- SAP Community

- Products and Technology

- Enterprise Resource Planning

- ERP Blogs by Members

- Fixed Asset SAP Business One 9.0 Configuration

- Subscribe to RSS Feed

- Mark as New

- Mark as Read

- Bookmark

- Subscribe

- Printer Friendly Page

- Report Inappropriate Content

SAP launched Fixed Asset add-on as the part of solution in 9.0 for all location.

Below are the steps to import the Fixed Asset master data successfully.

First of all Enable the Fixed Asset functionality as given in below screen.

Go to Administration > System initialization > Company Details > Basic Initialization Tab > and Tick on Enable Fixed Asset Check Box.

Now define the Masters and FA set up information.

First Define the account determination as shown in below Screen.

If you will not determine the Accounts for any group then system will generate errors when you will start to import the Master Data.

After configure the account determination, Define Depreciation Type as per your requirement as below

Now define the Asset Classes as below and link the account determination group with depreciation area as below

Now Make Asset group and Depreciation Group at Fixed Asset Master Data as below.

Depreciation Group:

Now Define your template in excel with columns as below

| Item code | Item Name | Asset Class | dep Group | Asset Group | Dep Type | Dep Area | Usefull Life |

| FA00001 | Voltas Split 2.0 Tons | AIR CONDITIONER | A C | A C | SLM4.75 | Main Books | 252 |

| FA00002 | Voltas Split 2.0 Tons | AIR CONDITIONER | A C | A C | SLM4.75 | Main Books | 252 |

| FA00003 | Voltas Split 2.0 Tons | AIR CONDITIONER | A C | A C | SLM4.75 | Main Books | 252 |

| FA00004 | Voltas Split 2.0 Tons | AIR CONDITIONER | A C | A C | SLM4.75 | Main Books | 252 |

| FA00005 | Voltas Split 2.0 Tons | AIR CONDITIONER | A C | A C | SLM4.75 | Main Books | 252 |

| FA00006 | Voltas Split 2.0 Tons | AIR CONDITIONER | A C | A C | SLM4.75 | Main Books | 252 |

(Note:: I have removed columns Capitalization Date and depreciation start date from above txt file. These columns were generating the issues at the time of capitalization and run depreciation Time. ) ℹ

[Note :: SAP has been provided DTW format to import the fixed asset master data with PL07 onwards :smile: .check link

Save the above template as .txt file.(Please remove the header line before saving) .

Now go to Data Import/Export menu as below and choose the column in sequence as you mentioned in .txt file and Import.

