- SAP Community

- Products and Technology

- Enterprise Resource Planning

- ERP Blogs by Members

- SEPA Pre-notification and SDD Timelines Functional...

- Subscribe to RSS Feed

- Mark as New

- Mark as Read

- Bookmark

- Subscribe

- Printer Friendly Page

- Report Inappropriate Content

SEPA SDD Time Lines and Pre-notification

SEPA stands for ‘Single Euro Payments Area’. It’s a system that is designed to create financial efficiency for countries using the currency Euro by providing a unified system in which to perform financial transactions. The SEPA seeks to create a better system for credit transfers, an improved debit system and a cheaper way for individuals and firms to make transactions within member countries or regions.

The implementation of SEPA is mandatory by 1st of February 2014 for the Euro area countries.

The changeover of national collection procedures to SEPA Direct Debit requires, along with the use and management of SEPA mandates, that the business partner or Customer be notified in advance about the items to be collected and the mandate to be used must be named.

The SEPA Direct Debit (SDD) Core and the SDD Business to Business (SDD B2B) Schemes developed by the European Payments Council (EPC) - like any other direct debit schemes. With SDD Schemes enable consumers to make cross-border direct debit payments throughout the 32 Single Euro Payments Area (SEPA) countries1. At the same time, the SDD Schemes can be used for payments domestically.

The payer and the biller must each hold an account with a payment service provider (PSP) located within SEPA. The accounts may be held in either euro or in any other currency. The transfer of funds (money) between the payer's bank and the biller's bank always takes place in the euro currency.

SEPA requires to meet modified lead times, examples:

- The pre-notification must always reach the payer with a period of 14 calendar days

- The lead time for submitting a SEPA CORE direct debit at the bank is 5 days for the first use of a mandate and 2 days for the subsequent use.

- The lead time for submitting a SEPA B2B direct debit at the bank is 1 day for the first use of a mandate and 1 day for the subsequent use.

Pre- Notification :

A pre notification is a notice to the debtor or payer informing at least 14 calendar days before collecting the payment, unless a different timeline has been agreed between the debtor and the billing organization or unit. The pre notification includes the amount of collection, due date.

SAP provides various OSS notes to incorporate this functionality. Following are the SAP notes to be implemented for SEPA Prenotification.

A) 1679118 :

When we run batch input session for transaction F110. If custom selections are changed by this batch input , change of field name is not transferred.This may result in follow-on-errors. As part of Note implementation 1679118, following list of existing standard Report objects will affect in the system.

1) F110VI00

2) F110VO00

3)F110VTOP

B) 1760564:

When we use the report for automatic scheduling of payment run(F110S). if you have define a value several times in selection of customers and vendors, this leads to document balance not equal to zero during processing. In this case , customers or vendors are included several times in selection and the error message FZ 326 is displayed in log.

As part of Note implementation 1760564, following list of existing standard Report objects will affect in the system.

1) RFF110S

2) RFF110S_DATA

3) RF110S_FORMS

C) 1770425:

In the payment program for payment requests, as mandate is rejected as invalid eventhough it is valid.As the mandate is specified as mandatory in the payment request,the system does not check any further mandates and no payment is made.In order to fix, we need to implement corrections mentioned in note. As part of Note implementation 1770425, following list of existing standard Report objects will affect in the system.

1)LF11BF01

D) 1776076 :

When we use SEPA Mandates, it is not possible to influence SEPA mandate selection according to our requirements or to adjust SEPA Mandate Lead times(five/two/one-day rule) individually during a payment run. As part of Note implementation 1776076, Changes are affected for below list of standard objects.

1. Function Module : FI_PAYMENT_BANK_SELECT

2. Function Module : FI_SEPA_CALCUALTE_DAYS

3. Function Module : FI_SEPA_FILTERED_MANDATES_GET

4. Function Module: FI_SEPA_PAYM_SET_PARAMS

5. Class: CL_SEPA_ADD_DAYS_ADJUST_DEMO and Interface IF_EX_SEPA_ADD_DAYS_ADJUST~ADJUST

6. Class:CL_SEPA_MANDATE_FILTER_DEMO and Interface IF_EX_SPEA_MANDATE_FILTER~FILTER

7. Classical BADI’s SAPF110S_SEPA_MANDATE_FILTER and SAPF110S_SEPA_ADD_DAYS_ADJUST are migrated to Enhancement Spot ES_SAPF110S_SEPA_MANDATE from release 6.0.

