- SAP Community

- Products and Technology

- Financial Management

- Financial Management Blogs by SAP

- EU Taxonomy for Financial Companies – The Green As...

Financial Management Blogs by SAP

Get financial management insights from blog posts by SAP experts. Find and share tips on how to increase efficiency, reduce risk, and optimize working capital.

Turn on suggestions

Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type.

Showing results for

Associate

Options

- Subscribe to RSS Feed

- Mark as New

- Mark as Read

- Bookmark

- Subscribe

- Printer Friendly Page

- Report Inappropriate Content

09-22-2022

8:55 PM

To begin with, I would like to introduce myself. My name is Denise Iwersen and I am a Customer Advisor for Financial Services in the Service Industries sector of SAP Germany. Sustainability currently is on everyone’s lips and has therefore led to the motivation to take a closer look at this topic. Consequently, I would like to use this blog post to give an overview of the requirements relating to the EU taxonomy for financial companies.

Sustainability is in focus of many companies. But it is no longer a trend with which companies can decorate themselves. Since January 1st,2022, companies in the European Union (EU) are already required to publish the first key figures according to the EU taxonomy.[1]

But what justifies this reporting obligation and what does it mean for financial and non-financial companies?

Climate change and its consequences have already arrived in our daily lives. Drought periods, forest fires and floods caused by high levels of precipitation have shaped the media of recent months and years and can be seen as signs of climate change.[2] In order to counter the harmful consequences of climate change, on June 15th December 2015, the 196 Parties of the United Nations Framework Convention in Climate Change (UNFCCC) signed the Paris Climate Agreement.[3] One of the key objectives of the Paris Climate Agreement is to contain global warming to 1.5°C to significantly reduce the risks of climate change.[4] The implementation of this objective however, requires adjustments and rethinking in the economy and society, as well as political encouragement.

To this end, the European Commission adopted the so-called European Climate Change Act as part of the European Green Deal which, among other things, requires climate neutrality in the EU by 2050.[5] In addition to the Paris Climate Agreement, United Nations (UN) Member States agreed in 2015 on 17 common goals, the Sustainable Development Goals (SDGs), for sustainable development. These are part of the 2030 Agenda to “promote sustainable peace and prosperity and protect our planet”[6]. The SDGs include targets for climate neutrality, including gender equality and human dignity. The development policy of the European Union, and thus also the policy in Germany, has committed itself to implementing the 2030 Agenda.[7] According to the Coalition Agreement of the 19th German Legislature "the implementation of the 2030 Agenda and the promotion of sustainable development is the yardstick of government action".[8] The current German federal government will also continue to do so.[9] Through various measures, such as promotion and legislation, the Federal Government must ensure that the implementation of the SDGs is monitored in all sectors of the economy. These measures are defined and described in the German sustainability strategy.[10] Consequently, this means that there is no direct obligation to comply with the 2030 Agenda, but that it must be driven by political measures.

From a business perspective, such policies may require adaptation of a company’s own corporate strategy and culture. As a role model, SAP has already taken steps[11] to achieve sustainability and has already aligned its corporate strategy and product portfolio to the 17 SGDs, which contributes to achieving our own sustainability goals, as well as those of our customers.[12] Nonetheless, companies’ commitment to the SDGs alone is not enough. A uniform measurement and disclosure of sustainability in the company must take place to communicate compliance with the sustainability goals to all stakeholders and to create comparability. Different international initiatives have evolved into different reporting standards. These are designed to help companies qualify and quantify their sustainability related activities and report them in a consistent manner. These include, for example, the Global Reporting Initiative (GRI)[13] or the Greenhouse Gas Protocol (GHG)[14]. GHG focuses exclusively on the assessment and disclosure of greenhouse gas emissions, classified into three “scopes”[15], whereas GRI is also incorporating economic, environmental and social factors into sustainability reporting. Of particular importance for Europe are the Corporate Sustainability Reporting Directive (CSRD), which will replace the Non-Financial Reporting Directive (NFRD),[16] and the Sustainable Finance Disclosure Regulation (SFDR). The CSRD is a standard setting of the “European Financial Reporting Advisory Group (EFRAG)” and defines principles for companies within the framework of the EU taxonomy, for the disclosure of sustainability information in the annex to the annual financial statements. Companies must show the impact of sustainability aspects on the company's own economic situation, as well as the impact of economic activities on sustainability aspects (double materiality perspective).[17] The application of the CSRD directive is subject to provisional agreement today, and from January 1st 2024 will be mandatory for all companies already subject to NFRD today.[18] On the other hand, the SFDR, also known as the Disclosure Regulation, regulates the disclosure obligations of financial market participants with regard to the consideration of sustainability risks and their impact in their investment decisions.[19] Both the CSRD and the SFDR are part of the European sustainability strategy to achieve carbon neutrality by 2050[20] and are in turn politically driven measures to drive the achievement of the 2030 Agenda in enterprises. At a global level, the International Sustainability Standard Board (ISSB) is to be mentioned, which was founded in the wake of the climate conference in Glasgow (COP26) held in October 2021. The task of the ISSB is to develop new accounting and reporting standards for sustainable business that focus on the needs of investors and financial markets.[21]

