- SAP Community

- Products and Technology

- Enterprise Resource Planning

- ERP Blogs by Members

- New GL : Company Code Validation vs Real Time COFI...

- Subscribe to RSS Feed

- Mark as New

- Mark as Read

- Bookmark

- Subscribe

- Printer Friendly Page

- Report Inappropriate Content

Recently I came across an issue in New GL wherein I have to understand the relation between , Real time COFI integration and Company code validation. If you opt for Company code validation then only you can activate and assign Real time COFI integration, otherwise NO.

In this blog, I want to analyse the logic behind the relation and justify SAP's error message.

Before proceeding to the analysis, take a look at the scenario and the error message.

- Company code is “Productive”.

- Company code validation is not checked in OKKP against controlling area ( Fig-1 )

Fig-1 : Activate / deactivation of Company code validation

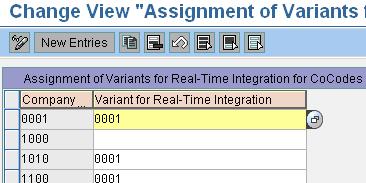

3. You want to activate and assign the Real time integration variant to one of the

company code under the controlling area.( Fig-2)

Fig 2 : Assignment of COFI realtime integration variant

4. And the error message : ( Fig-3)

Fig-3 : Error message while assigning the Variant

Fig -4 : Error message full text

Company code validation means, in the same document , all the objects must belong to the same company code. i.e in one document , you cannot input objects say cost centre belonging to 2 company codes.

WHY :

Business Process : Salary GL ( P& L account ) is originally charged to Cost center 0001 ( Company code-0001) , but it should be reposted to Cost center 0002 ( Company code 0002).

Scenario 1 : Transfer postings ( repostings ) happens from FI route

There should be NO company code validation , because in the same document you want to input 2 cost centers belonging to 2 different comp codes.

Posting in Company code 0001

Gl Cost centre Amt

Debit : Salary GL 0002 200 ( belongs to Co code- 0002)

Credit : Salary GL 0001 200 ( belongs to Co code- 0001)

With this FI posting, the 2 actual entries will be triggered as below (Through automatic inter company account determination settings) :

Company code-0001

Debit : Inter company GL 200

Credit : Salary GL 0001 200

( Note that the CO posting will be posted now accordingly)

Company code-0002

Debit : Salary GL 0002 200

Credit : Inter company GL 200

(Note that the CO posting will be posted now accordingly)

Conclusion : The CO entries are already passed by system. SO there is no need for any CO FI integration, therefore, COFI integration variant is not allowed. If it is allowed, the system may trigger( amounts to duplication.. so wrong ) the FI documents again from CO documents.

Scenario 2 : Transfer postings ( repostings ) happens from CO route

In this case, you activate the Company code validation, so FI route ( Scenario-1) cannot be followed . You use reposting functionality in CO wherein you transfer the amount from Cost center 0001 to 0002. But to give effect in FI, Realtime COFI integration variant must be assigned to the Company code to keep the CO and FI books duly reconciled.

TO SUMMARISE,

1. If you follow FI route to transfer the postings across company codes ( for example) don’t activate company code validation and justifiably, system will not allow you to assign Real time COFI integration variant to the Company code.

2. If you follow CO route, activate the company code validation and system will allow you to assign the COFI integration variant to the company code.

- SAP Managed Tags:

- SAP ERP

You must be a registered user to add a comment. If you've already registered, sign in. Otherwise, register and sign in.

-

"mm02"

1 -

A_PurchaseOrderItem additional fields

1 -

ABAP

1 -

ABAP Extensibility

1 -

ACCOSTRATE

1 -

ACDOCP

1 -

Adding your country in SPRO - Project Administration

1 -

Advance Return Management

1 -

AI and RPA in SAP Upgrades

1 -

Approval Workflows

1 -

Ariba

1 -

ARM

1 -

ASN

1 -

Asset Management

1 -

Associations in CDS Views

1 -

auditlog

1 -

Authorization

1 -

Availability date

1 -

Azure Center for SAP Solutions

1 -

AzureSentinel

2 -

Bank

1 -

BAPI_SALESORDER_CREATEFROMDAT2

1 -

BRF+

1 -

BRFPLUS

1 -

Bundled Cloud Services

1 -

business participation

1 -

Business Processes

1 -

CAPM

1 -

Carbon

1 -

Cental Finance

1 -

CFIN

1 -

CFIN Document Splitting

1 -

Cloud ALM

1 -

Cloud Integration

1 -

condition contract management

1 -

Connection - The default connection string cannot be used.

