- SAP Community

- Products and Technology

- Enterprise Resource Planning

- ERP Blogs by Members

- Reset clearing of document that has Withholding Ta...

- Subscribe to RSS Feed

- Mark as New

- Mark as Read

- Bookmark

- Subscribe

- Printer Friendly Page

- Report Inappropriate Content

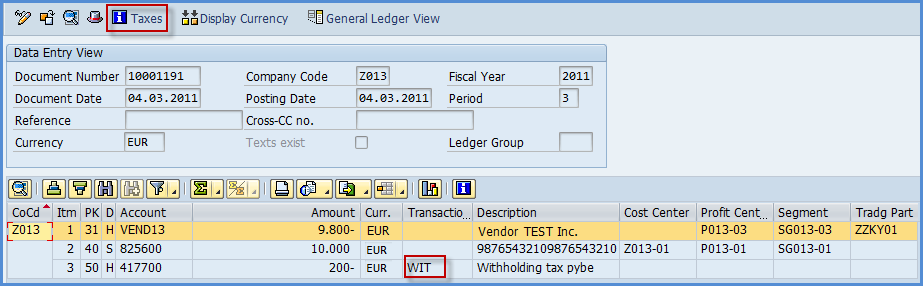

You have activated extended withholding tax in your company code and want to reset the clearing in a document in which you have a withholding tax.

Kindly consider that it is not possible to reset a clearing document, if a withholding tax line item is posted within this clearing process.

For other documents, that are not connected to withholding taxes, you should still be able to use "reset only" or "reset and reverse" functionality.

Please understand that the clearing information of the reversal document must not be reset for documents with withholding tax information, in order to keep the accumulation tables (WTAK/WTAD) intact and correct.

In case, both the withholding tax amount and the withholding tax base amount is zero for all items, the resetting of the reversal is allowed.

This information is also mentioned in SAP Note 431095 and has been corrected also for new releases in Note 1062551. Hence, the error 'Use the transaction for resetting check payments' Error Code 'FS 642' pops-up in such case, which is correct.

You may be able to reset the document if tables are manipulated, but this is not recommended.

As a workaround, posting a new document could be a possible solution.

Such behavior is SAP standard and there is no other way to avoid it as per the standard.

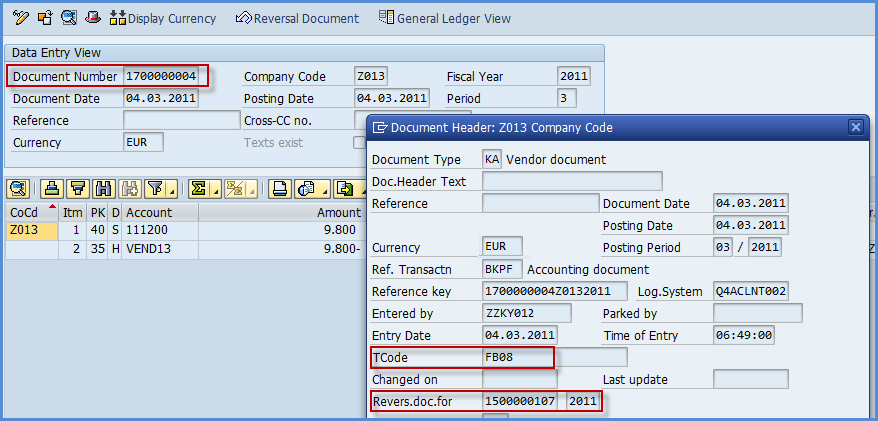

In case, you want to use FBRA to manually reset the clearing document, it can be done, as a result of which both invoice and payment document will be treated as open items. It is a fact that, reset alone reverses the clearing process. For example, resetting a payment document will leave the invoice as an open item, but would not reverse the payment document.

With resetting, the amount paid is not lost as the document is still active and open. Later the payment document can be cleared with other invoice. Since FBRA is a manual transaction, it is important that user should be aware of the steps they are performing. There is no restriction with reference to resetting, as some of you can use this transaction to reset and then clear the payment document with other invoice.

On the other hand, you may require to reverse the payment and void the check, then the following steps need to be reviewed:

After resetting through FBRA, you generally manually void the check in FCH8. Instead you can directly use FCH8 to complete the process. Whereas, in FBRA, if you try to reset and reverse the document, then system doesn't allow to do so by giving a message 'Use the transaction for resetting check payments' Message Code being ‘FS 642’.

- SAP Managed Tags:

- SAP ERP,

- FIN (Finance)

You must be a registered user to add a comment. If you've already registered, sign in. Otherwise, register and sign in.