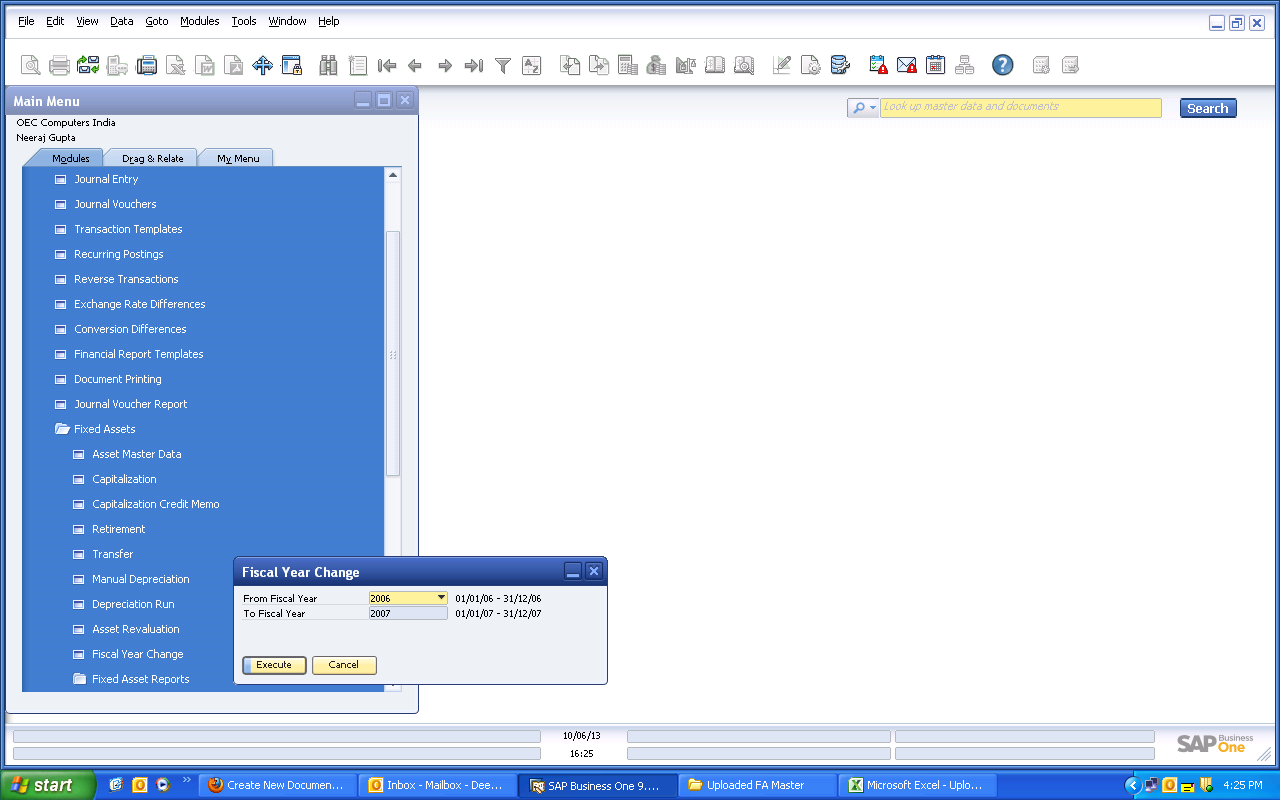

Note :::: If you are importing FA Master DATA for more then one Fiscal Year then first defined all fiscal year in System and execute all fiscal year one by one from lower to top through below screen.

Note :: There can be some issue due to Transaction notification. If you do face as such issue than please comment all transaction notification related to ITEM MASTER.

Please check below also specialy Mr. Jose reply..

{

You can Import fixed assets that have to be capitalized for current Financial year as NEW:

Meaning:

a) The start depreciation date is empty

b) The APC, Accumulated depreciation are empty

c) Capitalization date is empty

Once you have imported the asset as 'new', you can use application or DTW to enter the capitalizations

This is a logical consequence of system definition documented in the Help File: when you import an asset in any given year the values that you enter must be the values that the asset has on the first day of the fiscal year selected for the import:

BASIC RULES FOR IMPORT FIXED ASSET FROM EXCEL 9.0 (some documented and some based in my experience)

a)Capitalization date, if entered must be <= first day of fiscal year selected for import

b)Depreciation start date, if entered must be <=first day of fiscal year selected for import

c)Remaining useful life = Total number of months of total useful life -Number of calendar months counting from the calendar month of Depreciation start date until the last month of fiscal year prior to the year selected for import

d) If Remaining Useful life is 0, then APC - Accumulated Depreciation - Salvage Value =0

e) Having Salvage Value is only compatible with Depreciation type that has marked a % of salvage value <>0

f) If Asset Class selected has several areas active, all areas must have value in the import

g) Depreciation areas ' derived' must have exactly same values than the area that is derived from, except accumulated depreciation and depreciation type, that can be different,

h) Values must be defined always for 'main' Depreciation Area

I) Keep the same date format order and separator used in company database general settings for date type values. Only change the alphanumeric to numeric, example 'July' , is 07

j) For numeric values: do only use the decimal separator if the value has decimals. For example '10,00' should be entered as 10

k) For numeric values ensure that you use the same decimal separator used in company database general settings ',' or '.'

l) Do not use thousands separators, example '10.000,43' should be entered as 10000,43

j) Do use the same number of decimals that are allowed in company database general settings

k) Use Item No in the template as the first column A

}

Note: Check below thread if there is any issue in FA import:::

http://scn.sap.com/thread/s3373105

Check Below Threads for Fixed Asset related queries or issues.

Assistance needed with importing fixed assets with salvage value in SAP 9.0

SAP Business One 9.0 Fixed Assets, change existing depreciation

Calculation Base in Fixed Asset

Fixed Asset with later capitalization date

Documents for Fixed Assets module in SAP B1 9.1 India Localization

The specified item was not found. -------its about multiple depreciation areas

**********you can cancel the "Depreciation run" now in latest PL of SAP B1 V9.0 and V9.1.

Please share your suggestion and feedback too so that the document could be helpful for others.

CHEERS :smile: .

Edit..Now the size of pictures has been reduced as suggested by friends.

Please rate the document if you feel helpful this.

Regards

Deepak Tyagi

- SAP Managed Tags:

- SAP Business One

- « Previous

-

- 1

- 2

- Next »

You must be a registered user to add a comment. If you've already registered, sign in. Otherwise, register and sign in.

