- SAP Community

- Products and Technology

- Additional Blogs by SAP

- Ownership Manager System Generated Proposals from ...

- Subscribe to RSS Feed

- Mark as New

- Mark as Read

- Bookmark

- Subscribe

- Printer Friendly Page

- Report Inappropriate Content

Similar in function to the Dynamic Hierarchy Editor available in BPC 7.x versions, the SAP Business Objects Planning and Consolidation 10.0, version for Netweaver (BPC10NW), Ownership Manager allows the definition of complex holding/subsidiary relationships that can be time, category, and scope specific. The organizational structures defined by Ownership Manager are also used by the Consolidation Monitor and the Controls Monitor to display and status the defined organizational levels.

New to the Ownership Manager functionality is the ability for the BPC system to propose key consolidation parameters.

There are three main prerequisites for activating system calculations for ownership manager:

1. Model and Master Data requirements

Ownership manager functionality requires a configured ownership manager model as defined by :

Ownership-based Hierarchy Requirements .

Summary requirements:

Required member ids in the O_ACCOUNT (ownership model account) dimension:

METHOD

METHOD_SYS is populated by the system to store the generated proposal for the consolidation method

PCON

PCON_SYS is populated by the system to store the generated proposal for the consolidation rate

POWN

POWN is also known as the ultimate percent ownership of an entity by the holding company. It is the calculated share percentage based upon a specified calculation method (Direct Share or Group Share). For the Direct Share calculation, the percent ownership is assumed to be 100% of the subsidiary ownership. For Group Share calculations, the percent ownership is the product between the various subsidiaries percentages.

Example:

Holding Company (H1) owns 70% of subsidiary (S1) and S1 owns 50% of subsidiary S2.

Using the Direct Share method, the ultimate percent ownership of S2 is 50%.

Using the Group Share method, the ultimate percent ownership of S2 is 35% (=70%x50%).

directly or indirectly

PCTRL

PCTRL identifies the ultimate percent of control for each entity in a model.

Member ids used internally during Ownership Manager Calculations

METHOD_SYS

METHOD_SYS is populated by the system to store the generated proposal for the consolidation method

PCON_SYS

PCON_SYS is populated by the system to store the generated proposal for the consolidation rate

POWN_SYS

POWN_SYS is populated by the system to store the generated proposal for the financial interest rate, or percent shares owned. Shares Owned contains the number of shares and voting shares that an entity owns of another entity.

PCTRL_SYS

PCTRL_SYS is populated by the system to store the generated proposal for the percent of subsidiary control

Required O_ACCOUNT Dimension Properties

The IS_INPUT property for the O_ACCOUNT dimension identifies the dimension members which can be displayed in the Ownership Manager hierarchy display.

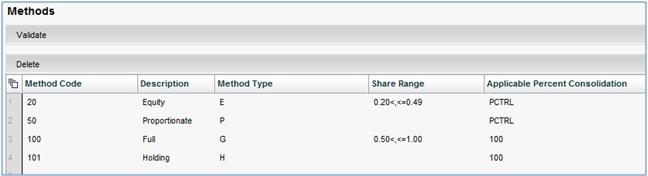

2. A Defined Method Business Rule:

The Method Business Rule table supports the Ownership Manager calculations by identifying a relationship between a range of shares allowing a system derived consolidation method (METHOD) as well as a proposed Financial Interest Rate (PCON):

- indentifying source accounts

- Indentifying target accounts

- Indentifying source flows

- Indentifying target flows

Note the unique syntax for identifying the share ranges.

0.20<,<=0.49 is interpreted by the system as a range definition: “any value greater than 20%, through any value less than or equal to 49%”.

0.50<,<=1.00 is interpreted by the system as a range definition: “any value greater than 50%, through any value less than or equal to 100%”.

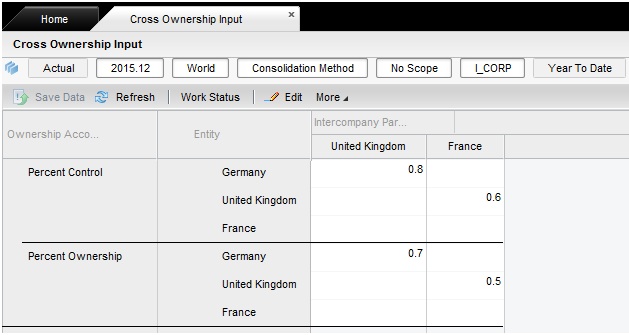

3. Implementing a Cross Ownership Matrix

Automatic ownership calculations require additional information to allow the ultimate ownership share ownership values. An input schedule providing details on Percent Control and Percent Ownership data must be provided by entity and intercompany partner. Data is saved to the OWNERSHIP model.

In the following example:

- Germany controls 80% of a UK subsidiary, and the UK subsidiary controls 60% of a French subsidiary

- Germany owns a 70% share of a UK subsidiary, and the UK subsidiary owns a 50% share of a French subsidiary

Note: Share and control data must be entered without any scope (group) specification (i.e.: S_NONE).

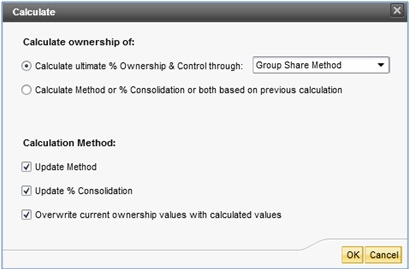

Once all prerequisites have been completed, the user can request system generated ownership manager calculation through the CALCULATE option available in the edit mode of the ownership definition:

User can select the accounting principle for calculating the ultimate ownership and control (Direct or Group share methods).

Checkbox options allow the user to update the “Current” sub column values for Method, Percent Consolidation, and calculated ownership percentages.

A graphical illustration of the data flow between the three prerequisites:

- SAP ECC Conversion to S/4HANA - Focus in CO-PA Costing-Based to Margin Analysis in Financial Management Blogs by SAP

- Group Reporting Data Audit in Enterprise Resource Planning Blogs by SAP

- 2024 SAP Cloud Identity Services & IAM Portfolio: What’s New? in Technology Blogs by Members

- Why I decided to work through a Beginner Tutorial Mission and what I learned from it in Technology Blogs by Members

- 全ての SAP BW、SAP BW/4HANA リリースの SAP ニアラインストレージ(NLS)ソリューション – SAP IQ in Technology Blogs by SAP