-

"mm02"

1 -

A_PurchaseOrderItem additional fields

1 -

ABAP

1 -

ABAP Extensibility

1 -

ACCOSTRATE

1 -

ACDOCP

1 -

Adding your country in SPRO - Project Administration

1 -

Advance Return Management

1 -

AI and RPA in SAP Upgrades

1 -

Approval Workflows

1 -

ARM

1 -

ASN

1 -

Asset Management

1 -

Associations in CDS Views

1 -

auditlog

1 -

Authorization

1 -

Availability date

1 -

Azure Center for SAP Solutions

1 -

AzureSentinel

2 -

Bank

1 -

BAPI_SALESORDER_CREATEFROMDAT2

1 -

BRF+

1 -

BRFPLUS

1 -

Bundled Cloud Services

1 -

business participation

1 -

Business Processes

1 -

CAPM

1 -

Carbon

1 -

Cental Finance

1 -

CFIN

1 -

CFIN Document Splitting

1 -

Cloud ALM

1 -

Cloud Integration

1 -

condition contract management

1 -

Connection - The default connection string cannot be used.

1 -

Custom Table Creation

1 -

Customer Screen in Production Order

1 -

Data Quality Management

1 -

Date required

1 -

Decisions

1 -

desafios4hana

1 -

Developing with SAP Integration Suite

1 -

Direct Outbound Delivery

1 -

DMOVE2S4

1 -

EAM

1 -

EDI

2 -

EDI 850

1 -

EDI 856

1 -

EHS Product Structure

1 -

Emergency Access Management

1 -

Energy

1 -

EPC

1 -

Find

1 -

FINSSKF

1 -

Fiori

1 -

Flexible Workflow

1 -

Gas

1 -

Gen AI enabled SAP Upgrades

1 -

General

1 -

generate_xlsx_file

1 -

Getting Started

1 -

HomogeneousDMO

1 -

IDOC

2 -

Integration

1 -

Learning Content

2 -

LogicApps

2 -

low touchproject

1 -

Maintenance

1 -

management

1 -

Material creation

1 -

Material Management

1 -

MD04

1 -

MD61

1 -

methodology

1 -

Microsoft

2 -

MicrosoftSentinel

2 -

Migration

1 -

MRP

1 -

MS Teams

2 -

MT940

1 -

Newcomer

1 -

Notifications

1 -

Oil

1 -

open connectors

1 -

Order Change Log

1 -

ORDERS

2 -

OSS Note 390635

1 -

outbound delivery

1 -

outsourcing

1 -

PCE

1 -

Permit to Work

1 -

PIR Consumption Mode

1 -

PIR's

1 -

PIRs

1 -

PIRs Consumption

1 -

PIRs Reduction

1 -

Plan Independent Requirement

1 -

Premium Plus

1 -

pricing

1 -

Primavera P6

1 -

Process Excellence

1 -

Process Management

1 -

Process Order Change Log

1 -

Process purchase requisitions

1 -

Product Information

1 -

Production Order Change Log

1 -

Purchase requisition

1 -

Purchasing Lead Time

1 -

Redwood for SAP Job execution Setup

1 -

RISE with SAP

1 -

RisewithSAP

1 -

Rizing

1 -

S4 Cost Center Planning

1 -

S4 HANA

1 -

S4HANA

3 -

Sales and Distribution

1 -

Sales Commission

1 -

sales order

1 -

SAP

2 -

SAP Best Practices

1 -

SAP Build

1 -

SAP Build apps

1 -

SAP Cloud ALM

1 -

SAP Data Quality Management

1 -

SAP Maintenance resource scheduling

2 -

SAP Note 390635

1 -

SAP S4HANA

2 -

SAP S4HANA Cloud private edition

1 -

SAP Upgrade Automation

1 -

SAP WCM

1 -

SAP Work Clearance Management

1 -

Schedule Agreement

1 -

SDM

1 -

security

2 -

Settlement Management

1 -

soar

2 -

SSIS

1 -

SU01

1 -

SUM2.0SP17

1 -

SUMDMO

1 -

Teams

2 -

User Administration

1 -

User Participation

1 -

Utilities

1 -

va01

1 -

vendor

1 -

vl01n

1 -

vl02n

1 -

WCM

1 -

X12 850

1 -

xlsx_file_abap

1 -

YTD|MTD|QTD in CDs views using Date Function

1

- « Previous

- Next »

- Automatic Matching of Invoice Reference with Bank Statement in Enterprise Resource Planning Q&A

- SAP Standard Table - PO Number, Invoice Number and Clearing document Number map in Enterprise Resource Planning Q&A

- Standard Downpayment Scenario in Enterprise Resource Planning Q&A

- Element 'DocumentDate' missing.Error in API in Enterprise Resource Planning Q&A

- Tax posting using BAPI - BAPI_ACC_DOCUMENT_POST in Enterprise Resource Planning Blogs by Members

| User | Count |

|---|---|

| 2 | |

| 2 | |

| 2 | |

| 2 | |

| 2 | |

| 1 | |

| 1 | |

| 1 | |

| 1 | |

| 1 |