Another objective of the Paris Climate Agreement under Article 2(c), namely, to strengthen financial flows leading[22] to low greenhouse gas emissions and more climate-resilient developments, is not directly reflected in the above-mentioned methods and initiatives. In the context of the redirection of financial flows, the Action Plan on Sustainable Finance adopted by the European Parliament in 2018 is also to be mentioned. The aim of this action plan is to steer cash flows from unsustainable to sustainable real investments.[23] In addition to the Action Plan and to achieve a reorientation of capital flows towards sustainable economic activities, a common understanding of “sustainable economic activities” must first be established. The so-called EU taxonomy, which became[24] legally effective in all EU member states with the Climate Delegated Act as of January 1, 2022, is such a classification system for sustainable economic activities.[25] The EU taxonomy is described as a “green classification system” that translates the EU’s climate objectives into criteria for sustainable economic activities. These environmental objectives are defined in Article 9 of the EU taxonomy[26]:

Moreover, an economic activity shall only be defined as sustainable if the following three criteria, defined in accordance with EU Regulation 2020/852, Article 3, apply:

The implementation of the regulation is currently mandatory for all EU companies with more than 500 employees who already have non-financial reporting under the Non-Financial Reporting Directive (NFRD), as well as listed companies, banks and insurance companies.[30] However, as mentioned above, the CSRD will replace the NFRD in the future, which will extend the reporting requirement to other companies.

In general, a distinction is made between financial companies and non-financial companies in the implementation of the EU taxonomy. Non-financial companies are currently required to report their taxonomy-eligible and non-taxonomy-eligible shares of their economic activities.[31] For these, this means disclosing the shares of their taxonomy-eligible and non-taxonomy-eligible economic activities in turnover, as well as investment (CapEx) and operating expenses (OpEx). As of January 1st, 2023, non-financial companies are required to report their share of taxonomy-aligned and non-taxonomy- aligned economic activities in turnover, investment (CapEx) and operating expenses (OpEx), as well as other qualitative information.[32] The purpose of these KPIs is to show the extent to which companies are contributing to sustainability through their business processes and through investments in the future.

But what does this mean for financial companies?

Since January 1st, 2022 financial companies must also report their taxonomy-eligible and non-taxonomy-eligible economic activities. This is done by disclosing the shares of the exposures in their total assets,[33] as it would not be meaningful to assess financial companies based on total revenue, capital expenditure and operating expenses. In the Delegated Regulation (EU) 2021/2178 of July 6th, 2021, the key performance indicators (KPIs) were set.[34]

Although financial entities are divided into (1) asset managers, (2) credit institutions, (3) investment firms and (4) insurance and reinsurance firms[35], the performance indicator for all financial entities is defined similarly and described in more detail below. This blog post subsequently focuses on the application of the EU taxonomy to credit institutions.

The core business of credit institutions involves providing finance to other companies or private individuals to enable investment in the real economy. Therefore, a key figure must be defined that enables an analysis of the assets with regards to taxonomy compliance. For this purpose, the green asset ratio (GAR) is used as a KPI for credit institutions. This is intended to show how much of the financing of taxonomy-aligned activities is in relation to the total assets.[36] The GAR is scheduled to start as of January 1st, 2024 and will be calculated and disclosed for the fiscal year 2023, while further KPIs are only to be calculated and disclosed as of January 1st, 2026.[37]

However, is there a specification as to how the GAR is to be calculated and in which format the key figure is to be displayed? The answer is yes. In general, the derivation of whether an exposure is taxonomy-aligned is identical to that of non-financial corporations. The activity for which funds are provided must:

All assets that meet these requirements may be reported as taxonomy-aligned activities in key figure GAR. The definition of how the GAR is determined is set out in Annex V, Chapter 1.2.1 of Delegated Regulation (EU) 2021/2178. The ratio is therefore derived from the ‘numerator’ representing the taxonomy-aligned assets and the ‘denominator’ representing the total assets. A detailed list of exposures to be included is described in Delegated Regulation (EU) 2021/2178 in Annex V, Chapter 1. The resulting GAR shall be disclosed as an aggregated value across all assets, as well as broken down by environmental objectives and the nature of the counterparty.[38]

As previously mentioned, we are committed to the 17 UN SDGs. We believe that digitisation can play an important role in achieving those. Our portfolio of solutions and services helps companies to achieve their sustainability goals. In the context of further developments in the regulatory environment (for example, regarding further KPIs as of 2026), it must be possible to flexibly adapt software solutions to new requirements. For this purpose, we provide a wide range of applications for implementing and integrating sustainability aspects for all areas of the company.

