- SAP Community

- Products and Technology

- Enterprise Resource Planning

- ERP Blogs by Members

- Third Party Deductions –Chapter VI-A Exemptions U/...

- Subscribe to RSS Feed

- Mark as New

- Mark as Read

- Bookmark

- Subscribe

- Printer Friendly Page

- Report Inappropriate Content

Third Party Deductions –Chapter VI-A Exemptions U/S 80 and U/S 88

Dear Gurus,

This blog post illustrates the phenomenon of mapping the Third Party Deductions as the exemptions under the Section 80 and 88.

The Investments and Contributions in 0585 and 0586 infotypes are termed as the Exemptions under the Section 80 and 88.The same grounds the statutory system provides for deductions from taxable income and rebates that are subtracted from the income tax otherwise payable by an employee. Sometimes employer facilitates deductions from employee's salary once in a year or any other frequency suggested by employee to contribute to the relevant Funds/Trusts etc. so that employee can avail deductions under section 80 and / or rebate under section 88.

We can assign wage types to be deducted for various heads under section 80 and section 88.The various types of the deductions under the Sec 80 and 88 are,

- Medical Insurance Premium (Non-Senior Ctz)

- Medical Insurance Premium (Non-Senior Ctz)

- Medical Insurance Premium (Senior Citizen)

- Permanent Physical Disability

- Payment towards Life Insurance Policy

Step1: Configure Wagetypes for Section 80

Contributions or investments made under Section 80 are considered as deductions from Gross Total Income (GTI) as per the limits specified by Central Government. By assigning a wage type, ensure that the annual value of the wage type along with the entries made in Section 80 Deductions, Infotype (0585) becomes eligible for deduction from GTI for the specified sub-section / division combination.More than one wage type can be associated with same sub-section / division combination using the sequence field.Copy the Custom Wagetypes from the Model Wage Types as follows,3010 Medical Insurance Premium (NSC) M80D3011 Medical Insurance Premium (SC) M80D3012 Permanent Physical Disability M80U

SPRO->IMG->Payroll->Payroll India->Tax->Third Party Deductions-> Configure Wage types for Section 80

Table: V_T7INIC

Assign the custom wage types replacing the Model Wage Types in the below table.

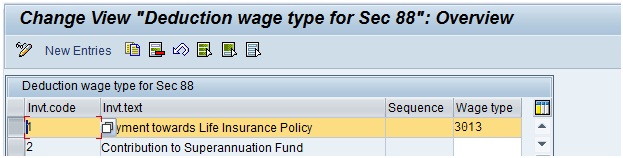

Step2:Configure Wagetypes for Section 88

The contributions or investments made under Section 88 are considered as rebates from the total tax payable by the employee. By assigning a wage type, ensure that the annual value of the wage type along with the entries made in Section 88 Deductions infotype (0586) becomes eligible for rebate from tax payable otherwise for the specified investment.More than one wage type can be associated with the same investment type by using the sequence number field.

SPRO->IMG->Payroll->Payroll India->Tax->Third Party Deductions-> Configure Wage types for Section 88

Table: V_T7INIAReplace the Model wage type MLIC with 3013 the custom Wage Type3. Step3:Define Membership/Deduction TypesIn this step, determine the different types of deduction that are made through the Membership Fees Infotype (0057). Each deduction type is represented by a subtype in the infotype.Check to see whether the necessary membership/deduction types for the organisation are included and, if necessary, add additional entries and delete the entries that we do not need.Note that each membership/deduction type corresponds to a subtype.Example4444 Housing Loan Principal5555 Payment towards Life Insurance Policy6666 Permanent Physical Disability7777 Medical Insr Premium (Non-Senior Ctz)SPRO->IMG->Payroll->Payroll India->Tax->Third Party Deductions-> Define Membership/Deduction Types