-

"mm02"

1 -

A_PurchaseOrderItem additional fields

1 -

ABAP

1 -

ABAP Extensibility

1 -

ACCOSTRATE

1 -

ACDOCP

1 -

Adding your country in SPRO - Project Administration

1 -

Advance Return Management

1 -

AI and RPA in SAP Upgrades

1 -

Approval Workflows

1 -

ARM

1 -

ASN

1 -

Asset Management

1 -

Associations in CDS Views

1 -

auditlog

1 -

Authorization

1 -

Availability date

1 -

Azure Center for SAP Solutions

1 -

AzureSentinel

2 -

Bank

1 -

BAPI_SALESORDER_CREATEFROMDAT2

1 -

BRF+

1 -

BRFPLUS

1 -

Bundled Cloud Services

1 -

business participation

1 -

Business Processes

1 -

CAPM

1 -

Carbon

1 -

Cental Finance

1 -

CFIN

1 -

CFIN Document Splitting

1 -

Cloud ALM

1 -

Cloud Integration

1 -

condition contract management

1 -

Connection - The default connection string cannot be used.

1 -

Custom Table Creation

1 -

Customer Screen in Production Order

1 -

Data Quality Management

1 -

Date required

1 -

Decisions

1 -

desafios4hana

1 -

Developing with SAP Integration Suite

1 -

Direct Outbound Delivery

1 -

DMOVE2S4

1 -

EAM

1 -

EDI

2 -

EDI 850

1 -

EDI 856

1 -

edocument

1 -

EHS Product Structure

1 -

Emergency Access Management

1 -

Energy

1 -

EPC

1 -

Financial Operations

1 -

Find

1 -

FINSSKF

1 -

Fiori

1 -

Flexible Workflow

1 -

Gas

1 -

Gen AI enabled SAP Upgrades

1 -

General

1 -

generate_xlsx_file

1 -

Getting Started

1 -

HomogeneousDMO

1 -

IDOC

2 -

Integration

1 -

Learning Content

2 -

LogicApps

2 -

low touchproject

1 -

Maintenance

1 -

management

1 -

Material creation

1 -

Material Management

1 -

MD04

1 -

MD61

1 -

methodology

1 -

Microsoft

2 -

MicrosoftSentinel

2 -

Migration

1 -

MRP

1 -

MS Teams

2 -

MT940

1 -

Newcomer

1 -

Notifications

1 -

Oil

1 -

open connectors

1 -

Order Change Log

1 -

ORDERS

2 -

OSS Note 390635

1 -

outbound delivery

1 -

outsourcing

1 -

PCE

1 -

Permit to Work

1 -

PIR Consumption Mode

1 -

PIR's

1 -

PIRs

1 -

PIRs Consumption

1 -

PIRs Reduction

1 -

Plan Independent Requirement

1 -

Premium Plus

1 -

pricing

1 -

Primavera P6

1 -

Process Excellence

1 -

Process Management

1 -

Process Order Change Log

1 -

Process purchase requisitions

1 -

Product Information

1 -

Production Order Change Log

1 -

Purchase requisition

1 -

Purchasing Lead Time

1 -

Redwood for SAP Job execution Setup

1 -

RISE with SAP

1 -

RisewithSAP

1 -

Rizing

1 -

S4 Cost Center Planning

1 -

S4 HANA

1 -

S4HANA

3 -

Sales and Distribution

1 -

Sales Commission

1 -

sales order

1 -

SAP

2 -

SAP Best Practices

1 -

SAP Build

1 -

SAP Build apps

1 -

SAP Cloud ALM

1 -

SAP Data Quality Management

1 -

SAP Maintenance resource scheduling

2 -

SAP Note 390635

1 -

SAP S4HANA

2 -

SAP S4HANA Cloud private edition

1 -

SAP Upgrade Automation

1 -

SAP WCM

1 -

SAP Work Clearance Management

1 -

Schedule Agreement

1 -

SDM

1 -

security

2 -

Settlement Management

1 -

soar

2 -

SSIS

1 -

SU01

1 -

SUM2.0SP17

1 -

SUMDMO

1 -

Teams

2 -

User Administration

1 -

User Participation

1 -

Utilities

1 -

va01

1 -

vendor

1 -

vl01n

1 -

vl02n

1 -

WCM

1 -

X12 850

1 -

xlsx_file_abap

1 -

YTD|MTD|QTD in CDs views using Date Function

1

- « Previous

- Next »

- Advance Return Management complete configuration(SAP ARM) in Enterprise Resource Planning Blogs by Members

- Posting Journal Entries with Tax Using SOAP Posting APIs in Enterprise Resource Planning Blogs by SAP

- How to set BOM when splitting material codes from different suppliers for the same material in Enterprise Resource Planning Q&A

- Integration of SAP Service and Asset Manager(SSAM) with SAP FSM to support S/4HANA Service Processes in Enterprise Resource Planning Blogs by SAP

- SAP S/4HANA Cloud Public Edition: Security Configuration APIs in Enterprise Resource Planning Blogs by SAP

| User | Count |

|---|---|

| 6 | |

| 2 | |

| 2 | |

| 2 | |

| 2 | |

| 2 | |

| 2 | |

| 1 | |

| 1 | |

| 1 |