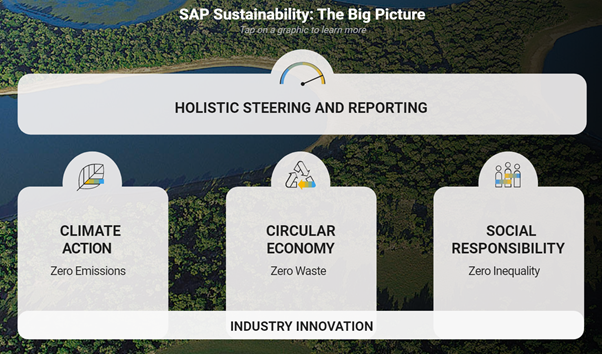

Customers can use the SAP Sustainability Navigator to get an initial overview of SAP’s sustainability solution portfolio. This can be divided into four areas:

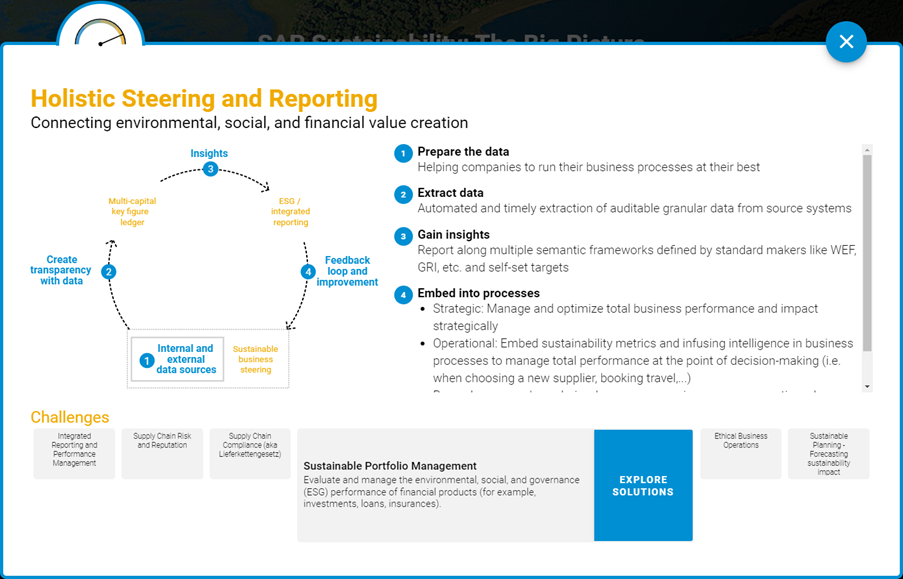

With a focus on the EU taxonomy, the focus is set on the management of sustainable economic activities (holistic steering and reporting).

As explained above, the EU taxonomy requires an assessment of economic activities. For credit institutions, this is the share of sustainable investments in their assets.

In the SAP Sustainability Navigator, you can choose “Holistic Steering and Reporting” and then “Sustainable Portfolio Management” and “Explore Solutions” to access SAP Profitability and Performance Management.

Figure 2: SAP Sustainability Navigator - Holistic Steering & Reporting

Figure 3: SAP Sustainability Navigator – Sustainable Portfolio Management

Figure 4: SAP Profitability & Performance Management - Modeling

With predefined content, SAP PaPM delivers an example for a calculation model of the KPIs specified by the EU taxonomy, the taxonomy-aligned shares of CapEx, OpEx, and turnover, as well as the assets.[39] In the same way, banks can connect all relevant data sources (inventory systems or external sources) to calculate the GAR and derive any additional data required to calculate the key figure at the required granularity level.

Figure 5: SAP Profitability & Performance Management - Reporting

In addition, the existing content can be enhanced with other sustainability key figures as well as relevant data. Business departments can therefore analyze and align the direction of their business activities along the EU taxonomy at a granular level.

