- SAP Community

- Products and Technology

- Enterprise Resource Planning

- ERP Blogs by Members

- Configuration of stitching charges in Payroll Indi...

- Subscribe to RSS Feed

- Mark as New

- Mark as Read

- Bookmark

- Subscribe

- Printer Friendly Page

- Report Inappropriate Content

Today I am going to share something which I have learnt purely based on my experience from all the previous projects, where we have done Configuration of stitching charges , Hence what ever I explain today is just a suggestion and there might be better ways of achieving the result than my approach.

Business Scenario:

As per Indian income tax act the Stitching charge exemption limit is Rs 540. To configure this requirement this blog will help you.

Configuration Steps are as follows:

- Create a taxability code in view V_T7INT7.

- Create wage type and assign it to a tax code and annual taxability

- Assign the wage type to an ALGRP through the RAPS view table V_T7INA9.

- Create a sub type for IT0582 - Exemptions info type in view V_T591A Corresponding to the tax code created.

5. Schema Changes

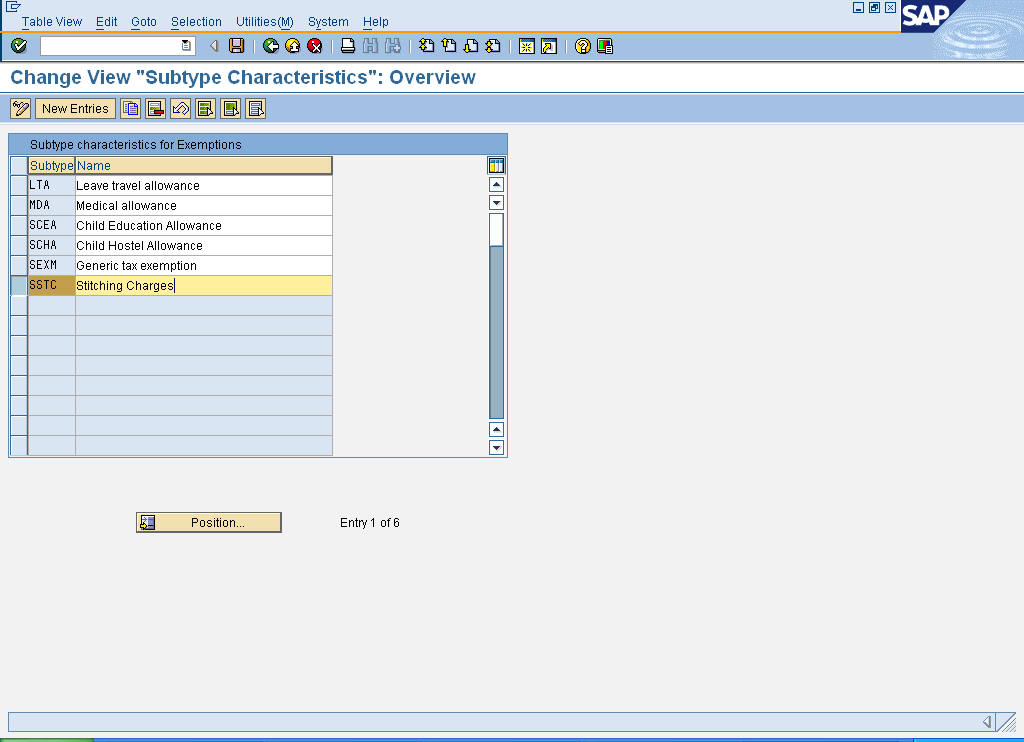

1 Create a taxability code in view V_T7INT7.

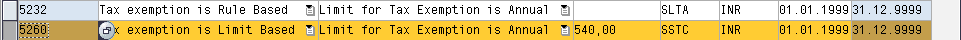

2 Create two wage types for Payment and Exemption. The wage type has to be assigning to a tax code for the annual taxability - (V_T7INT9).

3. Assign the wage type to an ALGRP through the RAPS view table V_T7INA9.

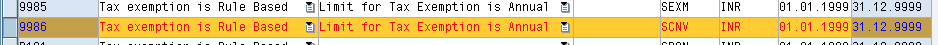

4. Create a sub type for IT0582 - Exemptions info type in view V_T591A Corresponding to the tax code created.

5. Schema Changes

Copy the Standard Schema INN1 to ZNN1.

- parm1: Tax code defined in table T7INT9

- parm2: Annual tax exemption wage type

- parm3: Whether the taxation treatment should be like an allowance or

Reimbursement. The supported options are 'A' & 'R'. The treatment of

'A' & 'R' is different for monthly and annual exemptions.

CASE STUDY

End User:

The required Exemption on stitching charges for eligible employees has to be entered in info type 0582 – “Exemptions “ Subtype – “SSTC”

Case:

There was a payment towards STC for an employee in info type 0015 amting to Rs.1000,But the exemption in info type 0582 is been entered as Rs 540. Hence the remaining amount will be l automatically taxed in the payroll.

The same information will be displayed in pay slip and also at annexure of Form 16.

Output:

- SAP Managed Tags:

- HCM (Human Capital Management)

You must be a registered user to add a comment. If you've already registered, sign in. Otherwise, register and sign in.

