- SAP Community

- Products and Technology

- Enterprise Resource Planning

- ERP Blogs by Members

- TDS Process , Issue Certificate & Quarterly return

- Subscribe to RSS Feed

- Mark as New

- Mark as Read

- Bookmark

- Subscribe

- Printer Friendly Page

- Report Inappropriate Content

Applies to:

Any business organization having TDS Implemented. This is applicable from ECC 6.0. For more

information, visit the Enterprise Resource Planning homepage.

Summary

This article displays the process of TDS Update Bank Challan, Issue Certificate and Quarterly return.

1.Hand Book Objective

The following document is to show the Process sequences that was development for the FI EWT) sub-module.This document contains the standard Process of the SAP ECC 6.0.

2. TDS

Tax Deducted at Source is one of the modes of collecting Income-tax from the assesses in India. This is governed under Indian Income Tax Act, 1961, by the Central Board for Direct Taxes (CBDT) and is part of the Department of Revenue managed by Indian Revenue Service (IRS), Ministry of Finance, Govt. of India.

2.1 Vendor Invoice with TDS

Module: | FI – Financial Accounting |

Area: | Extended Withholding Tax |

Description: | Create Vendor Invoice |

Navigate: | Accounting --> Financial Accounting --> Accounts Payable Document Entry FB60 – Invoice |

Direct access: | FB60 |

Configured by: | |

Date: | 18/10/2012 |

Prerequisite: Check vendor master should have maintained VAT Reg.No and Assigned EWT Type and code

Create Vendor invoice through FI Side, In case invoice comes from MIRO (MM side)use T.code J1INPP to update Business place

2.2 Creation & payment of TDS to Gov

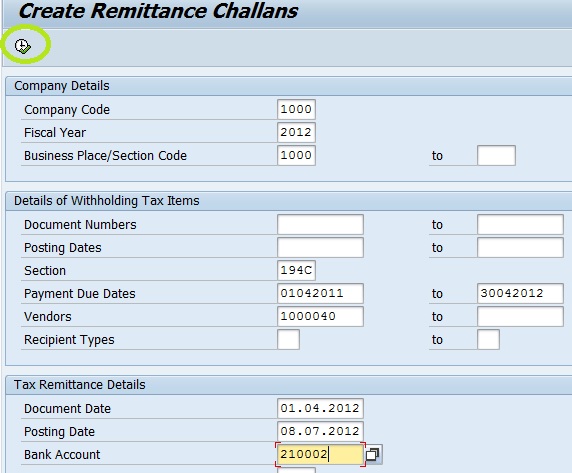

When you have remitted the deducted TDS to the government, you are sent a challan confirming that payment has been received. The system allows you to record the number of the challan in the invoices from which the TDS had been deducted and paid.

Module: | FI – Financial Accounting |

Area: | Extended Withholding Tax |

Description: | - Create Remittance Challan |

Navigate: | Accounting --> Financial Accounting --> Accounts Payable Withholding Tax -->India --> Extended Withholding Tax --> Remittance of Withholding Tax --> J1INCHLN - Create Remittance Challan |

Direct access: | J1INCHLN |

Configured by: | |

Date: | 18/10/2012 |

Execute

SAVE

In Above screen total basic TDS Remitted not updated

when you are creating “J1INCHLN – Create Remittance Challan“, “total basic TDS remitted” is not updated.

You need to update 0 % for all the WH Tax type and Code combination, in below two table (even though ECS and surcharge is not applicable).

SM30 – J_1IEWT_ECESS1

SM30 – J_1IEWT_SURC1

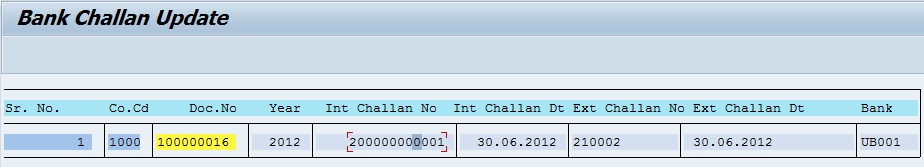

2.3 Enter Bank Challan

Module: | FI – Financial Accounting |

Area: | Extended Withholding Tax |

Description: | Enter Bank Challan |

Navigate: | Accounting --> Financial Accounting --> Accounts Payable --> Withholding Tax --> India --> Extended Withholding Tax-->Remittance of Withholding Tax -->J1INBANK - Enter Bank Challan |

Direct access: | J1INBANK |

Configured by: | |

Date: | 18/10/2012 |

2.4 Issue Certificates

Prerequisites

You have already remitted the TDS to the government and recorded the challan number in the transactions concerned (see Update of Challans). Only transactions with a challan number can be included in certificates.

The certificate printing program uses SAPscript form J_1ITDSCERT. If there are some changes in the certificate format this layout set can be changed accordingly.

If the certificates are to be divided by business area, with a unique number range per business area, you must have maintained the sections as a combination of section and business area, so for business area 0001 and section 194C, you could maintain the section as 194C0001, for example.

Module: | FI – Financial Accounting |

Area: | Extended Withholding Tax |

Description: | Certificates |

Navigate: | Accounting --> Financial Accounting --> Accounts Payable --> Withholding Tax -->India -->Extended Withholding Tax -->Certificates-->J1INCERT - Print |

Direct access: | J1INCER |

Configured by: | |

Date: | 18/10/2012 |

Execute

Execute

2.5 Quarterly TDS Returns

You use the Quarterly TDS Returns report to generate electronic TDS returns for payments other than salaries. You use the same report to generate the returns for residents and non-residents by choosing either Form 26Q or Form 27Q respectively. You prepare the returns on a quarterly basis.

