- SAP Community

- Products and Technology

- Enterprise Resource Planning

- ERP Blogs by Members

- Understanding functions in Payroll Schemas (specif...

- Subscribe to RSS Feed

- Mark as New

- Mark as Read

- Bookmark

- Subscribe

- Printer Friendly Page

- Report Inappropriate Content

Introduction

In SAP HR, functions provide the high-level logic for calculations. The functions can be associated with either a payroll class or time management class. In payroll, they provide the overall functionality for payroll processing including rules for calculations. Functions perform general processing such as reading wage types from specific infotypes, calculating payroll taxes on a given set of wages, benefits premiums etc and storing the results of the payroll calculation.

To understand how to read the functions, below is the example for one of the payroll functions, WPBP (Import work center and basic pay data).

WPBP (Import work center and basic pay data)

This function is used to transfer master data on the work center and basic pay for the payroll period to internal table WPBP. The basic pay wage types are stored in the internal table IT. If all the fields of the table WPBP are same during the entire payroll period, this table will contain one record. However, in certain cases different data may exist for different partial periods. In such cases, there will be multiple entries, which are identified by split indicators. Such cases have been explained in the below sections along with the screenshots.

Viewing the function

SAP Payroll comprises of many functions which can be accessed via transaction PE04. Some of these are country-specific while others are not. Each function is defined and documented and can be viewed via transaction PDSY in releases 4.5 and greater, or with report RPDSYS00 in earlier versions.

T Code: PE04

Characteristics of the function

Each function has a corresponding ABAP code associated wit it, which is obtained by adding ‘fu’ at the beginning of its name. While a payroll function may comprise of ABAP code, it is not executed in similar way as ABAP code is. A payroll function is executed in the payroll driver using schemas. Thus, when the payroll driver executes the schema, it automatically puts ‘fu’ in the beginning of the function name and then execute it further.

Usage of function in a Schema#

A function may be used as a part of schema or a sub schema, depending on the requirements. For example, in the below screenshots, the function ‘COM’ is used in the main schema X000 (International Personnel Calc. Schema for RPCALCX0 (International)), while the function WPBP is used as a function in the custom subschema XBD0 (Edit basic data).

Main Schema: X000

Sub schema XBD0

#A schema can be accessed via transaction PE01 and the details of the functions can be viewed by pressing F1 on the function name.

Syntax of a function

The syntax of a function in a schema is defined basis the parameter list defined in the characteristics of the function.

Below is the detailed explanation of the parameters.

- Par2 - different pay-scale type (No check)

- Par3 - rel. time unit (X - WPBP for each time unit)

- Par4 - Subtype of infotype 0008 (No check)

Thus for WPBP, if you specify a pay scale type which has not been maintained correctly in the indirect valuation tables, the personnel number is rejected during indirect valuation.

Setting the third parameter will result in split of WPBP in a greater detail if the time unit for the pay scale does not correspond to the time unit for the payroll area.

For the fourth parameter, the function WPBP is started for the subtype 0 of IT 08.

Executing function in Schema

A function cannot be directly executed in isolation. It can be executed only via schemas which are further executed using payroll driver. Key in the data in the payroll driver (T Code: PC00_M**_CALC_SIMU - payroll driver in simulation mode; ** indicates the country grouping or MOLGA)

Example

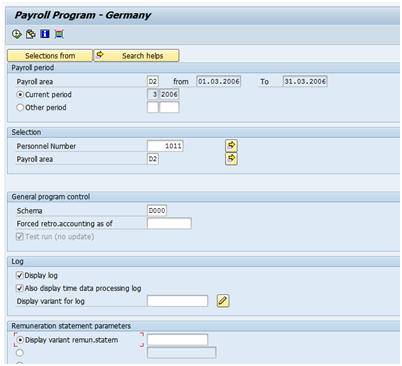

T Code:PC00_M01_CALC_SIMU (01 – MOLGA for Germany)

The driver will execute various functions step by step as per the schema. In case the “display log” option has been checked in the payroll driver, a payroll log will be generated basis the inputs given.

