- SAP Community

- Products and Technology

- Enterprise Resource Planning

- ERP Blogs by Members

- Payment card Processing

- Subscribe to RSS Feed

- Mark as New

- Mark as Read

- Bookmark

- Subscribe

- Printer Friendly Page

- Report Inappropriate Content

Define Card Types:

Img – Sales & Distribution – Billing – Payment Cards – Maintain Card Types.

Define Card Categories:

Img – Sales & Distribution – Billing – Payment Cards – Maintain Card Categories - Define Card Categories

Assign Card Categories to Card Types

Img – Sales & Distribution – Billing – Payment Cards – Maintain Card Categories – Determine Card Categories.

After these above 3 steps you need to link the Payment cards to Sales document types Standard SAP uses Plan 03, which can be used in all the cases and it is very rare to define new Plan type for which

“Maintain Payment Card Plan Type”

Img – Sales & Distribution – Billing – Payment Cards – Maintain Payment Card Plan Type

As soon as we assign the Plan type to sales document type, we can see the field “Payment cards“ will be now available in your sales order and at header level the “Payment cards tab”

Just now we have assign Payment card plan to sales document, similarly now we need to assign the payment guarantee procedure to our sales documents for which we need to:

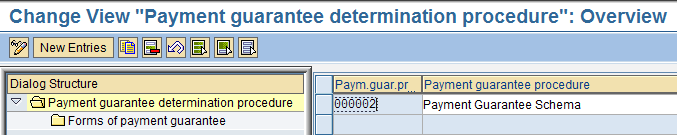

Maintain Payment Guarantee Procedure

Img – Sales & Distribution – Billing – Payment Cards – Auth. & settlement - Maintain Payment Guarantee Procedure

Define Payment guarantee Schema

Define Customer Determination Schema

Define Document Determination Schema

Assign Document Schema to Order Types

Define Payment guarantee Schema Determination.

Now let’s see each one by one below:

Define Payment guarantee schema:

Then go for Forms of Payment guarantee.

ii) Define Customer Determination Schema:

Assign this customer determination schema in XD02 at sales area data – Billing tab.

iii) Define Document Determination Schema:

iv) Assign Document Schema to Order Types:

V) Define Payment Guarantee determination Schema:

Here the highlighted field will determine the payment guarantee procedure for all the Customers.

If we need to determine the payment guarantee procedure for the particular selected customers then the line two i.e. 0002- 01- 000002 will help in doing so.

Define Checking group:

Now we need to check the card before Authorization, for which we need to define custom routine checks, authorization Horizons, and validity at the checking group level. So for this first we need to define the checking group and assigning those to sales document types.

Img – Sales & Distribution – Billing – Payment Cards – Auth. & settlement – Maintain checking group – Define checking group.

01 is the checking group, which we have defined

1 is the routine for the authorization requirement which is a standard one. This Routine 1 will do the following checks.

· This routine checks if the sales document is complete.

This routine also checks for the MAD (material availability date) if the system can perform complete delivery, in such case the whole amount will be taken off from the card specified.

In case if it is a partial delivery, then the partial portion of the total amount will be taken off from the card.

In case if preauthorization is maintained then the system will charge the customer £1 in case of partial delivery or incomplete delivery for the preauthorization, or the authorization house would collect it.

14 is the no: of days within which the authorization should be completed, so as to carry on the delivery, post goods issue, and billing.

30, is the no: of days till that day the card should be valid, so that the whole Order to cash process should be completed.

Assign Checking group to the Sales document type:

Maintain Authorization Validity period.

This is the no: of days we can keep card authorization valid, and after which we need to take the authorization once again.

So in this case the card details will remain 28 days and later preauthorization is still required...

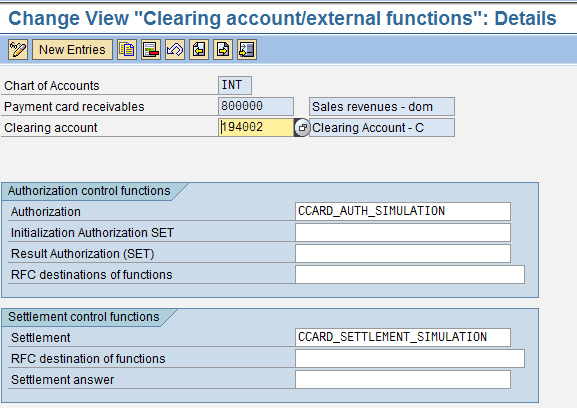

Maintain settings for Clearing house:

Img – Sales & Distribution – Billing – Payment Cards – Auth. & settlement – Maintain clearing house – Account determination

Here in Account determination we will be following the condition technique .

Create condition tables

Create assess sequence

Create condition types

Maintain Procedure and assign procedures to the billing type.

Assign GL accounts to condition type, chart of accounts, S.Org and card type

We need to Define and assign the condition type (A001 sap standard) and card type and Sales organisation to the GL account.

Setting up control for authorization and settlement.

Here we need to define the Payment card receivables, clearing account the routines for the simulations.

You have to assign the payment card details in customer master in general data – payment cards tab click pay

Now raise the sales order and select the payment card from the field Payment card field, and go to header data and where you can see Payment guarantee schema is determined at Risk management.

In Header data, Payment cards tab, upon saving the document the credit card status indicator will be green.

This is how we can configure Payment Card Processing. To know more about how the credit card number is deciphered by the system you can search the web with the tag. Luhn algorithm.