Module: | FI – Financial Accounting |

Area: | Extended Withholding Tax |

Description: | Quarterly TDS Returns |

Navigate: | Accounting --> Financial Accounting --> Accounts Payable --> Withholding Tax --> India-->Extended Withholding Tax-->Reporting-->J1INQEFILE - Quarterly TDS Returns |

Direct access: | J1INQEFILE |

Configured by: | |

Date: | 18/10/2012 |

- SAP Managed Tags:

- SAP ERP,

- FIN (Finance)

You must be a registered user to add a comment. If you've already registered, sign in. Otherwise, register and sign in.

-

"mm02"

1 -

A_PurchaseOrderItem additional fields

1 -

ABAP

1 -

ABAP Extensibility

1 -

ACCOSTRATE

1 -

ACDOCP

1 -

Adding your country in SPRO - Project Administration

1 -

Advance Return Management

1 -

AI and RPA in SAP Upgrades

1 -

Approval Workflows

1 -

ARM

1 -

ASN

1 -

Asset Management

1 -

Associations in CDS Views

1 -

auditlog

1 -

Authorization

1 -

Availability date

1 -

Azure Center for SAP Solutions

1 -

AzureSentinel

2 -

Bank

1 -

BAPI_SALESORDER_CREATEFROMDAT2

1 -

BRF+

1 -

BRFPLUS

1 -

Bundled Cloud Services

1 -

business participation

1 -

Business Processes

1 -

CAPM

1 -

Carbon

1 -

Cental Finance

1 -

CFIN

1 -

CFIN Document Splitting

1 -

Cloud ALM

1 -

Cloud Integration

1 -

condition contract management

1 -

Connection - The default connection string cannot be used.

1 -

Custom Table Creation

1 -

Customer Screen in Production Order

1 -

Data Quality Management

1 -

Date required

1 -

Decisions

1 -

desafios4hana

1 -

Developing with SAP Integration Suite

1 -

Direct Outbound Delivery

1 -

DMOVE2S4

1 -

EAM

1 -

EDI

2 -

EDI 850

1 -

EDI 856

1 -

EHS Product Structure

1 -

Emergency Access Management

1 -

Energy

1 -

EPC

1 -

Find

1 -

FINSSKF

1 -

Fiori

1 -

Flexible Workflow

1 -

Gas

1 -

Gen AI enabled SAP Upgrades

1 -

General

1 -

generate_xlsx_file

1 -

Getting Started

1 -

HomogeneousDMO

1 -

IDOC

2 -

Integration

1 -

Learning Content

2 -

LogicApps

2 -

low touchproject

1 -

Maintenance

1 -

management

1 -

Material creation

1 -

Material Management

1 -

MD04

1 -

MD61

1 -

methodology

1 -

Microsoft

2 -

MicrosoftSentinel

2 -

Migration

1 -

MRP

1 -

MS Teams

2 -

MT940

1 -

Newcomer

1 -

Notifications

1 -

Oil

1 -

open connectors

1 -

Order Change Log

1 -

ORDERS

2 -

OSS Note 390635

1 -

outbound delivery

1 -

outsourcing

1 -

PCE

1 -

Permit to Work

1 -

PIR Consumption Mode

1 -

PIR's

1 -

PIRs

1 -

PIRs Consumption

1 -

PIRs Reduction

1 -

Plan Independent Requirement

1 -

Premium Plus

1 -

pricing

1 -

Primavera P6

1 -

Process Excellence

1 -

Process Management

1 -

Process Order Change Log

1 -

Process purchase requisitions

1 -

Product Information

1 -

Production Order Change Log

1 -

Purchase requisition

1 -

Purchasing Lead Time

1 -

Redwood for SAP Job execution Setup

1 -

RISE with SAP

1 -

RisewithSAP

1 -

Rizing

1 -

S4 Cost Center Planning

1 -

S4 HANA

1 -

S4HANA

3 -

Sales and Distribution

1 -

Sales Commission

1 -

sales order

1 -

SAP

2 -

SAP Best Practices

1 -

SAP Build

1 -

SAP Build apps

1 -

SAP Cloud ALM

1 -

SAP Data Quality Management

1 -

SAP Maintenance resource scheduling

2 -

SAP Note 390635

1 -

SAP S4HANA

2 -

SAP S4HANA Cloud private edition

1 -

SAP Upgrade Automation

1 -

SAP WCM

1 -

SAP Work Clearance Management

1 -

Schedule Agreement

1 -

SDM

1 -

security

2 -

Settlement Management

1 -

soar

2 -

SSIS

1 -

SU01

1 -

SUM2.0SP17

1 -

SUMDMO

1 -

Teams

2 -

User Administration

1 -

User Participation

1 -

Utilities

1 -

va01

1 -

vendor

1 -

vl01n

1 -

vl02n

1 -

WCM

1 -

X12 850

1 -

xlsx_file_abap

1 -

YTD|MTD|QTD in CDs views using Date Function

1

- « Previous

- Next »

- Beyond Basic (1): Certificate-Based Authentication in Enterprise Resource Planning Blogs by SAP

- Asset Management in SAP S/4HANA Cloud Private Edition | 2023 FPS01 Release in Enterprise Resource Planning Blogs by SAP

- How to Use SAP Central Business Configuration's Built-In Support in Enterprise Resource Planning Blogs by SAP

- SAP S/4HANA Cloud Private Edition | 2023 FPS01 Release – Part 2 in Enterprise Resource Planning Blogs by SAP

- Transfer Data from IDoc to Inspection Lot (QM-IM-IL)? in Enterprise Resource Planning Q&A

| User | Count |

|---|---|

| 2 | |

| 2 | |

| 2 | |

| 2 | |

| 2 | |

| 1 | |

| 1 | |

| 1 | |

| 1 | |

| 1 |