- SAP Community

- Products and Technology

- Enterprise Resource Planning

- ERP Blogs by Members

- How To Create Your Financial Statements Like A Red...

- Subscribe to RSS Feed

- Mark as New

- Mark as Read

- Bookmark

- Subscribe

- Printer Friendly Page

- Report Inappropriate Content

The first time I implemented ByDesign, I was introduced to the concept of reporting your Income Statement 'by Function of Expense.'

My first reaction was like HUH?

This is AMERICA bro, and we report our P&L's (not Income Statements) by a GL Account tree (not a weird structure by Function of Expense).

Not only was this weird 'Function of Expense' concept being pushed on me, but the default Financial Statements in ByD REQUIRE you to produce your income statement in this un-American fashion. Right then and there I decided I'd find a workaround, because this is America, and I have the freedom to workaround whatever I want, damn-it.

Side-note: Here is what Nancy Pelosi has to say about Income Statements by 'Function of Expense':

So here is that workaround, step by step. Open up a can of Bud, crank up the Classic Rock station on your FM radio, and learn how to produce your financial statements like a red-blooded American.

Note #1: I finally googled 'Function of Expense' like a month ago and it seems to be a valid concept in US GAAP. I don't care though, because I have produced financials for literally dozens of companies (even ones in China) using some sort of GL account structure.

Note #2: None of what you are about to see is real or confidential data.

Here we go:

1. Navigate to Business Analytics > Design and Assign Reports. Find the Financial Statements report. Select New > Report as Copy

2. Rename the report to Financial Statements – by G/L Account Structure

3. In Characteristic Properties, select GL Account, and change the Hierarchy value to Fixed Hierarchy

4. Select the GL Account Structure Hierarchy

5. In Define Variables, select Financial Reporting Structure

6. Change the Financial Reporting Structure value to I/S by Function of Expense

7. Move ahead to the Confirmation activity and Save. Open Create Layout for this Report in a Web Browser

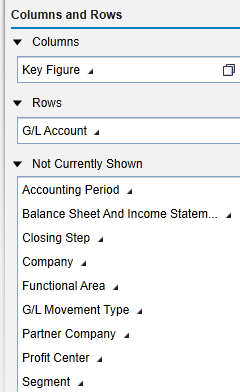

8. Add G/L Account to Rows

9. Navigate to Settings > Characteristics. In the Display Hierarchy column, select Description. Set the Initial Expansion Level to your taste. Here I have chosen Fully Expanded.

10. Click OK, and click GO. Now you have an Income Statement by GL Account Structure

God bless America.

God bless us, every bro.

Follow me on Twitter @JudsonOnDemand

- SAP Managed Tags:

- SAP Business ByDesign

You must be a registered user to add a comment. If you've already registered, sign in. Otherwise, register and sign in.

-

"mm02"

1 -

A_PurchaseOrderItem additional fields

1 -

ABAP

1 -

ABAP Extensibility

1 -

ACCOSTRATE

1 -

ACDOCP

1 -

Adding your country in SPRO - Project Administration

1 -

Advance Return Management

1 -

AI and RPA in SAP Upgrades

1 -

Approval Workflows

1 -

ARM

1 -

ASN

1 -

Asset Management

1 -

Associations in CDS Views

1 -

auditlog

1 -

Authorization

1 -

Availability date

1 -

Azure Center for SAP Solutions

1 -

AzureSentinel

2 -

Bank

1 -

BAPI_SALESORDER_CREATEFROMDAT2

1 -

BRF+

1 -

BRFPLUS

1 -

Bundled Cloud Services

1 -

business participation

1 -

Business Processes

1 -

CAPM

1 -

Carbon

1 -

Cental Finance

1 -

CFIN

1 -

CFIN Document Splitting

1 -

Cloud ALM

1 -

Cloud Integration

1 -

condition contract management

1 -

Connection - The default connection string cannot be used.