The aim of this blog post is to provide some transparency with regard to the regulatory framework in the area of sustainability for financial companies in general and for credit institutions particularly in Germany. Although this blog post can only deal with a small section of the current discussions in the overall context and, in this context, it is not possible to negotiate in full, it should be made clear that there is a high degree of complexity in the regulatory framework to be applied due to the scope and dynamics of the matter. Credit institutions need a sustainability strategy, which is generally already defined, but which needs to be further defined and adapted to change if necessary. In addition to the mandatory regulations, these include non-binding initiatives and standards.

Although the EU taxonomy will not apply to credit institutions until 2024 (for 2023) with regards to alignment of their activities, it remains to be noted that action is already required. Already today, the EU taxonomy must be implemented with regard to taxonomy eligibility for the first two environmental objectives. In our opinion, the results of today’s implementation form a good basis for the implementation of the following taxonomy alignment, based on all six environmental objectives.

This blog is intended to serve as a basis for dealing with further developments in the context of sustainability and EU taxonomy for credit institutions or other financial companies in Germany.

At this point, I would like to express my sincere thanks to peter.mortensen for helping with the creation of the blog post, as well as reiner.bihler and christian.kupper for all additional hints and comments.

[1] EU Taxonomy - REGULATION (EU) 2020/852, Article 27 (2a), 18.06.2020

[2] Consequences of climate change, Climate Action – Climate Change, European Commission,

[3] Paris Agreement, Article 1, United Nations, 2015 & ‘The Paris Agreement’, Climate Change, United Nations,

[4] Paris Agreement, Article 2 (a), United Nations, 2015

[5] REGULATION (EC) No 401/2009 and (EU) 2018/1999 (‘European Climate Law’), Official Journal of the European Union, 09.07.2021

[6] Sustainable Development Goals, 2030 Agenda / SGDs, United Nations

[7] German sustainability strategy, further development 2021 EU development policy, p.42

[8] German sustainability strategy, further development 2021 EU development policy, p.72

[9] The German Sustainability Strategy, Federal Government.de

[10] German sustainability strategy, further development 2021 EU development policy, chapter C. – The German contribution to SDGs, p. 131 ff.

[11] ‘Five Actions for Sustainable Enterprises’, SAP.com,

[12] Purpose & Sustainability, SAP.com, / ’17 Global Goals to achieve a sustainable future’, SAP.com

[13] Getting Started, Global Reporting Initiative

[14] GHG Standards, Greenhouse Gas Protocol

[15] The Greenhouse Gas Protocol, A Corporate Accounting and Reporting Standard, p. 25

[16] The amendments to the NFRD towards the CSRD are discussed in the proposal for a DIRECTIVE OF THE EUROPEAN PARLIAMENT AND OF THE COUNCIL amending Directives 2013/34/EU, 2004/109/EC and 2006/43/EC and Regulation (EU) No 537/2014 as regards the sustainability reporting of undertakings.

[17] Questions and Answers: Corporate Sustainability Reporting Directive proposal, European Commission, April 21, 2021

[18] New rules on corporate sustainability reporting: preliminary political agreement between Council and..., European Council, June 21, 2022

[19] REGULATION (EU) 2019/2088, (10), (13), 27.11.2019

[20] Factsheet: EU SUSTAINABLE FINANCE STRATEGY, European Commission, July 6, 2021

[21] ISSB: Frequently Asked Questions, IFRS.org

[22] Paris Agreement, Article 2 (c), United Nations, 2015, translated into German

[23] Sustainable finance: Commission's Action Plan for a greener and cleaner economy, March 8, 2018,

[24] DELEGATED REGULATION (EU) 2021/2139, Article 3, 04.06.2021

[25] Action Plan: Financing sustainable growth, Chapter 2.1, European Commission, Brussels, 08.03.2018

[26] EU taxonomy - REGULATION (EU) 2020/852, Article 9(a)-(f), 18.06.2020

[27] EU Taxonomy - REGULATION (EU) 2020/852, Article 10 (1), 18.06.2020

[28] EU taxonomy - REGULATION (EU) 2020/852, Article 17 (1) a), 18.06.2020

[29] EU Taxonomy - REGULATION (EU) 2020/852, Article 18 (1), 18.06.2020

[30] EU Taxonomy - REGULATION (EU) 2020/852, Article 1 (2), 18.06.2020

[31]Activities are "Taxonomy-eligible" if they can be assigned to taxonomy criteria (regardless of whether the criteria are met). Activities are “taxonomy-aligned” (alignment) if the taxonomy-eligible activities also meet the criteria. Deloitte.com, https://www2.deloitte.com/de/de/pages/audit/articles/eu-taxonomie-nachhaltigkeitsberichterstattung.h...