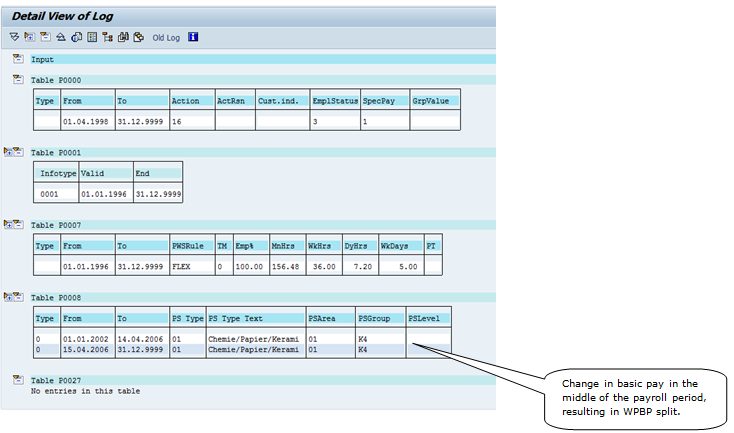

The below screenshots depict the output of WPBP function and how the processing is done basis the inputs provided to the function. Here, WPBP function will pick up the inputs from P0000/ P0001 / P0007 / P0008 and P0027 tables and perform indirect valuation of wage types from basic pay in the processing step and subsequently transfer the data into WPBP Table.

Inputs for the WPBP Function

WPBP function will pick up the inputs from P0000/ P0001 / P0007 / P0008 and P0027 tables.

Detailed view of the inputs

Processing during the WPBP function

Indirect valuation of wage types from basic pay is performed in the processing step and subsequently that output is transferred into WPBP Table.

Output – Creation of WPBP Table

In case there are no changes to the IT 0000 / 0001 / 0007 / 0008 / 0027 during the given payroll period, there will be only one entry. However, if certain changes have been made to above infotypes during the payroll period, a split will be created for the partial periods and accordingly, multiple entries will be created in WPBP table. This is being shown in the subsequent section.

WPBP splits created by WPBP function

As mentioned above if there are any changes to IT 0000 / 0001 / 0007 / 0008 / 0027 for an employee during the given payroll period, a split will be created for the partial periods in WPBP table.

For example there had been a change in the basic pay for an employee in the middle of a given payroll period (01.04.2006– 30.04.2006), which resulted in multiple splits in WPBP Table.

Inputs for the WPBP Function

Processing of WPBP Table with splits

Output of WPBP Table with splits

Detailed output of WPBP Table with two entries

- SAP Managed Tags:

- HCM (Human Capital Management)

You must be a registered user to add a comment. If you've already registered, sign in. Otherwise, register and sign in.

-

"mm02"

1 -

A_PurchaseOrderItem additional fields

1 -

ABAP

1 -

ABAP Extensibility

1 -

ACCOSTRATE

1 -

ACDOCP

1 -

Adding your country in SPRO - Project Administration

1 -

Advance Return Management

1 -

AI and RPA in SAP Upgrades

1 -

Approval Workflows

1 -

ARM

1 -

ASN

1 -

Asset Management

1 -

Associations in CDS Views

1 -

auditlog

1 -

Authorization

1 -

Availability date

1 -

Azure Center for SAP Solutions

1 -

AzureSentinel

2 -

Bank

1 -

BAPI_SALESORDER_CREATEFROMDAT2

1 -

BRF+

1 -

BRFPLUS

1 -

Bundled Cloud Services

1 -

business participation

1 -

Business Processes

1 -

CAPM

1 -

Carbon

1 -

Cental Finance

1 -

CFIN

1 -

CFIN Document Splitting

1 -

Cloud ALM

1 -

Cloud Integration

1 -

condition contract management

1 -

Connection - The default connection string cannot be used.

