IAT - International ACH Transactions Explained

Configuration and Execution with examples.

What is IAT?

As per the Federal Reserve and NACHA, IAT is a new standard class entry (SEC) code that will replace CBR and PBR SEC Codes that are currently in use today. NACHA rules will require that IAT code and format of all ACH Payments entering or exiting the USA.

Why is IAT necessary?

IAT was developed to respond to OFAC’s request to align the NACHA Rules with OFAC compliance obligations and to make it easier for RDFIs to comply with those obligations. In the current environment, many U.S. financial institutions are receiving international payments that cannot be properly identified. These unidentifiable payments enter the U.S. through correspondent banking relationships and are often difficult to trace or accurately process as international payments. The new IAT code supports the end of anonymity and promotes traceability of international electronic payments.

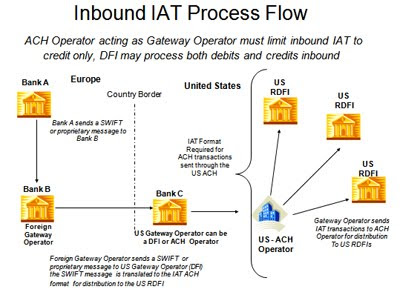

Inbound IAT Process Flow:

IAT Outbound Process Flow:

Formatting:

Q: What information should we expect to include in the mandatory addenda records for IAT? A: The new format will accommodate the following data elements:

- Originator's name/address

- Beneficiary's name/address

- Originating bank name/ID/branch code

- Foreign correspondent bank name/ID/branch code

- Receiving bank name/ID/branch code

- Reason for payment

IAT File Header Record:

The File Header Record introduces the file. It describes the file characteristics and identifies the sender of the file (ODFI - aka Gateway Operator) and who the file is being delivered to (ACH Operator). The record also includes the time, date, and file ID fields that are used to identify a specific file.

IAT Example Output:

IAT Company Batch Header Record for IAT Entries Example:

In light of these new developments SAP has responded with OSS Notes:

1343600 and 631281

Details of these notes (specifically 1343600) include the new ACH format suppliment for International ACH Transactions (IAT) that went into effect Sept. 18th 2009

Solutions include:

Using the payment medium workbench to facilitate in the creation of the new ACH / IAT Format. New data elements will have to be created such as "FPM_ACH_IAT_FBCORR_BANK (Foreign Correspondent Bank Name)", and "FPM_AACH_IAT_FR_XCHNG_IND (Foreign Exchange Indicator)".

Additional IAT configuration must be done as well including the following:

Payment Medium Format - New Entries "SAP ACH IAT Specific format ACH / IAT Version 4000"

New Instruction keys will have to be defined as well within configuration such as the following:

"Instruction - 10 Code ANN Annuity"

"Instruction - 11 Code ARC Accounts Receivable Entry"

"Instruction - 15 Code LOA Loan"

After Data Structures have been created you will need to create the new format:

SPRO-->Financial Accounting-->Acct Rec. Acct Pay-->Business Transactions-->Outgoing Payments-->Pament Media-->Make Settings for Payment Medium Formats from Payment Medium Workbench-->Adjust Note to Payee.

- Make sure to add the following: "ACH /IAT Version 4000" also if this will be used for payroll purposes also add the following: "FI_PAYMEDIUM_ACH_DETAILS"

The instruction keys are used while creating FI invoices with only one being alloted at a time.

TIP:

- It's suggested as in our testing that a new Payment method be created in order to facilitate this new format (keep things clean in your system)

Jay Esparza