8. Type group FIPRQ

E) 1780941:

Once we enter a payment method for SEPA direct debits in a payment run for SEPA payment methods the system displays a checkbox in the parameters for the payment run (F110) using which the update run is a run for direct debit pre-notifications. This allows you to send letters and protects the items affected by the direct debit against being otherwise cleared, but does not post and does not permit any payment medium creation either. The new "direct debit pre-notification" object is visible in the payment run (F110), in the document display (FB03), in the line item display (FBL5N) and in mandate display (FSEPA_M4).

F) 1792691:

This error occurs if the creditor identifier is different in the paying company code and the mandate.In order to fix, we need to implement corrections mentioned in note. As part of Note implementation 1792691, following list of existing standard Report objects will affect in the system.

1)F110OFS0

Once the above notes are implemented, the functionality of SEPA Direct Debit pre-notification will become active.

How does PreNotification work in SAP.

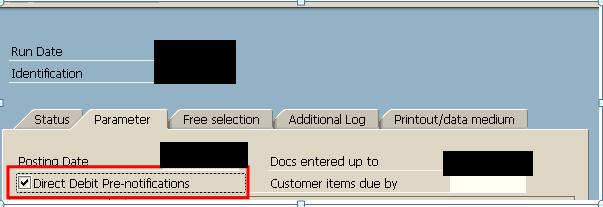

When F110 (Automatic Payment Run) is executed –after giving the information such as the Posting Date, Doc Entered up to , the company code , Payment Method , Next Payment Execution date in the in the Parameter tab – we shall get an option to select the Direct Debit Pre-notifications indicator.

Below is the screen shot of the same.

The option of to select the Direct Debit Pre-notifications indicator shall be coming only for SEPA payment methods – once the SEPA Mandate Required field is marked in Payment Method/Country settings in FBZP.

One should schedule a run for the creation of direct debit pre-notifications before the payment run taking into account the payers or customer items that are due in 14 days for a SEPA Direct Debit pre-notification. The actual payment run can be scheduled and the payment medium can be created as per the notified timelines.

The standard print program RFFOAVIS_DD_PRENOTIF and script form F110_DD_PRENOTIF are used for SEPA direct debit pre-notifications.

To meet any specific business requirement, the standard script F110_DD_PRENOTIF can be copied into a custom script and can be used.

Deletion direct debit pre-notifications

If the direct debit pre-notification are not correct –one can delete all the notifications in the payment program run.

Goto F110 => Environment =>Direct Debit Pre-notifications=> Delete

SDD Timelines (SEPA DIRECT DEBIT)

SAP has released some standard notes to be implemented for SEPA Direct Debit timelines.

A)1601466 : SEPA : Target Calender/ Calculation of lead days

According SEPA Rule book , a target calender has to be taken into account so that weekends not consider in the calcuation.

B) 1605678: F110/SEPA: Consideration of Target calendar

When we calculate the execution date or due date of the SEPA Direct debit, the system does not take any calendar into account in the payment program. However, according to the SEPA guidelines, only bank days according to target calendar should be used for the lead days and the due date.

C) 1757993: PMF SEPA: Increasing the lead time days for B2B mandates

D) 1725028: F110/F111:” Superseding” SEPA mandates

The subsequent use of a mandate may “surpersede” the first use. The SEPA leads time amount to 5 days for the first use and 2 days for the subsequent use.If the next payment run is exucuted only one day later or just few days later , the execution date of the subsequent use may be before the execution date of the first use. This is inconsistent. The bank is supposed to excute the recurring payment for first payment.

E) 1884024: The posting date of the payment documents posted in FPY1 is the same for all documents, whether or not there are different execution dates (field DPAYH-AUSFD).

This is not desirable, especially if "N days in the future" have to be selected due to the SEPA items with a due date.

Once all the relevant OSS Notes are implemented for SEPA Direct debit , we will see in the DME

file the SDD timelines.

How does SDD timelines work in SAP.

The SEPA core direct debit scheme is based on the SEPA Core Direct Debit Scheme Rulebook of the European Payments Council. With the SEPA core direct debit scheme, the payer can effect payments to the payee in euros through its payment service provider within the Single Euro Payments Area (SEPA). For the execution of payments using the SEPA core direct debit scheme, the payer must issue a SEPA direct debit mandate to the payee prior to the payment transaction. The customer (i.e. the payee) initiates the respective payment transaction by presenting the direct debits through the Bank to the payer’s payment service provider.

The SDD timelines are calculated based on standard function module FI_SEPA_CALCULATE_DAYS.