1 -

Custom Table Creation

1 -

Customer Screen in Production Order

1 -

Customizing

1 -

Data Quality Management

1 -

Date required

1 -

Decisions

1 -

desafios4hana

1 -

Developing with SAP Integration Suite

1 -

Direct Outbound Delivery

1 -

DMOVE2S4

1 -

EAM

1 -

EDI

3 -

EDI 850

1 -

EDI 856

1 -

edocument

1 -

EHS Product Structure

1 -

Emergency Access Management

1 -

Energy

1 -

EPC

1 -

Financial Operations

1 -

Find

1 -

FINSSKF

1 -

Fiori

1 -

Flexible Workflow

1 -

Gas

1 -

Gen AI enabled SAP Upgrades

1 -

General

1 -

generate_xlsx_file

1 -

Getting Started

1 -

HomogeneousDMO

1 -

How to add new Fields in the Selection Screen Parameter in FBL1H Tcode

1 -

IDOC

2 -

Integration

1 -

Learning Content

2 -

Ledger Combinations in SAP

1 -

LogicApps

2 -

low touchproject

1 -

Maintenance

1 -

management

1 -

Material creation

1 -

Material Management

1 -

MD04

1 -

MD61

1 -

methodology

1 -

Microsoft

2 -

MicrosoftSentinel

2 -

Migration

1 -

mm purchasing

1 -

MRP

1 -

MS Teams

2 -

MT940

1 -

Newcomer

1 -

Notifications

1 -

Oil

1 -

open connectors

1 -

Order Change Log

1 -

ORDERS

2 -

OSS Note 390635

1 -

outbound delivery

1 -

outsourcing

1 -

PCE

1 -

Permit to Work

1 -

PIR Consumption Mode

1 -

PIR's

1 -

PIRs

1 -

PIRs Consumption

1 -

PIRs Reduction

1 -

Plan Independent Requirement

1 -

POSTMAN

1 -

Premium Plus

1 -

pricing

1 -

Primavera P6

1 -

Process Excellence

1 -

Process Management

1 -

Process Order Change Log

1 -

Process purchase requisitions

1 -

Product Information

1 -

Production Order Change Log

1 -

purchase order

1 -

Purchase requisition

1 -

Purchasing Lead Time

1 -

Redwood for SAP Job execution Setup

1 -

RISE with SAP

1 -

RisewithSAP

1 -

Rizing

1 -

S4 Cost Center Planning

1 -

S4 HANA

1 -

S4HANA

3 -

S4HANACloud audit

1 -

Sales and Distribution

1 -

Sales Commission

1 -

sales order

1 -

SAP

2 -

SAP Best Practices

1 -

SAP Build

1 -

SAP Build apps

1 -

SAP CI

1 -

SAP Cloud ALM

1 -

SAP CPI

1 -

SAP Data Quality Management

1 -

SAP ERP

1 -

SAP Maintenance resource scheduling

2 -

SAP Note 390635

1 -

SAP S4HANA

2 -

SAP S4HANA Cloud private edition

1 -

SAP Upgrade Automation

1 -

SAP WCM

1 -

SAP Work Clearance Management

1 -

Schedule Agreement

1 -

SDM

1 -

security

2 -

Settlement Management

1 -

soar

2 -

Sourcing and Procurement

1 -

SSIS

1 -

SU01

1 -

SUM2.0SP17

1 -

SUMDMO

1 -

Teams

2 -

Time Management

1 -

User Administration

1 -

User Participation

1 -

Utilities

1 -

va01

1 -

vendor

1 -

vl01n

1 -

vl02n

1 -

WCM

1 -

X12 850

1 -

xlsx_file_abap

1 -

YTD|MTD|QTD in CDs views using Date Function

1

- « Previous

- Next »

- Adapting to technical annex 1.9 for Colombia: Updates for SAP S/4HANA Cloud in Enterprise Resource Planning Blogs by SAP

- Adapting to technical annex 1.9 for Colombia: Updates for SAP S/4HANA and SAP ERP in Enterprise Resource Planning Blogs by SAP

- SAP S/4HANA Data Migration and Master Data Management Best Practices with SAP BTP in Enterprise Resource Planning Blogs by SAP

- SAP Activate methodology Prepare and Explore phases in the context of SAFe. in Enterprise Resource Planning Blogs by SAP

- Quick Start guide for PLM system integration 3.0 Implementation/Installation in Enterprise Resource Planning Blogs by SAP

| User | Count |

|---|---|

| 3 | |

| 3 | |

| 2 | |

| 2 | |

| 2 | |

| 2 | |

| 2 | |

| 2 | |

| 1 | |

| 1 |