Sridhar Vijjhalwar

- SAP Managed Tags:

- SAP ERP,

- SD (Sales and Distribution)

You must be a registered user to add a comment. If you've already registered, sign in. Otherwise, register and sign in.

-

"mm02"

1 -

A_PurchaseOrderItem additional fields

1 -

ABAP

1 -

ABAP Extensibility

1 -

ACCOSTRATE

1 -

ACDOCP

1 -

Adding your country in SPRO - Project Administration

1 -

Advance Return Management

1 -

AI and RPA in SAP Upgrades

1 -

Approval Workflows

1 -

ARM

1 -

ASN

1 -

Asset Management

1 -

Associations in CDS Views

1 -

auditlog

1 -

Authorization

1 -

Availability date

1 -

Azure Center for SAP Solutions

1 -

AzureSentinel

2 -

Bank

1 -

BAPI_SALESORDER_CREATEFROMDAT2

1 -

BRF+

1 -

BRFPLUS

1 -

Bundled Cloud Services

1 -

business participation

1 -

Business Processes

1 -

CAPM

1 -

Carbon

1 -

Cental Finance

1 -

CFIN

1 -

CFIN Document Splitting

1 -

Cloud ALM

1 -

Cloud Integration

1 -

condition contract management

1 -

Connection - The default connection string cannot be used.

1 -

Custom Table Creation

1 -

Customer Screen in Production Order

1 -

Data Quality Management

1 -

Date required

1 -

Decisions

1 -

desafios4hana

1 -

Developing with SAP Integration Suite

1 -

Direct Outbound Delivery

1 -

DMOVE2S4

1 -

EAM

1 -

EDI

2 -

EDI 850

1 -

EDI 856

1 -

edocument

1 -

EHS Product Structure

1 -

Emergency Access Management

1 -

Energy

1 -

EPC

1 -

Financial Operations

1 -

Find

1 -

FINSSKF

1 -

Fiori

1 -

Flexible Workflow

1 -

Gas

1 -

Gen AI enabled SAP Upgrades

1 -

General

1 -

generate_xlsx_file

1 -

Getting Started

1 -

HomogeneousDMO

1 -

IDOC

2 -

Integration

1 -

Learning Content

2 -

LogicApps

2 -

low touchproject

1 -

Maintenance

1 -

management

1 -

Material creation

1 -

Material Management

1 -

MD04

1 -

MD61

1 -

methodology

1 -

Microsoft

2 -

MicrosoftSentinel

2 -

Migration

1 -

MRP

1 -

MS Teams

2 -

MT940

1 -

Newcomer

1 -

Notifications

1 -

Oil

1 -

open connectors

1 -

Order Change Log

1 -

ORDERS

2 -

OSS Note 390635

1 -

outbound delivery

1 -

outsourcing

1 -

PCE

1 -

Permit to Work

1 -

PIR Consumption Mode

1 -

PIR's

1 -

PIRs

1 -

PIRs Consumption

1 -

PIRs Reduction

1 -

Plan Independent Requirement

1 -

Premium Plus

1 -

pricing

1 -

Primavera P6

1 -

Process Excellence

1 -

Process Management

1 -

Process Order Change Log

1 -

Process purchase requisitions

1 -

Product Information

1 -

Production Order Change Log

1 -

Purchase requisition

1 -

Purchasing Lead Time

1 -

Redwood for SAP Job execution Setup

1 -

RISE with SAP

1 -

RisewithSAP

1 -

Rizing

1 -

S4 Cost Center Planning

1 -

S4 HANA

1 -

S4HANA

3 -

Sales and Distribution

1 -

Sales Commission

1 -

sales order

1 -

SAP

2 -

SAP Best Practices

1 -

SAP Build

1 -

SAP Build apps

1 -

SAP Cloud ALM

1 -

SAP Data Quality Management

1 -

SAP Maintenance resource scheduling

2 -

SAP Note 390635

1 -

SAP S4HANA

2 -

SAP S4HANA Cloud private edition

1 -

SAP Upgrade Automation

1 -

SAP WCM

1 -

SAP Work Clearance Management

1 -

Schedule Agreement

1 -

SDM

1 -

security

2 -

Settlement Management

1 -

soar

2 -

SSIS

1 -

SU01

1 -

SUM2.0SP17

1 -

SUMDMO

1 -

Teams

2 -

User Administration

1 -

User Participation

1 -

Utilities

1 -

va01

1 -

vendor

1 -

vl01n

1 -

vl02n

1 -

WCM

1 -

X12 850

1 -

xlsx_file_abap

1 -

YTD|MTD|QTD in CDs views using Date Function

1

- « Previous

- Next »

- Advance Return Management complete configuration(SAP ARM) in Enterprise Resource Planning Blogs by Members

- Kanban with production orders: Scheduling of orders in Enterprise Resource Planning Q&A

- The Role of SAP Business AI in the Chemical Industry. Overview in Enterprise Resource Planning Blogs by SAP

- Introducing the market standard of electronic invoicing for the United States in Enterprise Resource Planning Blogs by SAP

- SAP ERP Functionality for EDI Processing: UoMs Determination for Inbound Orders in Enterprise Resource Planning Blogs by Members

| User | Count |

|---|---|

| 2 | |

| 2 | |

| 2 | |

| 2 | |

| 2 | |

| 2 | |

| 2 | |

| 1 | |

| 1 | |

| 1 |