Example :-

Case 1 – Core Direct Debit Customer and First Time Collection

‘TEST SEPA’ is Core Direct Debit customer and has an invoice due on 23.10.2013 for first time collection.

Mandate ID has been created for the customer TEST SEPA

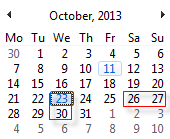

Execute F110 – the DMEE file will be generated which needs to be sent to bank for the collections. The Invoice is due on 23.10.2013. We have executed the F110 on 23.10.2013. Since it’s a first time collection – lead time for submitting a SEPA CORE direct debit at the bank is 5 days for the first use of a mandate. So the Required Collection Date should be 30.10.2013 (26th and 27th are Bank Holiday)

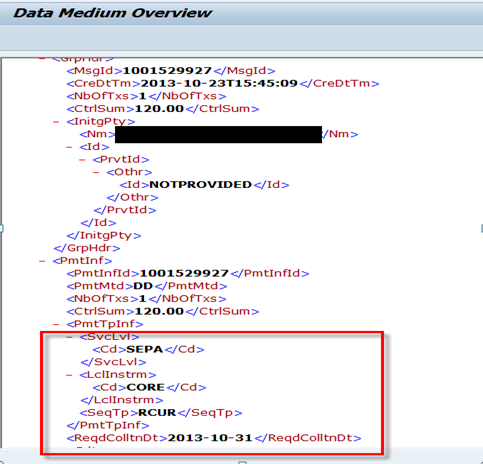

Below is the screen shot of the DMEE – its shows all the details correctly. The F110 execution date as 23.10.2013, the customer TEST SEPA is CORE customer; it’s the first time collection, in the node sequence type once can notice FRST and required collection date as 30.10.2013.

Once the F110 is executed – the mandate master data gets updated with the USE tab with payment run information.

Case 2 – Core Direct Debit Customer and Recur Collection

Lets take the same customer TEST SEPA. Post another invoice and due date should be less than 30.10.2013. This would be a RCUR collection.

Execute the F110 and check the DME file.

For a RCUR collection – the lead time for submitting a SEPA CORE direct debit at the bank is 2 days for the subsequent use. So ideally for the above scenarios the due date is 24.10.2013 and being RCUR collection the required collection date should be 28.10.2013.

However the DMEE gives the Required Collection Date as 31.10.2013 – which is correct. The reason for this is – the FRST collection for the Customer TEST SEPA is on 30.10.2013 (Please refer Case 1 above). Hence any other collections due before this day will happen after 30.10.2013 only ie after the FRST collection is collected or completed on 30.10.2013.

Similarly like SEPA Core direct debit, the SDD timelines will work for SEPA B2B direct debit too wherein the lead time is 1 day.

Case 3 – B2B Direct Debit Customer and First Time Collection

Lets take a B2B Customer with 2 invoices which are due on 04.09.2013 and 30.09.2013.

Execute the F110 run and check the DME File. Below is the screen shot of the DMEE – its shows all the details correctly. The F110 execution date as 23.10.2013, the customer is B2B customer; since it’s the first time collection, in the node sequence type one can notice FRST and required collection date as 30.10.2013. ( Lead time is 1 day). All the details are being shown correctly.

Case 3 – B2B Direct Debit Customer for RCUR Collection

Lets take a B2B Customer with invoices for RCUR collection. The lead time is 1 day. Execute F110 with required details and check the DME File.

The sequence type is RCUR and Required collection date is 25.10.2013.

- SAP Managed Tags:

- FIN (Finance)

You must be a registered user to add a comment. If you've already registered, sign in. Otherwise, register and sign in.

-

"mm02"

1 -

A_PurchaseOrderItem additional fields

1 -

ABAP

1 -

ABAP Extensibility

1 -

ACCOSTRATE

1 -

ACDOCP

1 -

Adding your country in SPRO - Project Administration

1 -

Advance Return Management

1 -

AI and RPA in SAP Upgrades

1 -

Approval Workflows

1 -

ARM

1 -

ASN

1 -

Asset Management

1 -

Associations in CDS Views

1 -

auditlog

1 -

Authorization

1 -

Availability date

1 -

Azure Center for SAP Solutions

1 -

AzureSentinel

2 -

Bank

1 -

BAPI_SALESORDER_CREATEFROMDAT2

1 -

BRF+

1 -

BRFPLUS

1 -

Bundled Cloud Services

1 -

business participation

1 -

Business Processes

1 -

CAPM

1 -

Carbon

1 -

Cental Finance

1 -

CFIN

1 -

CFIN Document Splitting

1 -

Cloud ALM

1 -

Cloud Integration

1 -

condition contract management

1 -

Connection - The default connection string cannot be used.