[32] DELEGATED REGULATION (EU) 2021/2178, Article 10, 06.07.2021

[33] DELEGATED REGULATION (EU) 2021/2178, Article 10, 06.07.2021

[34] DELEGATED REGULATION (EU) 2021/2178, p.1, List of Reasons (3), 06.07.2021

[35] DELEGATED REGULATION (EU) 2021/2178, p.2-3, paragraph (4)-(10), 06.07.2021

[36] DELEGATED REGULATION (EU) 2021/2178, p.2, paragraph (5), 06.07.2021

[37] DELEGATED REGULATION (EU) 2021/2178, p.3, paragraph (12), 06.07.2021

[38] DELEGATED REGULATION (EU) 2021/2178, Annex V, Chapter 1.2.1, 06.07.2021

[39] Content refers to companies (non-FSI) and their financial assets

Sustainability is in focus of many companies. But it is no longer a trend with which companies can decorate themselves. Since January 1st,2022, companies in the European Union (EU) are already required to publish the first key figures according to the EU taxonomy.[1]

But what justifies this reporting obligation and what does it mean for financial and non-financial companies?

Climate change and its consequences have already arrived in our daily lives. Drought periods, forest fires and floods caused by high levels of precipitation have shaped the media of recent months and years and can be seen as signs of climate change.[2] In order to counter the harmful consequences of climate change, on June 15th December 2015, the 196 Parties of the United Nations Framework Convention in Climate Change (UNFCCC) signed the Paris Climate Agreement.[3] One of the key objectives of the Paris Climate Agreement is to contain global warming to 1.5°C to significantly reduce the risks of climate change.[4] The implementation of this objective however, requires adjustments and rethinking in the economy and society, as well as political encouragement.

To this end, the European Commission adopted the so-called European Climate Change Act as part of the European Green Deal which, among other things, requires climate neutrality in the EU by 2050.[5] In addition to the Paris Climate Agreement, United Nations (UN) Member States agreed in 2015 on 17 common goals, the Sustainable Development Goals (SDGs), for sustainable development. These are part of the 2030 Agenda to “promote sustainable peace and prosperity and protect our planet”[6]. The SDGs include targets for climate neutrality, including gender equality and human dignity. The development policy of the European Union, and thus also the policy in Germany, has committed itself to implementing the 2030 Agenda.[7] According to the Coalition Agreement of the 19th German Legislature "the implementation of the 2030 Agenda and the promotion of sustainable development is the yardstick of government action".[8] The current German federal government will also continue to do so.[9] Through various measures, such as promotion and legislation, the Federal Government must ensure that the implementation of the SDGs is monitored in all sectors of the economy. These measures are defined and described in the German sustainability strategy.[10] Consequently, this means that there is no direct obligation to comply with the 2030 Agenda, but that it must be driven by political measures.

From a business perspective, such policies may require adaptation of a company’s own corporate strategy and culture. As a role model, SAP has already taken steps[11] to achieve sustainability and has already aligned its corporate strategy and product portfolio to the 17 SGDs, which contributes to achieving our own sustainability goals, as well as those of our customers.[12] Nonetheless, companies’ commitment to the SDGs alone is not enough. A uniform measurement and disclosure of sustainability in the company must take place to communicate compliance with the sustainability goals to all stakeholders and to create comparability. Different international initiatives have evolved into different reporting standards. These are designed to help companies qualify and quantify their sustainability related activities and report them in a consistent manner. These include, for example, the Global Reporting Initiative (GRI)[13] or the Greenhouse Gas Protocol (GHG)[14]. GHG focuses exclusively on the assessment and disclosure of greenhouse gas emissions, classified into three “scopes”[15], whereas GRI is also incorporating economic, environmental and social factors into sustainability reporting. Of particular importance for Europe are the Corporate Sustainability Reporting Directive (CSRD), which will replace the Non-Financial Reporting Directive (NFRD),[16] and the Sustainable Finance Disclosure Regulation (SFDR). The CSRD is a standard setting of the “European Financial Reporting Advisory Group (EFRAG)” and defines principles for companies within the framework of the EU taxonomy, for the disclosure of sustainability information in the annex to the annual financial statements. Companies must show the impact of sustainability aspects on the company's own economic situation, as well as the impact of economic activities on sustainability aspects (double materiality perspective).[17] The application of the CSRD directive is subject to provisional agreement today, and from January 1st 2024 will be mandatory for all companies already subject to NFRD today.[18] On the other hand, the SFDR, also known as the Disclosure Regulation, regulates the disclosure obligations of financial market participants with regard to the consideration of sustainability risks and their impact in their investment decisions.[19] Both the CSRD and the SFDR are part of the European sustainability strategy to achieve carbon neutrality by 2050[20] and are in turn politically driven measures to drive the achievement of the 2030 Agenda in enterprises. At a global level, the International Sustainability Standard Board (ISSB) is to be mentioned, which was founded in the wake of the climate conference in Glasgow (COP26) held in October 2021. The task of the ISSB is to develop new accounting and reporting standards for sustainable business that focus on the needs of investors and financial markets.[21]