1 -

Custom Table Creation

1 -

Customer Screen in Production Order

1 -

Data Quality Management

1 -

Date required

1 -

Decisions

1 -

desafios4hana

1 -

Developing with SAP Integration Suite

1 -

Direct Outbound Delivery

1 -

DMOVE2S4

1 -

EAM

1 -

EDI

2 -

EDI 850

1 -

EDI 856

1 -

EHS Product Structure

1 -

Emergency Access Management

1 -

Energy

1 -

EPC

1 -

Find

1 -

FINSSKF

1 -

Fiori

1 -

Flexible Workflow

1 -

Gas

1 -

Gen AI enabled SAP Upgrades

1 -

General

1 -

generate_xlsx_file

1 -

Getting Started

1 -

HomogeneousDMO

1 -

IDOC

2 -

Integration

1 -

Learning Content

2 -

LogicApps

2 -

low touchproject

1 -

Maintenance

1 -

management

1 -

Material creation

1 -

Material Management

1 -

MD04

1 -

MD61

1 -

methodology

1 -

Microsoft

2 -

MicrosoftSentinel

2 -

Migration

1 -

MRP

1 -

MS Teams

2 -

MT940

1 -

Newcomer

1 -

Notifications

1 -

Oil

1 -

open connectors

1 -

Order Change Log

1 -

ORDERS

2 -

OSS Note 390635

1 -

outbound delivery

1 -

outsourcing

1 -

PCE

1 -

Permit to Work

1 -

PIR Consumption Mode

1 -

PIR's

1 -

PIRs

1 -

PIRs Consumption

1 -

PIRs Reduction

1 -

Plan Independent Requirement

1 -

Premium Plus

1 -

pricing

1 -

Primavera P6

1 -

Process Excellence

1 -

Process Management

1 -

Process Order Change Log

1 -

Process purchase requisitions

1 -

Product Information

1 -

Production Order Change Log

1 -

Purchase requisition

1 -

Purchasing Lead Time

1 -

Redwood for SAP Job execution Setup

1 -

RISE with SAP

1 -

RisewithSAP

1 -

Rizing

1 -

S4 Cost Center Planning

1 -

S4 HANA

1 -

S4HANA

3 -

Sales and Distribution

1 -

Sales Commission

1 -

sales order

1 -

SAP

2 -

SAP Best Practices

1 -

SAP Build

1 -

SAP Build apps

1 -

SAP Cloud ALM

1 -

SAP Data Quality Management

1 -

SAP Maintenance resource scheduling

2 -

SAP Note 390635

1 -

SAP S4HANA

2 -

SAP S4HANA Cloud private edition

1 -

SAP Upgrade Automation

1 -

SAP WCM

1 -

SAP Work Clearance Management

1 -

Schedule Agreement

1 -

SDM

1 -

security

2 -

Settlement Management

1 -

soar

2 -

SSIS

1 -

SU01

1 -

SUM2.0SP17

1 -

SUMDMO

1 -

Teams

2 -

User Administration

1 -

User Participation

1 -

Utilities

1 -

va01

1 -

vendor

1 -

vl01n

1 -

vl02n

1 -

WCM

1 -

X12 850

1 -

xlsx_file_abap

1 -

YTD|MTD|QTD in CDs views using Date Function

1

- « Previous

- Next »

- Building Low Code Extensions with Key User Extensibility in SAP S/4HANA and SAP Build in Enterprise Resource Planning Blogs by SAP

- Rebate Accruals validity period issue in Enterprise Resource Planning Q&A

- FAQ on Upgrading SAP S/4HANA Cloud Public Edition in Enterprise Resource Planning Blogs by SAP

- Futuristic Aerospace or Defense BTP Data Mesh Layer using Collibra, Next Labs ABAC/DAM, IAG and GRC in Enterprise Resource Planning Blogs by Members

- SAP ERP Functionality for EDI Processing: UoMs Determination for Inbound Orders in Enterprise Resource Planning Blogs by Members

| User | Count |

|---|---|

| 2 | |

| 2 | |

| 2 | |

| 2 | |

| 2 | |

| 1 | |

| 1 | |

| 1 | |

| 1 | |

| 1 |