Step3:Define Membership/Deduction TypesIn this step, determine the different types of deduction that are made through the Membership Fees Infotype (0057). Each deduction type is represented by a subtype in the infotype.Check to see whether the necessary membership/deduction types for the organisation are included and, if necessary, add additional entries and delete the entries that we do not need.Note that each membership/deduction type corresponds to a subtype.Example4444 Housing Loan Principal5555 Payment towards Life Insurance Policy6666 Permanent Physical Disability7777 Medical Insr Premium (Non-Senior Ctz)SPRO->IMG->Payroll->Payroll India->Tax->Third Party Deductions-> Define Membership/Deduction Types

Table: VV_T591A_0057

Step4: Check entry permissibility for Membership Fees Infotype (005

In this step, maintain those wage types that we want to pay through the Membership Fees Infotype (0057) for Third Party deductions.Check the entries delivered by SAP. In case we want to allow the entry of a new wage type in the Membership Fees Infotype (0057), proceed as follows:

- 1. Select New entries.

- 2. Enter the key of the wage type.

- 3. Define the validity period.

- 4. Determine whether the wage type can be entered once or more than once at any one time (time constraint).

- 5. Save the entries.

SPRO->IMG->Payroll->Payroll India->Tax->Third Party Deductions-> Check entry permissibility for Membership Fees Infotype (0057)

Table: V_T512Z

Step5: Maintenance Of Master Data

Maintain the 0057 info types and relevant subtypes for the employee.Mentione the amount and the Payee Key details.

Step6: Payroll Processing

Process the Payroll for the employee.

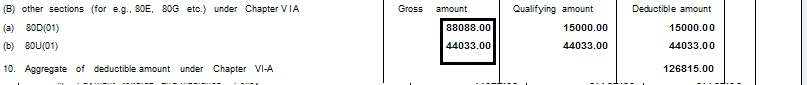

Step7: Execute the Form 16:

T.Code:PC00_M40_F16

The Third Party Deductions mentioned through the 0057 infotype are reflected under the Chapter VI-A Exemptions under Section 80C,80D(01) and 80U(01).

Bibliography:

1)http://taxworry.com/easy-chart-of-deductions-80c-80u-80ddb-individual/

2)http://help.sap.com/saphelp_erp2005/helpdata/en/72/99f0032fc9463ea3df7af9fd1c57b7/content.htm

3)http://help.sap.com/saphelp_erp2005/helpdata/en/7e/5e061d4a1611d1894c0000e829fbbd/content.htm

Sincerely

Govardhan Reddy

- SAP Managed Tags:

- HCM (Human Capital Management)

You must be a registered user to add a comment. If you've already registered, sign in. Otherwise, register and sign in.

-

"mm02"

1 -

A_PurchaseOrderItem additional fields

1 -

ABAP

1 -

ABAP Extensibility

1 -

ACCOSTRATE

1 -

ACDOCP

1 -

Adding your country in SPRO - Project Administration

1 -

Advance Return Management

1 -

AI and RPA in SAP Upgrades

1 -

Approval Workflows

1 -

ARM

1 -

ASN

1 -

Asset Management

1 -

Associations in CDS Views

1 -

auditlog

1 -

Authorization

1 -

Availability date

1 -

Azure Center for SAP Solutions

1 -

AzureSentinel

2 -

Bank

1 -

BAPI_SALESORDER_CREATEFROMDAT2

1 -

BRF+

1 -

BRFPLUS

1 -

Bundled Cloud Services

1 -

business participation

1 -

Business Processes

1 -

CAPM

1 -

Carbon

1 -

Cental Finance

1 -

CFIN

1 -

CFIN Document Splitting

1 -

Cloud ALM

1 -

Cloud Integration

1 -

condition contract management

1 -

Connection - The default connection string cannot be used.