-

"mm02"

1 -

A_PurchaseOrderItem additional fields

1 -

ABAP

1 -

ABAP Extensibility

1 -

ACCOSTRATE

1 -

ACDOCP

1 -

Adding your country in SPRO - Project Administration

1 -

Advance Return Management

1 -

AI and RPA in SAP Upgrades

1 -

Approval Workflows

1 -

ARM

1 -

ASN

1 -

Asset Management

1 -

Associations in CDS Views

1 -

auditlog

1 -

Authorization

1 -

Availability date

1 -

Azure Center for SAP Solutions

1 -

AzureSentinel

2 -

Bank

1 -

BAPI_SALESORDER_CREATEFROMDAT2

1 -

BRF+

1 -

BRFPLUS

1 -

Bundled Cloud Services

1 -

business participation

1 -

Business Processes

1 -

CAPM

1 -

Carbon

1 -

Cental Finance

1 -

CFIN

1 -

CFIN Document Splitting

1 -

Cloud ALM

1 -

Cloud Integration

1 -

condition contract management

1 -

Connection - The default connection string cannot be used.

1 -

Custom Table Creation

1 -

Customer Screen in Production Order

1 -

Data Quality Management

1 -

Date required

1 -

Decisions

1 -

desafios4hana

1 -

Developing with SAP Integration Suite

1 -

Direct Outbound Delivery

1 -

DMOVE2S4

1 -

EAM

1 -

EDI

2 -

EDI 850

1 -

EDI 856

1 -

EHS Product Structure

1 -

Emergency Access Management

1 -

Energy

1 -

EPC

1 -

Find

1 -

FINSSKF

1 -

Fiori

1 -

Flexible Workflow

1 -

Gas

1 -

Gen AI enabled SAP Upgrades

1 -

General

1 -

generate_xlsx_file

1 -

Getting Started

1 -

HomogeneousDMO

1 -

IDOC

2 -

Integration

1 -

Learning Content

2 -

LogicApps

2 -

low touchproject

1 -

Maintenance

1 -

management

1 -

Material creation

1 -

Material Management

1 -

MD04

1 -

MD61

1 -

methodology

1 -

Microsoft

2 -

MicrosoftSentinel

2 -

Migration

1 -

MRP

1 -

MS Teams

2 -

MT940

1 -

Newcomer

1 -

Notifications

1 -

Oil

1 -

open connectors

1 -

Order Change Log

1 -

ORDERS

2 -

OSS Note 390635

1 -

outbound delivery

1 -

outsourcing

1 -

PCE

1 -

Permit to Work

1 -

PIR Consumption Mode

1 -

PIR's

1 -

PIRs

1 -

PIRs Consumption

1 -

PIRs Reduction

1 -

Plan Independent Requirement

1 -

Premium Plus

1 -

pricing

1 -

Primavera P6

1 -

Process Excellence

1 -

Process Management

1 -

Process Order Change Log

1 -

Process purchase requisitions

1 -

Product Information

1 -

Production Order Change Log

1 -

Purchase requisition

1 -

Purchasing Lead Time

1 -

Redwood for SAP Job execution Setup

1 -

RISE with SAP

1 -

RisewithSAP

1 -

Rizing

1 -

S4 Cost Center Planning

1 -

S4 HANA

1 -

S4HANA

3 -

Sales and Distribution

1 -

Sales Commission

1 -

sales order

1 -

SAP

2 -

SAP Best Practices

1 -

SAP Build

1 -

SAP Build apps

1 -

SAP Cloud ALM

1 -

SAP Data Quality Management

1 -

SAP Maintenance resource scheduling

2 -

SAP Note 390635

1 -

SAP S4HANA

2 -

SAP S4HANA Cloud private edition

1 -

SAP Upgrade Automation

1 -

SAP WCM

1 -

SAP Work Clearance Management

1 -

Schedule Agreement

1 -

SDM

1 -

security

2 -

Settlement Management

1 -

soar

2 -

SSIS

1 -

SU01

1 -

SUM2.0SP17

1 -

SUMDMO

1 -

Teams

2 -

User Administration

1 -

User Participation

1 -

Utilities

1 -

va01

1 -

vendor

1 -

vl01n

1 -

vl02n

1 -

WCM

1 -

X12 850

1 -

xlsx_file_abap

1 -

YTD|MTD|QTD in CDs views using Date Function

1

- « Previous

- Next »

- Setting the ALP indicator on ZL table Absence Valuation in Enterprise Resource Planning Q&A

- Speeding up your SAP HCM move to the cloud in 2024 in Enterprise Resource Planning Blogs by SAP

- Enhancements, evolutions, and enabled innovations across SAP’s Public Sector solution portfolio in Enterprise Resource Planning Blogs by SAP

- eDocument Colombia Cloud Initial Configuration in Enterprise Resource Planning Blogs by SAP

- Sales in SAP S/4HANA Cloud Public Edition 2402 in Enterprise Resource Planning Blogs by SAP

| User | Count |

|---|---|

| 2 | |

| 2 | |

| 2 | |

| 2 | |

| 2 | |

| 1 | |

| 1 | |

| 1 | |

| 1 | |

| 1 |