Another objective of the Paris Climate Agreement under Article 2(c), namely, to strengthen financial flows leading[22] to low greenhouse gas emissions and more climate-resilient developments, is not directly reflected in the above-mentioned methods and initiatives. In the context of the redirection of financial flows, the Action Plan on Sustainable Finance adopted by the European Parliament in 2018 is also to be mentioned. The aim of this action plan is to steer cash flows from unsustainable to sustainable real investments.[23] In addition to the Action Plan and to achieve a reorientation of capital flows towards sustainable economic activities, a common understanding of “sustainable economic activities” must first be established. The so-called EU taxonomy, which became[24] legally effective in all EU member states with the Climate Delegated Act as of January 1, 2022, is such a classification system for sustainable economic activities.[25] The EU taxonomy is described as a “green classification system” that translates the EU’s climate objectives into criteria for sustainable economic activities. These environmental objectives are defined in Article 9 of the EU taxonomy[26]:

- Climate protection,

- adaptation to climate change,

- the sustainable use and protection of water and marine resources,

- the transition to a circular economy,

- pollution prevention and control and

- the protection and restoration of biodiversity and ecosystems.

Moreover, an economic activity shall only be defined as sustainable if the following three criteria, defined in accordance with EU Regulation 2020/852, Article 3, apply:

- An economic activity must make a significant contribution to attaining at least one of the climate objectives. A significant contribution will be made, for example, if the activity supports the achievement of the climate targets set out in the Paris Climate Agreement.[27]

- An economic activity must not adversely affect any of the environmental objectives. A negative impact, for example, is caused by greenhouse gas emissions.[28]

- An economic activity must respect minimum protection in accordance with the OECD Guidelines and the UN Guiding Principles on Business and Human Rights.[29]

The implementation of the regulation is currently mandatory for all EU companies with more than 500 employees who already have non-financial reporting under the Non-Financial Reporting Directive (NFRD), as well as listed companies, banks and insurance companies.[30] However, as mentioned above, the CSRD will replace the NFRD in the future, which will extend the reporting requirement to other companies.

In general, a distinction is made between financial companies and non-financial companies in the implementation of the EU taxonomy. Non-financial companies are currently required to report their taxonomy-eligible and non-taxonomy-eligible shares of their economic activities.[31] For these, this means disclosing the shares of their taxonomy-eligible and non-taxonomy-eligible economic activities in turnover, as well as investment (CapEx) and operating expenses (OpEx). As of January 1st, 2023, non-financial companies are required to report their share of taxonomy-aligned and non-taxonomy- aligned economic activities in turnover, investment (CapEx) and operating expenses (OpEx), as well as other qualitative information.[32] The purpose of these KPIs is to show the extent to which companies are contributing to sustainability through their business processes and through investments in the future.

But what does this mean for financial companies?

Since January 1st, 2022 financial companies must also report their taxonomy-eligible and non-taxonomy-eligible economic activities. This is done by disclosing the shares of the exposures in their total assets,[33] as it would not be meaningful to assess financial companies based on total revenue, capital expenditure and operating expenses. In the Delegated Regulation (EU) 2021/2178 of July 6th, 2021, the key performance indicators (KPIs) were set.[34]

Although financial entities are divided into (1) asset managers, (2) credit institutions, (3) investment firms and (4) insurance and reinsurance firms[35], the performance indicator for all financial entities is defined similarly and described in more detail below. This blog post subsequently focuses on the application of the EU taxonomy to credit institutions.

The core business of credit institutions involves providing finance to other companies or private individuals to enable investment in the real economy. Therefore, a key figure must be defined that enables an analysis of the assets with regards to taxonomy compliance. For this purpose, the green asset ratio (GAR) is used as a KPI for credit institutions. This is intended to show how much of the financing of taxonomy-aligned activities is in relation to the total assets.[36] The GAR is scheduled to start as of January 1st, 2024 and will be calculated and disclosed for the fiscal year 2023, while further KPIs are only to be calculated and disclosed as of January 1st, 2026.[37]

However, is there a specification as to how the GAR is to be calculated and in which format the key figure is to be displayed? The answer is yes. In general, the derivation of whether an exposure is taxonomy-aligned is identical to that of non-financial corporations. The activity for which funds are provided must:

- make a significant contribution to at least one of the climate objectives,

- not adversely affect any of the other environmental objectives and

- comply with the minimum protection set out in the OECD and UN Guiding Principles.