1 -

Custom Table Creation

1 -

Customer Screen in Production Order

1 -

Data Quality Management

1 -

Date required

1 -

Decisions

1 -

desafios4hana

1 -

Developing with SAP Integration Suite

1 -

Direct Outbound Delivery

1 -

DMOVE2S4

1 -

EAM

1 -

EDI

2 -

EDI 850

1 -

EDI 856

1 -

EHS Product Structure

1 -

Emergency Access Management

1 -

Energy

1 -

EPC

1 -

Find

1 -

FINSSKF

1 -

Fiori

1 -

Flexible Workflow

1 -

Gas

1 -

Gen AI enabled SAP Upgrades

1 -

General

1 -

generate_xlsx_file

1 -

Getting Started

1 -

HomogeneousDMO

1 -

IDOC

2 -

integration

1 -

Learning Content

2 -

LogicApps

2 -

low touchproject

1 -

Maintenance

1 -

management

1 -

Material creation

1 -

Material Management

1 -

MD04

1 -

MD61

1 -

methodology

1 -

Microsoft

2 -

MicrosoftSentinel

2 -

Migration

1 -

MRP

1 -

MS Teams

2 -

MT940

1 -

Newcomer

1 -

Notifications

1 -

Oil

1 -

open connectors

1 -

Order Change Log

1 -

ORDERS

2 -

OSS Note 390635

1 -

outbound delivery

1 -

outsourcing

1 -

PCE

1 -

Permit to Work

1 -

PIR Consumption Mode

1 -

PIR's

1 -

PIRs

1 -

PIRs Consumption

1 -

PIRs Reduction

1 -

Plan Independent Requirement

1 -

Premium Plus

1 -

pricing

1 -

Primavera P6

1 -

Process Excellence

1 -

Process Management

1 -

Process Order Change Log

1 -

Process purchase requisitions

1 -

Product Information

1 -

Production Order Change Log

1 -

Purchase requisition

1 -

Purchasing Lead Time

1 -

Redwood for SAP Job execution Setup

1 -

RISE with SAP

1 -

RisewithSAP

1 -

Rizing

1 -

S4 Cost Center Planning

1 -

S4 HANA

1 -

S4HANA

3 -

Sales and Distribution

1 -

Sales Commission

1 -

sales order

1 -

SAP

2 -

SAP Best Practices

1 -

SAP Build

1 -

SAP Build apps

1 -

SAP Cloud ALM

1 -

SAP Data Quality Management

1 -

SAP Maintenance resource scheduling

2 -

SAP Note 390635

1 -

SAP S4HANA

2 -

SAP S4HANA Cloud private edition

1 -

SAP Upgrade Automation

1 -

SAP WCM

1 -

SAP Work Clearance Management

1 -

Schedule Agreement

1 -

SDM

1 -

security

2 -

Settlement Management

1 -

soar

2 -

SSIS

1 -

SU01

1 -

SUM2.0SP17

1 -

SUMDMO

1 -

Teams

2 -

User Administration

1 -

User Participation

1 -

Utilities

1 -

va01

1 -

vendor

1 -

vl01n

1 -

vl02n

1 -

WCM

1 -

X12 850

1 -

xlsx_file_abap

1 -

YTD|MTD|QTD in CDs views using Date Function

1

- « Previous

- Next »

- Discrepancy in Chapter VI deductions in the Payslip in Enterprise Resource Planning Q&A

- Margin Analysis 4 Sell from stock in S/4HANA in Enterprise Resource Planning Blogs by SAP

- Product Compliance in SAP S/4HANA Cloud 2208 in Enterprise Resource Planning Blogs by SAP

- W-4 Employee’s Withholding Certificate and Federal Income Tax Withholding for 2020 in Enterprise Resource Planning Blogs by SAP

- Budget Changes for FY 2019-2020 . Tax related Changes for FY 2019-2020. in Enterprise Resource Planning Q&A

| User | Count |

|---|---|

| 2 | |

| 2 | |

| 1 | |

| 1 | |

| 1 | |

| 1 | |

| 1 | |

| 1 | |

| 1 | |

| 1 |