1 -

Custom Table Creation

1 -

Customer Screen in Production Order

1 -

Data Quality Management

1 -

Date required

1 -

Decisions

1 -

desafios4hana

1 -

Developing with SAP Integration Suite

1 -

Direct Outbound Delivery

1 -

DMOVE2S4

1 -

EAM

1 -

EDI

2 -

EDI 850

1 -

EDI 856

1 -

edocument

1 -

EHS Product Structure

1 -

Emergency Access Management

1 -

Energy

1 -

EPC

1 -

Financial Operations

1 -

Find

1 -

FINSSKF

1 -

Fiori

1 -

Flexible Workflow

1 -

Gas

1 -

Gen AI enabled SAP Upgrades

1 -

General

1 -

generate_xlsx_file

1 -

Getting Started

1 -

HomogeneousDMO

1 -

IDOC

2 -

Integration

1 -

Learning Content

2 -

LogicApps

2 -

low touchproject

1 -

Maintenance

1 -

management

1 -

Material creation

1 -

Material Management

1 -

MD04

1 -

MD61

1 -

methodology

1 -

Microsoft

2 -

MicrosoftSentinel

2 -

Migration

1 -

MRP

1 -

MS Teams

2 -

MT940

1 -

Newcomer

1 -

Notifications

1 -

Oil

1 -

open connectors

1 -

Order Change Log

1 -

ORDERS

2 -

OSS Note 390635

1 -

outbound delivery

1 -

outsourcing

1 -

PCE

1 -

Permit to Work

1 -

PIR Consumption Mode

1 -

PIR's

1 -

PIRs

1 -

PIRs Consumption

1 -

PIRs Reduction

1 -

Plan Independent Requirement

1 -

Premium Plus

1 -

pricing

1 -

Primavera P6

1 -

Process Excellence

1 -

Process Management

1 -

Process Order Change Log

1 -

Process purchase requisitions

1 -

Product Information

1 -

Production Order Change Log

1 -

Purchase requisition

1 -

Purchasing Lead Time

1 -

Redwood for SAP Job execution Setup

1 -

RISE with SAP

1 -

RisewithSAP

1 -

Rizing

1 -

S4 Cost Center Planning

1 -

S4 HANA

1 -

S4HANA

3 -

Sales and Distribution

1 -

Sales Commission

1 -

sales order

1 -

SAP

2 -

SAP Best Practices

1 -

SAP Build

1 -

SAP Build apps

1 -

SAP Cloud ALM

1 -

SAP Data Quality Management

1 -

SAP Maintenance resource scheduling

2 -

SAP Note 390635

1 -

SAP S4HANA

2 -

SAP S4HANA Cloud private edition

1 -

SAP Upgrade Automation

1 -

SAP WCM

1 -

SAP Work Clearance Management

1 -

Schedule Agreement

1 -

SDM

1 -

security

2 -

Settlement Management

1 -

soar

2 -

SSIS

1 -

SU01

1 -

SUM2.0SP17

1 -

SUMDMO

1 -

Teams

2 -

User Administration

1 -

User Participation

1 -

Utilities

1 -

va01

1 -

vendor

1 -

vl01n

1 -

vl02n

1 -

WCM

1 -

X12 850

1 -

xlsx_file_abap

1 -

YTD|MTD|QTD in CDs views using Date Function

1

- « Previous

- Next »

- ISAE 3000 for SAP S/4HANA Cloud Public Edition - Evaluation of the Authorization Role Concept in Enterprise Resource Planning Blogs by SAP

- Error in editing App Manage Global Hierarchies in Fiori could not see Language button in Enterprise Resource Planning Q&A

- SAP Fiori for SAP S/4HANA - Composite Roles in launchpad content and layout tools in Enterprise Resource Planning Blogs by SAP

- Improvements to manage treasury position in SAP Treasury and Risk Management in Enterprise Resource Planning Blogs by SAP

- How to enter project budget with active UPA in Enterprise Resource Planning Q&A

| User | Count |

|---|---|

| 6 | |

| 2 | |

| 2 | |

| 2 | |

| 2 | |

| 2 | |

| 2 | |

| 1 | |

| 1 | |

| 1 |