All assets that meet these requirements may be reported as taxonomy-aligned activities in key figure GAR. The definition of how the GAR is determined is set out in Annex V, Chapter 1.2.1 of Delegated Regulation (EU) 2021/2178. The ratio is therefore derived from the ‘numerator’ representing the taxonomy-aligned assets and the ‘denominator’ representing the total assets. A detailed list of exposures to be included is described in Delegated Regulation (EU) 2021/2178 in Annex V, Chapter 1. The resulting GAR shall be disclosed as an aggregated value across all assets, as well as broken down by environmental objectives and the nature of the counterparty.[38]

How can SAP help with this?

As previously mentioned, we are committed to the 17 UN SDGs. We believe that digitisation can play an important role in achieving those. Our portfolio of solutions and services helps companies to achieve their sustainability goals. In the context of further developments in the regulatory environment (for example, regarding further KPIs as of 2026), it must be possible to flexibly adapt software solutions to new requirements. For this purpose, we provide a wide range of applications for implementing and integrating sustainability aspects for all areas of the company.

Customers can use the SAP Sustainability Navigator to get an initial overview of SAP’s sustainability solution portfolio. This can be divided into four areas:

- Sustainability and ESG reporting and governance

- Climate Change and Emissions

- Circular economy and waste prevention

- Social responsibility and no inequalities

Figure 1: SAP Sustainability Navigator - The Big Picture

With a focus on the EU taxonomy, the focus is set on the management of sustainable economic activities (holistic steering and reporting).

As explained above, the EU taxonomy requires an assessment of economic activities. For credit institutions, this is the share of sustainable investments in their assets.

In the SAP Sustainability Navigator, you can choose “Holistic Steering and Reporting” and then “Sustainable Portfolio Management” and “Explore Solutions” to access SAP Profitability and Performance Management.

Figure 2: SAP Sustainability Navigator - Holistic Steering & Reporting

Figure 3: SAP Sustainability Navigator – Sustainable Portfolio Management

Figure 4: SAP Profitability & Performance Management - Modeling

With predefined content, SAP PaPM delivers an example for a calculation model of the KPIs specified by the EU taxonomy, the taxonomy-aligned shares of CapEx, OpEx, and turnover, as well as the assets.[39] In the same way, banks can connect all relevant data sources (inventory systems or external sources) to calculate the GAR and derive any additional data required to calculate the key figure at the required granularity level.

Figure 5: SAP Profitability & Performance Management - Reporting

In addition, the existing content can be enhanced with other sustainability key figures as well as relevant data. Business departments can therefore analyze and align the direction of their business activities along the EU taxonomy at a granular level.

Summary and Outlook

The aim of this blog post is to provide some transparency with regard to the regulatory framework in the area of sustainability for financial companies in general and for credit institutions particularly in Germany. Although this blog post can only deal with a small section of the current discussions in the overall context and, in this context, it is not possible to negotiate in full, it should be made clear that there is a high degree of complexity in the regulatory framework to be applied due to the scope and dynamics of the matter. Credit institutions need a sustainability strategy, which is generally already defined, but which needs to be further defined and adapted to change if necessary. In addition to the mandatory regulations, these include non-binding initiatives and standards.

Although the EU taxonomy will not apply to credit institutions until 2024 (for 2023) with regards to alignment of their activities, it remains to be noted that action is already required. Already today, the EU taxonomy must be implemented with regard to taxonomy eligibility for the first two environmental objectives. In our opinion, the results of today’s implementation form a good basis for the implementation of the following taxonomy alignment, based on all six environmental objectives.

This blog is intended to serve as a basis for dealing with further developments in the context of sustainability and EU taxonomy for credit institutions or other financial companies in Germany.

At this point, I would like to express my sincere thanks to peter.mortensen for helping with the creation of the blog post, as well as reiner.bihler and christian.kupper for all additional hints and comments.

References

[1] EU Taxonomy - REGULATION (EU) 2020/852, Article 27 (2a), 18.06.2020

[2] Consequences of climate change, Climate Action – Climate Change, European Commission,

[3] Paris Agreement, Article 1, United Nations, 2015 & ‘The Paris Agreement’, Climate Change, United Nations,

[4] Paris Agreement, Article 2 (a), United Nations, 2015

[5] REGULATION (EC) No 401/2009 and (EU) 2018/1999 (‘European Climate Law’), Official Journal of the European Union, 09.07.2021

[6] Sustainable Development Goals, 2030 Agenda / SGDs, United Nations

[7] German sustainability strategy, further development 2021 EU development policy, p.42

[8] German sustainability strategy, further development 2021 EU development policy, p.72

[9] The German Sustainability Strategy, Federal Government.de

[10] German sustainability strategy, further development 2021 EU development policy, chapter C. – The German contribution to SDGs, p. 131 ff.

