- SAP Community

- Products and Technology

- Additional Blogs by SAP

- IFRS 11: The End of Proportionate Consolidation?

- Subscribe to RSS Feed

- Mark as New

- Mark as Read

- Bookmark

- Subscribe

- Printer Friendly Page

- Report Inappropriate Content

The IASB (International Accounting Standards Board) recently issued IFRS 11 Joint Arrangements that eliminates proportionate consolidation as a method to account for joint ventures. The question naturally arises of whether the proportionate consolidation method should be removed from SAP® Enterprise Performance Management (EPM) solutions for consolidation.

SAP® solutions for consolidation, part of SAP® EPM solutions, include SAP® Financial Consolidation and SAP® Planning and Consolidation. A starter kit for IFRS has been developed for each application to perform, validate and publish a statutory consolidation in accordance with IFRS (International Financial Reporting Standards).

Based on a more detailed document available on the SAP Community NetWork here and that also deals with the other standards published at the same date (IFRS 10, IFRS 12, IAS 27 and IAS 28 revised), this current blog summarizes the conclusions regarding IFRS 11 and focuses on the main question of maintaining – or not – proportionate consolidation in SAP® EPM solutions for consolidation.

Main changes introduced by IFRS 11

Firstly, there are now only two categories of joint arrangements - joint operations and joint-ventures -instead of three in IAS 31 Interests in Joint Ventures.

Secondly, this classification should now result from a principles-based approach.

Under IAS 31, the legal structure of the arrangement was the key criteria: any joint arrangement that was structured through a separate vehicle (meaning here entity in a broad sense) qualified as a jointly controlled entity.

Under IFRS 11, the legal structure is taken into account as a first step: any joint arrangement that is not structured through a separate vehicle is a joint operation. However, the classification ultimately depends on the substance of the arrangement. In other words, a joint arrangement that is a separate legal

entity can be classified as a joint operation. For more details and examples, please refer to the comprehensive article.

Thus, the transition from IAS 31 to IFRS 11 classification can be summarized as follows:

- Jointly controlled assets and jointly controlled operations under IAS 31 will qualify as joint operations in IFRS 11 (because they are not structured through a separate entity)

- Jointly controlled entities under IAS 31 may be classified either as joint ventures or as joint operations depending on the substance of the arrangement

Last but not least, IFRS 11 does not offer any accounting choice: each type of joint arrangement (joint operation or joint venture) corresponds to one – and only one – accounting method. As regards joint ventures, the option for proportionate consolidation has been removed. Joint ventures must be accounted for using equity method.

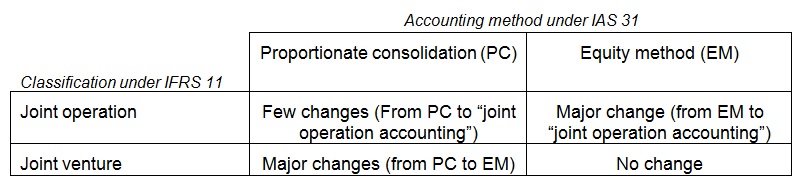

This change potentially affects entities that were previously classified as ‘jointly controlled entities’ and that can now be qualified either as joint operations or joint ventures. Depending on the accounting option chosen under IAS 31 on the one hand and their classification under IFRS 11 on the other hand, the impact on the investor’s financial statements will be very different:

For a detailed analysis of each case, please refer to the comprehensive document.

Groups that currently use proportionate consolidation are particularly concerned about the effect of IFRS 11 on the revenues – and related performance measures such as EBIT or EBITDA – they will report. Revenues and expenses will decrease as they will not present their share of the joint ventures’ revenue and expenses as part of their own revenue and expense. Moreover the share of the profit or loss of joint ventures accounted for using the equity method is usually presented in the last part of the income statement and does not contribute to the operating profit, a key metric used for communication with stakeholders.

Should proportionate consolidation be removed from SAP® solutions for consolidation?

This question naturally arises as IFRS 11 now requires the use of equity method for all joint ventures. However, we believe that the answer should be no, for the following reasons.

Firstly IFRS are not applied everywhere even though their use is constantly growing. Some local regulations will continue to allow or require the use of proportionate consolidation for joint ventures. Therefore SAP solutions for consolidation will keep on providing this consolidation method.

Secondly, proportionate consolidation can still be used by companies’ management for internal reporting purposes and therefore for segment reporting presentation as allowed by IFRS 8 (with appropriate reconciliation). Feedback received by the IASB through comment letters to exposure draft ED9 (which gives rise to IFRS 11) shows that many current users of proportionate consolidation are deeply attached to this method. They believe that it better reflects performance (including margins), extent of operations and risk exposures of joint arrangements.

Lastly, proportionate consolidation, as a consolidation method in the software, can be used for joint operation accounting where joint operators do not apply IFRS in the separate statements (see the comprehensive document for more details).

For more information

In addition to a more detailed analysis of IFRS 11 and its consequences, the comprehensive document available here provides information about the changes introduced by IFRS 10 (regarding the definition of control and an extensive guidance) and by IAS 28 amended.

To get an overview of all standards published or revised by the IASB in 2011, please refer to our previous blog.

For more information about starter kits for SAP EPM solutions, join us online: Facebook, Twitter

- Consolidation Extension for SAP Analytics Cloud – Automated Eliminations and Adjustments (part 1) in Technology Blogs by Members

- Understanding the Basic SAP Revenue Accounting and Reporting (RAR) in Financial Management Q&A

- Profit Center Valuation with Universal Parallel Accounting in SAP S/4HANA 2023 in Enterprise Resource Planning Blogs by SAP

- SAP S/4HANA Cloud for group reporting 2308 is generally available in Technology Blogs by SAP

- Percentage from Partner Group Reporting in Enterprise Resource Planning Q&A