1 -

Custom Table Creation

1 -

Customer Screen in Production Order

1 -

Data Quality Management

1 -

Date required

1 -

Decisions

1 -

desafios4hana

1 -

Developing with SAP Integration Suite

1 -

Direct Outbound Delivery

1 -

DMOVE2S4

1 -

EAM

1 -

EDI

2 -

EDI 850

1 -

EDI 856

1 -

edocument

1 -

EHS Product Structure

1 -

Emergency Access Management

1 -

Energy

1 -

EPC

1 -

Financial Operations

1 -

Find

1 -

FINSSKF

1 -

Fiori

1 -

Flexible Workflow

1 -

Gas

1 -

Gen AI enabled SAP Upgrades

1 -

General

1 -

generate_xlsx_file

1 -

Getting Started

1 -

HomogeneousDMO

1 -

IDOC

2 -

Integration

1 -

Learning Content

2 -

LogicApps

2 -

low touchproject

1 -

Maintenance

1 -

management

1 -

Material creation

1 -

Material Management

1 -

MD04

1 -

MD61

1 -

methodology

1 -

Microsoft

2 -

MicrosoftSentinel

2 -

Migration

1 -

MRP

1 -

MS Teams

2 -

MT940

1 -

Newcomer

1 -

Notifications

1 -

Oil

1 -

open connectors

1 -

Order Change Log

1 -

ORDERS

2 -

OSS Note 390635

1 -

outbound delivery

1 -

outsourcing

1 -

PCE

1 -

Permit to Work

1 -

PIR Consumption Mode

1 -

PIR's

1 -

PIRs

1 -

PIRs Consumption

1 -

PIRs Reduction

1 -

Plan Independent Requirement

1 -

Premium Plus

1 -

pricing

1 -

Primavera P6

1 -

Process Excellence

1 -

Process Management

1 -

Process Order Change Log

1 -

Process purchase requisitions

1 -

Product Information

1 -

Production Order Change Log

1 -

Purchase requisition

1 -

Purchasing Lead Time

1 -

Redwood for SAP Job execution Setup

1 -

RISE with SAP

1 -

RisewithSAP

1 -

Rizing

1 -

S4 Cost Center Planning

1 -

S4 HANA

1 -

S4HANA

3 -

Sales and Distribution

1 -

Sales Commission

1 -

sales order

1 -

SAP

2 -

SAP Best Practices

1 -

SAP Build

1 -

SAP Build apps

1 -

SAP Cloud ALM

1 -

SAP Data Quality Management

1 -

SAP Maintenance resource scheduling

2 -

SAP Note 390635

1 -

SAP S4HANA

2 -

SAP S4HANA Cloud private edition

1 -

SAP Upgrade Automation

1 -

SAP WCM

1 -

SAP Work Clearance Management

1 -

Schedule Agreement

1 -

SDM

1 -

security

2 -

Settlement Management

1 -

soar

2 -

SSIS

1 -

SU01

1 -

SUM2.0SP17

1 -

SUMDMO

1 -

Teams

2 -

User Administration

1 -

User Participation

1 -

Utilities

1 -

va01

1 -

vendor

1 -

vl01n

1 -

vl02n

1 -

WCM

1 -

X12 850

1 -

xlsx_file_abap

1 -

YTD|MTD|QTD in CDs views using Date Function

1

- « Previous

- Next »

- SAP Baseline Activation Service and the Scroll of Ultimate Understanding: All-Inclusive Insights in Enterprise Resource Planning Blogs by SAP

- Defense & Security in SAP S/4HANA Cloud, Private Edition 2023 in Enterprise Resource Planning Blogs by SAP

- Projects in SAP in Enterprise Resource Planning Blogs by Members

- Challenges of the Technical Approach to Clean Core in Enterprise Resource Planning Blogs by Members

- The S/4HANA Deployment Dictionary: Your Back Pocket Guide to Everything Greenfield, Brownfield & Bluefield in Enterprise Resource Planning Blogs by Members

| User | Count |

|---|---|

| 6 | |

| 2 | |

| 2 | |

| 2 | |

| 2 | |

| 2 | |

| 2 | |

| 1 | |

| 1 | |

| 1 |