

- ERP Blogs by Members

- Configuration on Asset Management Part 1

- Subscribe to RSS Feed

- Mark as New

- Mark as Read

- Bookmark

- Subscribe

- Printer Friendly Page

- Report Inappropriate Content

INTRODUCTION

Asset accounting module in SAP manages fixed assets data of an

organization by way of asset master records. Asset accounting module thus

acts as a sub ledger to the FI module for managing asset records.

You must assign a chart of depreciation to each company code that is defined

in Asset Accounting. SAP provides country-specific charts of depreciation with

predefined depreciation areas. These charts of depreciation serve only as a

reference for creating your own charts of depreciation, and are therefore not

directly accessible in the SAP system. When creating a chart of depreciation,

you have to copy the reference chart of depreciation.

Copy Reference Chart of Depreciation/Depreciation areas

- 2. Specify Description of Chart of Depreciation

Change the name as per your requirement.

3. Copy/Delete Depreciation Areas

4. Assign Input Tax Indicator for Non-Taxable Acquisitions

In this step, you specify an input tax indicator per company code. The system

then uses this indicator when you post acquisitions that are not subject to tax,

but which are posted to accounts that are tax-relevant.

Assign input tax indicator Z1 (Input tax 0%)

Assign output tax indicator Y3 (output tax 0%)

5. Assign Chart of Depreciation to company code

7. Specify Account Determination

The key of an account determination must be stored in the asset class. The

account determination links an asset master record to the general ledger

accounts to be posted for an accounting transaction using the asset class.

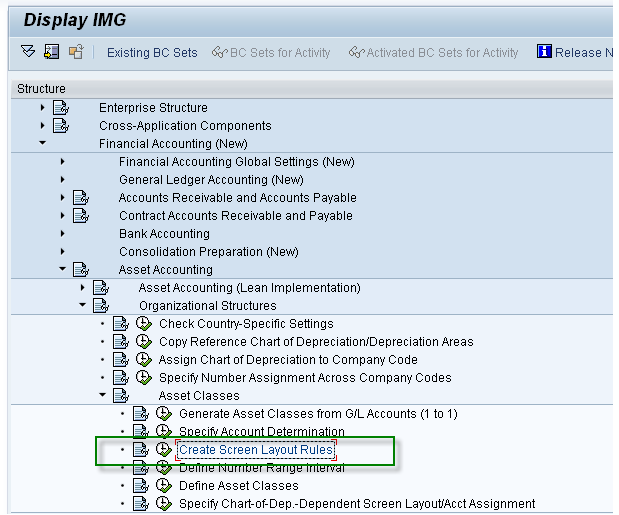

8. Create Screen Layout Rules

In this step, you create only the keys and descriptions of the screen layout

controls. You define the field group rules for the screen layouts themselves in

the step Master data.

9. Define Number Range Interval

Number range interval is required for the main asset number for the company

code. Normally we should specify internal number ranges for assets. The

number range key is then assigned to each of the asset class.

For Example:

01 | 2013 | 2100000000 | 2199999999 |

10. Define Asset Classes

The asset class is the most important criteria for structuring fixed assets from

an accounting point of view. Every asset has to be assigned to exactly one

asset class. The asset class is used to assign the assets (and their business

transactions) to the correct general ledger accounts. Several asset classes

can use the same account assignment.

Double Click on Asset Class and assign Account determination, Screen layout to Asset Class and Number Range.

11. Assign G/L Accounts

In this step you assign the balance sheet accounts and the depreciation

accounts for Asset accounting.

12. Specify Financial Statement Version for Asset Reports

You specify which financial statement version the system is to use as a

default per depreciation area. This default applies when the financial

statement version is contained in the sort version used for a given report.

Select company code xxxx.

13. Specify Document Type for Posting of Depreciation

- SAP Managed Tags:

- FIN Asset Accounting

You must be a registered user to add a comment. If you've already registered, sign in. Otherwise, register and sign in.

-

"mm02"

1 -

A_PurchaseOrderItem additional fields

1 -

ABAP

1 -

ABAP Extensibility

1 -

ACCOSTRATE

1 -

ACDOCP

1 -

Adding your country in SPRO - Project Administration

1 -

Advance Return Management

1 -

AI and RPA in SAP Upgrades

1 -

API and Integration

1 -

Approval Workflows

1 -

Ariba

1 -

ARM

1 -

ASN

1 -

Asset Management

1 -

Associations in CDS Views

1 -

auditlog

1 -

Authorization

1 -

Availability date

1 -

Azure Center for SAP Solutions

1 -

AzureSentinel

2 -

Bank

1 -

BAPI_SALESORDER_CREATEFROMDAT2

1 -

BRF+

1 -

BRFPLUS

1 -

Bundled Cloud Services

1 -

business participation

1 -

Business Processes

1 -

CAPM

1 -

Carbon

1 -

Cental Finance

1 -

CFIN

1 -

CFIN Document Splitting

1 -

Cloud ALM

1 -

Cloud Integration

1 -

condition contract management

1 -

Connection - The default connection string cannot be used.

