In purchasing, there might be requirements of defaulting of Tax codes in purchasing documents for various conditions of Material, Plant & Account assignment.

The tax indicator is used in the automatic determination of the tax code in Purchasing.

The tax code can be determined automatically within the framework of price determination (via the conditions). Tax Indicators can be derived from the material master record, customizing or the purchasing document. The system determines the tax code from the combination of these tax indicators.

If the tax code can be determined automatically via conditions, it takes precedence over the tax code that has been maintained in the purchasing info record.

- Tax Indicators There are three types of tax indicators in purchasing – Tax indicators for Material, Plant & Account Assignment. All the defined in SPRO as under:

Materials Management -> Purchasing -> Taxes

Tax Indicator for material

We can define the tax indicator depending upon the requirement for grouping of materials w.r.t. the taxation apply.

The defined above is assigned to the materials in the material master in the purchasing view.

"

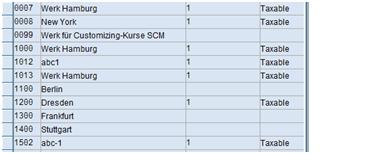

Tax Indicator for Plant

The tax indicator for Plant is defined to enable the taxation requirements for the purchasing from a plant.

The Tax Indicator for plant is defined as below accompanied by the destination country.

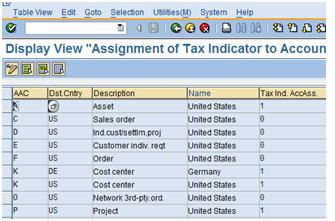

Tax indicator for Account Assignment

Procedure to implement tax indicators:-

The tax indicators are assigned in the standard access sequence 0003 in various combinations.

Access Sequence – 0003:

The access sequence is assigned to standard condition type NAVS – Non deductible tax.

The tax codes to be automatically defaulted in the purchasing documents for various Tax indicator conditions are defined in the condition records of NAVS

In the Purchase Order the condition type NAVS picks the various Tax Indicators from the document and defaults the corresponding Tax Code from the condition records

E.g. The condition type determines tax code Q1 from the condition records and defaults in the Purchase Order