[11] ‘Five Actions for Sustainable Enterprises’, SAP.com,

[12] Purpose & Sustainability, SAP.com, / ’17 Global Goals to achieve a sustainable future’, SAP.com

[13] Getting Started, Global Reporting Initiative

[14] GHG Standards, Greenhouse Gas Protocol

[15] The Greenhouse Gas Protocol, A Corporate Accounting and Reporting Standard, p. 25

[16] The amendments to the NFRD towards the CSRD are discussed in the proposal for a DIRECTIVE OF THE EUROPEAN PARLIAMENT AND OF THE COUNCIL amending Directives 2013/34/EU, 2004/109/EC and 2006/43/EC and Regulation (EU) No 537/2014 as regards the sustainability reporting of undertakings.

[17] Questions and Answers: Corporate Sustainability Reporting Directive proposal, European Commission, April 21, 2021

[18] New rules on corporate sustainability reporting: preliminary political agreement between Council and..., European Council, June 21, 2022

[19] REGULATION (EU) 2019/2088, (10), (13), 27.11.2019

[20] Factsheet: EU SUSTAINABLE FINANCE STRATEGY, European Commission, July 6, 2021

[21] ISSB: Frequently Asked Questions, IFRS.org

[22] Paris Agreement, Article 2 (c), United Nations, 2015, translated into German

[23] Sustainable finance: Commission's Action Plan for a greener and cleaner economy, March 8, 2018,

[24] DELEGATED REGULATION (EU) 2021/2139, Article 3, 04.06.2021

[25] Action Plan: Financing sustainable growth, Chapter 2.1, European Commission, Brussels, 08.03.2018

[26] EU taxonomy - REGULATION (EU) 2020/852, Article 9(a)-(f), 18.06.2020

[27] EU Taxonomy - REGULATION (EU) 2020/852, Article 10 (1), 18.06.2020

[28] EU taxonomy - REGULATION (EU) 2020/852, Article 17 (1) a), 18.06.2020

[29] EU Taxonomy - REGULATION (EU) 2020/852, Article 18 (1), 18.06.2020

[30] EU Taxonomy - REGULATION (EU) 2020/852, Article 1 (2), 18.06.2020

[31]Activities are "Taxonomy-eligible" if they can be assigned to taxonomy criteria (regardless of whether the criteria are met). Activities are “taxonomy-aligned” (alignment) if the taxonomy-eligible activities also meet the criteria. Deloitte.com, https://www2.deloitte.com/de/de/pages/audit/articles/eu-taxonomie-nachhaltigkeitsberichterstattung.h...

[32] DELEGATED REGULATION (EU) 2021/2178, Article 10, 06.07.2021

[33] DELEGATED REGULATION (EU) 2021/2178, Article 10, 06.07.2021

[34] DELEGATED REGULATION (EU) 2021/2178, p.1, List of Reasons (3), 06.07.2021

[35] DELEGATED REGULATION (EU) 2021/2178, p.2-3, paragraph (4)-(10), 06.07.2021

[36] DELEGATED REGULATION (EU) 2021/2178, p.2, paragraph (5), 06.07.2021

[37] DELEGATED REGULATION (EU) 2021/2178, p.3, paragraph (12), 06.07.2021

[38] DELEGATED REGULATION (EU) 2021/2178, Annex V, Chapter 1.2.1, 06.07.2021

[39] Content refers to companies (non-FSI) and their financial assets

- SAP Managed Tags:

- Banking,

- SAP Profitability and Performance Management,

- Sustainability

Labels:

2 Comments

You must be a registered user to add a comment. If you've already registered, sign in. Otherwise, register and sign in.

Labels in this area

Related Content

- SAP advanced treasury and risk management package for GROW with SAP in Financial Management Blogs by SAP

- Digital Banking Add-on Package for RISE and GROW with SAP in Financial Management Blogs by SAP

- Manage dates-driven planning processes with SAP Analytics Cloud in Financial Management Blogs by SAP

- Advanced treasury and risk management package for RISE with SAP in Financial Management Blogs by SAP

- Get peace of mind for evolving compliance requirements with SAP advanced compliance automation in Financial Management Blogs by SAP

Top kudoed authors

| User | Count |

|---|---|

| 3 | |

| 3 | |

| 1 | |

| 1 | |

| 1 | |

| 1 | |

| 1 | |

| 1 | |

| 1 | |

| 1 |