1 -

Custom Table Creation

1 -

Customer Screen in Production Order

1 -

Customizing

1 -

Data Quality Management

1 -

Date required

1 -

Decisions

1 -

desafios4hana

1 -

Developing with SAP Integration Suite

2 -

Direct Outbound Delivery

1 -

DMOVE2S4

1 -

EAM

1 -

EDI

3 -

EDI 850

1 -

EDI 856

1 -

edocument

1 -

EHS Product Structure

1 -

Emergency Access Management

1 -

Employee Central Integration (Inc. EC APIs)

1 -

Energy

1 -

EPC

1 -

Financial Operations

1 -

Find

1 -

FINSSKF

1 -

Fiori

1 -

Flexible Workflow

1 -

Gas

1 -

Gen AI enabled SAP Upgrades

1 -

General

1 -

generate_xlsx_file

1 -

Getting Started

1 -

HomogeneousDMO

1 -

How to add new Fields in the Selection Screen Parameter in FBL1H Tcode

1 -

IDOC

2 -

Integration

1 -

Learning Content

2 -

Ledger Combinations in SAP

1 -

LogicApps

2 -

low touchproject

1 -

Maintenance

1 -

management

1 -

Material creation

1 -

Material Management

1 -

MD04

1 -

MD61

1 -

methodology

1 -

Microsoft

2 -

MicrosoftSentinel

2 -

Migration

1 -

mm purchasing

1 -

MRP

1 -

MS Teams

2 -

MT940

1 -

Newcomer

1 -

Notifications

1 -

Oil

1 -

open connectors

1 -

Order Change Log

1 -

ORDERS

2 -

OSS Note 390635

1 -

outbound delivery

1 -

outsourcing

1 -

PCE

1 -

Permit to Work

1 -

PIR Consumption Mode

1 -

PIR's

1 -

PIRs

1 -

PIRs Consumption

1 -

PIRs Reduction

1 -

Plan Independent Requirement

1 -

POSTMAN

1 -

Premium Plus

1 -

pricing

1 -

Primavera P6

1 -

Process Excellence

1 -

Process Management

1 -

Process Order Change Log

1 -

Process purchase requisitions

1 -

Product Information

1 -

Production Order Change Log

1 -

purchase order

1 -

Purchase requisition

1 -

Purchasing Lead Time

1 -

Redwood for SAP Job execution Setup

1 -

RISE with SAP

1 -

RisewithSAP

1 -

Rizing

1 -

S4 Cost Center Planning

1 -

S4 HANA

1 -

S4HANA

3 -

S4HANACloud audit

1 -

Sales and Distribution

1 -

Sales Commission

1 -

sales order

1 -

SAP

2 -

SAP Best Practices

1 -

SAP Build

1 -

SAP Build apps

1 -

SAP CI

1 -

SAP Cloud ALM

1 -

SAP CPI

1 -

SAP CPI (Cloud Platform Integration)

1 -

SAP Data Quality Management

1 -

SAP ERP

1 -

SAP Maintenance resource scheduling

2 -

SAP Note 390635

1 -

SAP S4HANA

2 -

SAP S4HANA Cloud private edition

1 -

SAP Upgrade Automation

1 -

SAP WCM

1 -

SAP Work Clearance Management

1 -

Schedule Agreement

1 -

SDM

1 -

security

2 -

Settlement Management

1 -

soar

2 -

Sourcing and Procurement

1 -

SSIS

1 -

SU01

1 -

SUM2.0SP17

1 -

SUMDMO

1 -

Teams

2 -

Time Management

1 -

User Administration

1 -

User Participation

1 -

Utilities

1 -

va01

1 -

vendor

1 -

vl01n

1 -

vl02n

1 -

WCM

1 -

X12 850

1 -

xlsx_file_abap

1 -

YTD|MTD|QTD in CDs views using Date Function

1

- « Previous

- Next »

- Subscription Billing with Convergent Invoicing and Contract-Based Revenue Recognition in Enterprise Resource Planning Blogs by SAP

- SAP Activate Realize and Deploy phase activities in the context of Scaled Agile Framework in Enterprise Resource Planning Blogs by SAP

- Understand Upgrading and Patching Processes of SAP S/4HANA Cloud Public Edition in Enterprise Resource Planning Blogs by SAP

- Preferred Success Round Table Discussion with SAP Customers on 29th April @ SAP NOW India. in Enterprise Resource Planning Blogs by SAP

- 4 Expert Tips for Setting Up the Organizational Structure in SAP Central Business Configuration in Enterprise Resource Planning Blogs by SAP

| User | Count |

|---|---|

| 5 | |

| 3 | |

| 2 | |

| 2 | |

| 1 | |

| 1 | |

| 1 | |

| 1 | |

| 1 | |

| 1 |